Scalper1 News

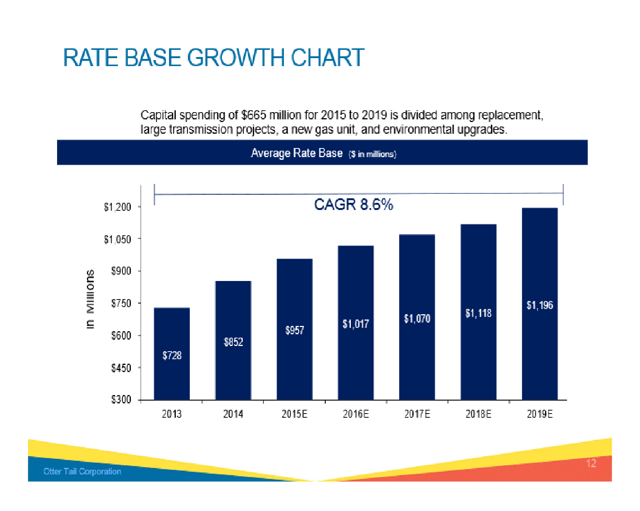

Otter Tail Corporation reported 2015 second quarter results on August 3rd. Based on its performance, the company unofficially increased its full-year EPS projection. Six months in, the company’s potential to cover both its annual dividend and corporate costs looks solid. Even considering Otter Tail traditionally pays a dividend exceeding the average of diversified utilities, the company’s share price is not yet out of fair value range. The allure of owning a diversified utility is the blend of a stable, healthy dividend and the potential of share price appreciation. Otter Tail Corporation (NASDAQ: OTTR ) operates as an electric utility in northern states in the Midwest and as a manufacturer of plastics, PVC pipe and metal fabrication. The company reported second quarter results on August 3rd. After a first quarter reset 9% to 10% downward of full-year estimates, the company unofficially raised full-year estimates in its second quarter reporting. The overall effect is still a decrease from the company’s original guidance. But, the bump now represents improvement over 2014 results which can be extrapolated into safety of the dividend and potential for share price improvement. Otter Tail’s first quarter results were mixed in its manufacturing segment, Varistar. The segment was unexpectedly tripped up by the downturn in the oil and gas industry. The second quarter performance still showed some impact but the company was better able to manage the challenges. The loss of sales to manufacturers of oil and gas equipment was partially offset by sales to manufacturers of lawn and garden equipment, recreational equipment and wind energy equipment. Year-over-year, the segment’s revenue in the quarter decreased 4%. On the bottom line, the segment’s operating income increased 8.6% year-over-year. The primary contributor to the difference was lower resin prices. Otter Tail sold more pounds of PVC pipe at lower prices but it cost the company much less to do so. Relative to its core business of being an electric utility, the company’s performance was favorable in the second quarter. The weather is, obviously, beyond the company’s control. To date, 2015 has offered milder seasons. In the 2014 second quarter, compared to “normal”, both the heating degree days and cooling degree days exceeded 100%. By comparison, in 2015, the heating degree days registered only 82.7% of normal and cooling degree days registered 78.9% of normal. Sales in the quarter were lower to both retail and wholesale customers. This loss was offset by ECR (environmental cost recovery) rider revenue related to the company’s ACQS (air quality control system) environmental upgrade project and higher transmission tariff revenue from MISO (Midcontinent Independent System Operator) related to increased investment in regional transmission lines. The slide below from the latest investor presentation depicts the regulated rate base capital expenditures for the next 5 years which will drive growth: (click to enlarge) Contributing directly to the segment’s bottom line, the company’s production fuel costs and maintenance expenses were lower in the quarter. Year-over-year, the segment’s operating income and net income increased over 50%. The second quarter delivered $0.36 in EPS from continuing operations, a 71% increase compared to the 2014 second quarter. Year-to-date, the EPS total of $0.73 is still lagging 2014 by 10%. In 2014, full-year EPS was $1.55. Otter Tail’s original guidance for 2015 was a range of $1.65 to $1.80. With the first quarter results, the range was adjusted to $1.50 to $1.65. In the second quarter press release, Otter Tail management stated it “now expects to be in the middle to upper end of the range”. The company did not formally adjust the range. But, the statement unofficially moves the guidance to $1.57 to $1.65. Based on the company’s strategy, the utility segment’s earnings are to support the dividend paid to shareholders. The 2015 EPS projection for the segment is $1.23 to $1.26. The company’s current annual dividend rate is $1.23. The Varistar segment’s earnings are intended to cover corporate costs and drive share price appreciation. The current full-year projection per share for this segment is $0.50 to $0.58. Corporate costs are projected in a range of $0.19 to $0.23 per share. Compared to 2014 where corporate costs totaled $0.22 per share for the full year, the company is currently operating at just 80% of the 2014 rate. An adjustment to full-year EPS warrants an adjustment in a buy point for Otter Tail. Using the unofficial full-year EPS range of $1.57 to $1.65 equates to a midpoint of $1.61. At a dividend rate of $1.23, the payout ratio based on the unofficial midpoint would be less than 80%. Acknowledging Otter Tail, at 4.4%, has consistently paid above the average yield for diversified utilities, any price up to $30.75 maintains a yield of 4%. As well, any price below $30.75 equates to a P/E ratio equal to the average P/E ratio of 19.09 for the Utilities sector. Disclosure: I am/we are long OTTR. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Additional disclosure: I belong to an investment club that owns shares in OTTR. Scalper1 News

