Scalper1 News

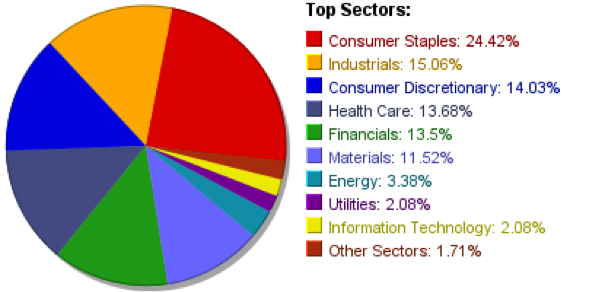

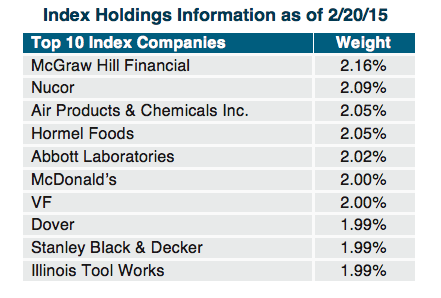

Summary Dividend aristocrats, or blue-chip companies that consistently raise their dividends, tend to outperform the broader market over long periods. Dividend increases are positive predictors of future corporate performance. Dividend aristocrats are unique due to the fact that most companies are unable to increase dividends when facing business cycle downturns and capital market shocks. By offering consistently increasing payouts on a long-term basis, dividend aristocrats act as a hedge against economic uncertainty and provide downside portfolio protection. Dividend aristocrats, or blue-chip companies that consistently raise their dividends , tend to outperform the broader market over long periods. To be considered a dividend aristocrat, a company must typically have raised its dividend for at least 25 consecutive years. Dividend aristocrats are unique due to the fact that most companies are simply unable to continually boost dividend payouts when facing business cycle downturns and capital market shocks. Dividend increases are positive predictors of future corporate performance. By offering consistently increasing payouts on a long-term basis, dividend aristocrats act as a hedge against economic uncertainty and provide downside portfolio protection. The ProShares S&P 500 Dividend Aristocrats ETF (NYSEARCA: NOBL ) tracks the S&P 500 Dividend Aristocrats Index, which only includes companies that (1) are members of the S&P 500 and (2) have increased their dividends for at least 25 consecutive years . If an existing member cuts, or even freezes its dividend, it is dropped from the index. Rebalancing takes place quarterly with an annual reconstitution, taking place during the January rebalance. Only the very best dividend payers are permitted to remain in this elite club. (click to enlarge) What should excite you about NOBL is the fact that the vast majority of companies that comprise this ETF have raised their dividends during some tough times, including the financial crisis of 2008. I don’t know about you, but I find this kind of financial strength and predictability intoxicating, in fact, almost irresistible. The 53 companies in this ETF are equally weighted and they’re diversified across a variety of sectors, such as consumer staples, consumer discretionary, industrials, materials, and many others. Unlike many dividend-oriented ETFs, NOBL does not have the majority of its exposure in financial, telecom or utility stocks, which makes it especially attractive, considering how poorly these stocks perform in a rising interest rate environment. Sector weights are capped at 30% each. NOBL’s current dividend yield is 1.60% and its annual expense ratio is just 35 basis points. An abundance of historical data going back to 2005, when Standard & Poor’s first constructed the S&P 500 Dividend Aristocrats Index, confirms its superior performance over the S&P 500. Over the past 12 months, the S&P 500 Dividend Aristocrats ETF has produced a total return of 17.82% vs. 14.92% for the SPDR S&P 500 Trust ETF (NYSEARCA: SPY ): (click to enlarge) Conclusion The S&P 500 Dividend Aristocrats Index is made up of some of the highest-quality, income-producing stocks available to investors today. Even if you are a risk-averse investor, you may still find NOBL to be an attractive core holding since it’s comprised of companies with stable earnings which produce less volatile returns. NOBL held up better than the S&P 500 during the last bear market. The Aristocrats Index lost -22% during the 2008 financial crisis while the S&P 500 Index fell -37%. NOBL, since late January, is outperforming many “defensive” funds, most of which typically hold utility companies. The Dow Jones Utility Average (DJUA) peaked on January 29th at 652. Now at 600, the DJUA has lost -8% while NOBL has gained +3%. Another potential benefit, because of NOBL’s very small exposure to the Utility sector, would likely be outperformance over most other dividend-paying funds in a rising interest rate environment . You may not be aware of the fact that the 10-year Treasury bond has risen from 1.67% to 2.11% since February 2nd. This move may be a prelude of what’s to come this year. So, bottom line, it may be time to “overweight” NOBL in your investment portfolio. Consider replacing the plain vanilla S&P 500 fund and potentially other “defensive” equity funds in your portfolio with NOBL to enjoy the consistent dividend-paying and defensive attributes of this elite ETF. Additional disclosure: George Kiraly Jr., CFP, MBA is the president of LodeStar Advisory Group, LLC, an independent Registered Investment Adviser located in Short Hills, New Jersey. George Kiraly, LodeStar Advisory Group, and/or its clients may hold positions in the ETFs, mutual funds and/or any investment asset mentioned above. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. Disclosure: The author is long NOBL. