Scalper1 News

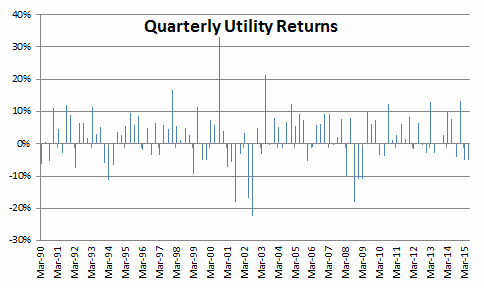

Summary Utilities have produced their worst quarterly returns in 2015 since the financial crisis. Higher interest rates have disproportionately hurt rate-sensitive sectors like utilities. In a relatively fully valued market, the relative underperformance of utilities may present investors an opportunity. The S&P 500 Utility Index, replicated by the Utilities Select Sector SPDR ETF (NYSEARCA: XLU ), has produced a -9.96% return to begin 2015, trailing the S&P 500 (NYSEARCA: SPY ) by over 12%. What has happened? The increase in Treasury yields disproportionately disfavored bond-like stocks with high dividend payouts including utilities and telecom. The trailing dividend yield on the Utilities ETF is now 3.69%. Investors have punished equity sectors with more fixed income-like return streams. After a -5.17% return in the first quarter, the utility index has followed up with a -5.05% return so far in the second quarter. These are the worst returns for the sector since the financial crisis when risk premia on all assets increased as graphed below: Source: Standard and Poor’s; Bloomberg Comparison Versus Bonds For the pounding that interest rate sensitive stocks have taken in 2015, the yield on XLU is still higher than the yield on iShares iBoxx Investment Grade Corporate Bond Index ETF LQD at 3.43%. For the same cash flow stream, I would rather own the equity upside of being a utility shareholder than be the leverage provider by owning their corporate bonds. The -9.96% loss on XLU in the first half has been larger than the -7.54% return on the Barclays Long Treasury Index as proxied by the iShares 20+ Year Treasury Bond ETF (NYSEARCA: TLT ). Conclusion I believe that the utility sector is now relatively cheap, and should be viewed as increasingly attractive to the large Income Investing community on Seeking Alpha. However, I use the term relative as I still expect forward returns on domestic assets to be subnormal . The index I have used as my sector proxy in this article features both gas and electric utilities, fully regulated and a mix of regulated and unregulated business, and features companies located in geographies with different growth trajectories. These utility stocks, at 15.9x trailing earnings, are still collectively trading at a 8% discount to the price Berkshire Hathaway paid for NV Energy in 2013 . Since that purchase in June 2013, the earnings multiple on the broader market has expanded by 13%. Consider this a margin of safety discount to a purchase made by an investor that has a long history of traditionally not paying full sticker price. When Berkshire Hathaway’s ( BRK.A , BRK.B ) MidAmerican Energy Holdings unit bought Pacificorp in 2006, it was reported in Electric Utility Week that Buffett told Oregon regulators that owning utilities was “not a way to get rich – it’s a way to stay rich.” In 2015, utilities have gotten 12% cheaper relative to the rest of the market. Perhaps utilities present dividend-paying investors with long-term horizons an opportunity in a relatively fully valued equity market. Disclaimer: My articles may contain statements and projections that are forward-looking in nature, and therefore inherently subject to numerous risks, uncertainties and assumptions. While my articles focus on generating long-term risk-adjusted returns, investment decisions necessarily involve the risk of loss of principal. Individual investor circumstances vary significantly, and information gleaned from my articles should be applied to your own unique investment situation, objectives, risk tolerance, and investment horizon. Disclosure: I am/we are long SPY. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Summary Utilities have produced their worst quarterly returns in 2015 since the financial crisis. Higher interest rates have disproportionately hurt rate-sensitive sectors like utilities. In a relatively fully valued market, the relative underperformance of utilities may present investors an opportunity. The S&P 500 Utility Index, replicated by the Utilities Select Sector SPDR ETF (NYSEARCA: XLU ), has produced a -9.96% return to begin 2015, trailing the S&P 500 (NYSEARCA: SPY ) by over 12%. What has happened? The increase in Treasury yields disproportionately disfavored bond-like stocks with high dividend payouts including utilities and telecom. The trailing dividend yield on the Utilities ETF is now 3.69%. Investors have punished equity sectors with more fixed income-like return streams. After a -5.17% return in the first quarter, the utility index has followed up with a -5.05% return so far in the second quarter. These are the worst returns for the sector since the financial crisis when risk premia on all assets increased as graphed below: Source: Standard and Poor’s; Bloomberg Comparison Versus Bonds For the pounding that interest rate sensitive stocks have taken in 2015, the yield on XLU is still higher than the yield on iShares iBoxx Investment Grade Corporate Bond Index ETF LQD at 3.43%. For the same cash flow stream, I would rather own the equity upside of being a utility shareholder than be the leverage provider by owning their corporate bonds. The -9.96% loss on XLU in the first half has been larger than the -7.54% return on the Barclays Long Treasury Index as proxied by the iShares 20+ Year Treasury Bond ETF (NYSEARCA: TLT ). Conclusion I believe that the utility sector is now relatively cheap, and should be viewed as increasingly attractive to the large Income Investing community on Seeking Alpha. However, I use the term relative as I still expect forward returns on domestic assets to be subnormal . The index I have used as my sector proxy in this article features both gas and electric utilities, fully regulated and a mix of regulated and unregulated business, and features companies located in geographies with different growth trajectories. These utility stocks, at 15.9x trailing earnings, are still collectively trading at a 8% discount to the price Berkshire Hathaway paid for NV Energy in 2013 . Since that purchase in June 2013, the earnings multiple on the broader market has expanded by 13%. Consider this a margin of safety discount to a purchase made by an investor that has a long history of traditionally not paying full sticker price. When Berkshire Hathaway’s ( BRK.A , BRK.B ) MidAmerican Energy Holdings unit bought Pacificorp in 2006, it was reported in Electric Utility Week that Buffett told Oregon regulators that owning utilities was “not a way to get rich – it’s a way to stay rich.” In 2015, utilities have gotten 12% cheaper relative to the rest of the market. Perhaps utilities present dividend-paying investors with long-term horizons an opportunity in a relatively fully valued equity market. Disclaimer: My articles may contain statements and projections that are forward-looking in nature, and therefore inherently subject to numerous risks, uncertainties and assumptions. While my articles focus on generating long-term risk-adjusted returns, investment decisions necessarily involve the risk of loss of principal. Individual investor circumstances vary significantly, and information gleaned from my articles should be applied to your own unique investment situation, objectives, risk tolerance, and investment horizon. Disclosure: I am/we are long SPY. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Scalper1 News