Otter Tail Corporation reported 2015 second quarter results on August 3rd. Based on its performance, the company unofficially increased its full-year EPS projection. Six months in, the company’s potential to cover both its annual dividend and corporate costs looks solid. Even considering Otter Tail traditionally pays a dividend exceeding the average of diversified utilities, the company’s share price is not yet out of fair value range. The allure of owning a diversified utility is the blend of a stable, healthy dividend and the potential of share price appreciation. Otter Tail Corporation (NASDAQ: OTTR ) operates as an electric utility in northern states in the Midwest and as a manufacturer of plastics, PVC pipe and metal fabrication. The company reported second quarter results on August 3rd. After a first quarter reset 9% to 10% downward of full-year estimates, the company unofficially raised full-year estimates in its second quarter reporting. The overall effect is still a decrease from the company’s original guidance. But, the bump now represents improvement over 2014 results which can be extrapolated into safety of the dividend and potential for share price improvement. Otter Tail’s first quarter results were mixed in its manufacturing segment, Varistar. The segment was unexpectedly tripped up by the downturn in the oil and gas industry. The second quarter performance still showed some impact but the company was better able to manage the challenges. The loss of sales to manufacturers of oil and gas equipment was partially offset by sales to manufacturers of lawn and garden equipment, recreational equipment and wind energy equipment. Year-over-year, the segment’s revenue in the quarter decreased 4%. On the bottom line, the segment’s operating income increased 8.6% year-over-year. The primary contributor to the difference was lower resin prices. Otter Tail sold more pounds of PVC pipe at lower prices but it cost the company much less to do so. Relative to its core business of being an electric utility, the company’s performance was favorable in the second quarter. The weather is, obviously, beyond the company’s control. To date, 2015 has offered milder seasons. In the 2014 second quarter, compared to “normal”, both the heating degree days and cooling degree days exceeded 100%. By comparison, in 2015, the heating degree days registered only 82.7% of normal and cooling degree days registered 78.9% of normal. Sales in the quarter were lower to both retail and wholesale customers. This loss was offset by ECR (environmental cost recovery) rider revenue related to the company’s ACQS (air quality control system) environmental upgrade project and higher transmission tariff revenue from MISO (Midcontinent Independent System Operator) related to increased investment in regional transmission lines. The slide below from the latest investor presentation depicts the regulated rate base capital expenditures for the next 5 years which will drive growth: (click to enlarge) Contributing directly to the segment’s bottom line, the company’s production fuel costs and maintenance expenses were lower in the quarter. Year-over-year, the segment’s operating income and net income increased over 50%. The second quarter delivered $0.36 in EPS from continuing operations, a 71% increase compared to the 2014 second quarter. Year-to-date, the EPS total of $0.73 is still lagging 2014 by 10%. In 2014, full-year EPS was $1.55. Otter Tail’s original guidance for 2015 was a range of $1.65 to $1.80. With the first quarter results, the range was adjusted to $1.50 to $1.65. In the second quarter press release, Otter Tail management stated it “now expects to be in the middle to upper end of the range”. The company did not formally adjust the range. But, the statement unofficially moves the guidance to $1.57 to $1.65. Based on the company’s strategy, the utility segment’s earnings are to support the dividend paid to shareholders. The 2015 EPS projection for the segment is $1.23 to $1.26. The company’s current annual dividend rate is $1.23. The Varistar segment’s earnings are intended to cover corporate costs and drive share price appreciation. The current full-year projection per share for this segment is $0.50 to $0.58. Corporate costs are projected in a range of $0.19 to $0.23 per share. Compared to 2014 where corporate costs totaled $0.22 per share for the full year, the company is currently operating at just 80% of the 2014 rate. An adjustment to full-year EPS warrants an adjustment in a buy point for Otter Tail. Using the unofficial full-year EPS range of $1.57 to $1.65 equates to a midpoint of $1.61. At a dividend rate of $1.23, the payout ratio based on the unofficial midpoint would be less than 80%. Acknowledging Otter Tail, at 4.4%, has consistently paid above the average yield for diversified utilities, any price up to $30.75 maintains a yield of 4%. As well, any price below $30.75 equates to a P/E ratio equal to the average P/E ratio of 19.09 for the Utilities sector. Disclosure: I am/we are long OTTR. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Additional disclosure: I belong to an investment club that owns shares in OTTR. Scalper1 News

Scalper1 News