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it. The author has no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Summary Dividend aristocrats, or blue-chip companies that consistently raise their dividends, tend to outperform the broader market over long periods. Dividend increases are positive predictors of future corporate performance. Dividend aristocrats are unique due to the fact that most companies are unable to increase dividends when facing business cycle downturns and capital market shocks. By offering consistently increasing payouts on a long-term basis, dividend aristocrats act as a hedge against economic uncertainty and provide downside portfolio protection. Dividend aristocrats, or blue-chip companies that consistently raise their dividends , tend to outperform the broader market over long periods. To be considered a dividend aristocrat, a company must typically have raised its dividend for at least 25 consecutive years. Dividend aristocrats are unique due to the fact that most companies are simply unable to continually boost dividend payouts when facing business cycle downturns and capital market shocks. Dividend increases are positive predictors of future corporate performance. By offering consistently increasing payouts on a long-term basis, dividend aristocrats act as a hedge against economic uncertainty and provide downside portfolio protection. The ProShares S&P 500 Dividend Aristocrats ETF (NYSEARCA: NOBL ) tracks the S&P 500 Dividend Aristocrats Index, which only includes companies that (1) are members of the S&P 500 and (2) have increased their dividends for at least 25 consecutive years . If an existing member cuts, or even freezes its dividend, it is dropped from the index. Rebalancing takes place quarterly with an annual reconstitution, taking place during the January rebalance. Only the very best dividend payers are permitted to remain in this elite club. (click to enlarge) What should excite you about NOBL is the fact that the vast majority of companies that comprise this ETF have raised their dividends during some tough times, including the financial crisis of 2008. I don’t know about you, but I find this kind of financial strength and predictability intoxicating, in fact, almost irresistible. The 53 companies in this ETF are equally weighted and they’re diversified across a variety of sectors, such as consumer staples, consumer discretionary, industrials, materials, and many others. Unlike many dividend-oriented ETFs, NOBL does not have the majority of its exposure in financial, telecom or utility stocks, which makes it especially attractive, considering how poorly these stocks perform in a rising interest rate environment. Sector weights are capped at 30% each. NOBL’s current dividend yield is 1.60% and its annual expense ratio is just 35 basis points. An abundance of historical data going back to 2005, when Standard & Poor’s first constructed the S&P 500 Dividend Aristocrats Index, confirms its superior performance over the S&P 500. Over the past 12 months, the S&P 500 Dividend Aristocrats ETF has produced a total return of 17.82% vs. 14.92% for the SPDR S&P 500 Trust ETF (NYSEARCA: SPY ): (click to enlarge) Conclusion The S&P 500 Dividend Aristocrats Index is made up of some of the highest-quality, income-producing stocks available to investors today. Even if you are a risk-averse investor, you may still find NOBL to be an attractive core holding since it’s comprised of companies with stable earnings which produce less volatile returns. NOBL held up better than the S&P 500 during the last bear market. The Aristocrats Index lost -22% during the 2008 financial crisis while the S&P 500 Index fell -37%. NOBL, since late January, is outperforming many “defensive” funds, most of which typically hold utility companies. The Dow Jones Utility Average (DJUA) peaked on January 29th at 652. Now at 600, the DJUA has lost -8% while NOBL has gained +3%. Another potential benefit, because of NOBL’s very small exposure to the Utility sector, would likely be outperformance over most other dividend-paying funds in a rising interest rate environment . You may not be aware of the fact that the 10-year Treasury bond has risen from 1.67% to 2.11% since February 2nd. This move may be a prelude of what’s to come this year. So, bottom line, it may be time to “overweight” NOBL in your investment portfolio. Consider replacing the plain vanilla S&P 500 fund and potentially other “defensive” equity funds in your portfolio with NOBL to enjoy the consistent dividend-paying and defensive attributes of this elite ETF. Additional disclosure: George Kiraly Jr., CFP, MBA is the president of LodeStar Advisory Group, LLC, an independent Registered Investment Adviser located in Short Hills, New Jersey. George Kiraly, LodeStar Advisory Group, and/or its clients may hold positions in the ETFs, mutual funds and/or any investment asset mentioned above. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. Disclosure: The author is long NOBL. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it. The author has no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Scalper1 News