Scalper1 News

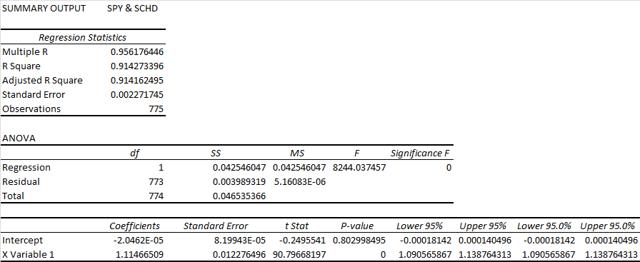

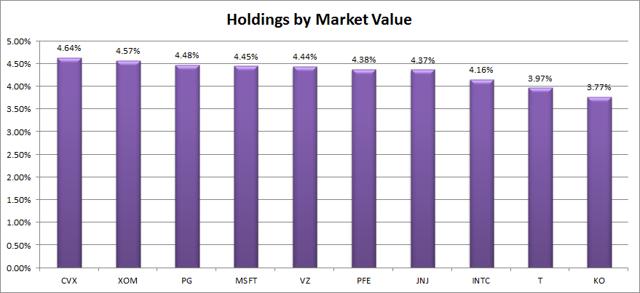

Summary I’m taking a look at SCHD as a candidate for inclusion in my ETF portfolio. The risk level, measured in standard deviation of daily returns is great. The ETF looks even better if combined with other major funds such as SPY. Investors should be seeking to improve their risk adjusted returns. I’m a big fan of using ETFs to achieve the risk adjusted returns relative to the portfolios that a normal investor can generate for themselves after trading costs. I’m working on building a new portfolio and I’m going to be analyzing several of the ETFs that I am considering for my personal portfolio. One of the funds that I’m considering is the Schwab U.S. Dividend Equity ETF (NYSEARCA: SCHD ). I’ll be performing a substantial portion of my analysis along the lines of modern portfolio theory, so my goal is to find ways to minimize costs while achieving diversification to reduce my risk level. What does SCHD do? SCHD invests in large dividend companies. It has shined in my first look at the fund. I was originally planning a 10 to 15% position for a dividend ETF, but now I’m contemplating raising that position up as high as 20 to 25%. At this point, the portfolio is still in the planning and funding stage. Does SCHD provide diversification benefits to a portfolio? Each investor may hold a different portfolio, but I use (NYSEARCA: SPY ) as the basis for my analysis. I believe SPY, or another large cap U.S. fund with similar properties, represents the reasonable first step for many investors designing an ETF portfolio. Therefore, I start my diversification analysis by seeing how it works with SPY. I start with an ANOVA table: (click to enlarge) At first look it may seem like the correlation of 91.42% would mitigate the diversification benefits of using SCHD with a major fund like SPY, but 91% still offers some meaningful benefits as long as the ETF can stand on its own strengths. In my opinion, SCHD passes that test and is a very viable candidate. Standard deviation of daily returns (dividend adjusted, measured since late 2011) This is the strongest area for the ETF. The returns are remarkably stable relative to most equity investments. Generally speaking, standard deviation of daily returns is the realm of SPY. Most ETFs look fairly poor when compared to just holding the S&P 500. The only reason those other equity ETFs can be useful under modern portfolio theory is diversification benefits when used as a fairly small percent of the portfolio. For the period I selected for comparison, the standard deviation on daily returns for SPY is 0.7754%. For SCHD the standard deviation of daily returns is 0.6651%. Mixing it with SPY I also run comparison on the standard deviation of daily returns for the portfolio assuming that the portfolio is combined with the S&P 500. For research, I assume daily rebalancing because it dramatically simplifies the math. With a 50/50 weighting in a portfolio holding only SPY and SCHD, the standard deviation of daily returns across the entire portfolio is 0.7124%. That is a very attractive risk position for a portfolio that only contains two ETFs. Why I use standard deviation of daily returns I don’t believe historical returns have predictive power for future returns, but I do believe historical values for standard deviations of returns relative to other ETFs have some predictive power on future risks and correlations. Yield The distribution yield is 2.52%. The SEC 30 day yield is 2.84%. For a dividend investor that wanted to minimize trading costs, that is a fairly strong yield on an ETF with less systematic risk than SPY. Expense Ratio The ETF is posting .07% for an expense ratio, which is very low. Market to NAV The ETF is trading at a .05% premium to NAV currently, but that is fairly close. A twentieth of one percent is not exposing an investor to a large risk in that regard. This value can change suddenly, so investors should check before submitting a trade. Largest Holdings The biggest holdings are around 4 to 5% of the portfolio. I prepared the following chart to break it down: (click to enlarge) I’m fairly happy with the construction of the top of the portfolio. At present, I’m not very optimistic on Verizon (NYSE: VZ ) or AT&T (NYSE: T ) because I think the industry risk is still being priced into the companies after Sprint (NYSE: S ) became much more aggressive. However, in the longer term (5 to 20 years) I think it makes sense to include them in the fund. Conclusion I’m currently screening a large volume of ETFs for my own portfolio. I’ll do a little more digging on SCHD later and post what I find. The portfolio I’m building is through Schwab, so I’m able to trade SCHD with no commissions. I have a strong preference for researching ETFs that are free to trade in my account. I’m expecting that SCHD will end up with a significant position in my portfolio. Scalper1 News

Summary I’m taking a look at SCHD as a candidate for inclusion in my ETF portfolio. The risk level, measured in standard deviation of daily returns is great. The ETF looks even better if combined with other major funds such as SPY. Investors should be seeking to improve their risk adjusted returns. I’m a big fan of using ETFs to achieve the risk adjusted returns relative to the portfolios that a normal investor can generate for themselves after trading costs. I’m working on building a new portfolio and I’m going to be analyzing several of the ETFs that I am considering for my personal portfolio. One of the funds that I’m considering is the Schwab U.S. Dividend Equity ETF (NYSEARCA: SCHD ). I’ll be performing a substantial portion of my analysis along the lines of modern portfolio theory, so my goal is to find ways to minimize costs while achieving diversification to reduce my risk level. What does SCHD do? SCHD invests in large dividend companies. It has shined in my first look at the fund. I was originally planning a 10 to 15% position for a dividend ETF, but now I’m contemplating raising that position up as high as 20 to 25%. At this point, the portfolio is still in the planning and funding stage. Does SCHD provide diversification benefits to a portfolio? Each investor may hold a different portfolio, but I use (NYSEARCA: SPY ) as the basis for my analysis. I believe SPY, or another large cap U.S. fund with similar properties, represents the reasonable first step for many investors designing an ETF portfolio. Therefore, I start my diversification analysis by seeing how it works with SPY. I start with an ANOVA table: (click to enlarge) At first look it may seem like the correlation of 91.42% would mitigate the diversification benefits of using SCHD with a major fund like SPY, but 91% still offers some meaningful benefits as long as the ETF can stand on its own strengths. In my opinion, SCHD passes that test and is a very viable candidate. Standard deviation of daily returns (dividend adjusted, measured since late 2011) This is the strongest area for the ETF. The returns are remarkably stable relative to most equity investments. Generally speaking, standard deviation of daily returns is the realm of SPY. Most ETFs look fairly poor when compared to just holding the S&P 500. The only reason those other equity ETFs can be useful under modern portfolio theory is diversification benefits when used as a fairly small percent of the portfolio. For the period I selected for comparison, the standard deviation on daily returns for SPY is 0.7754%. For SCHD the standard deviation of daily returns is 0.6651%. Mixing it with SPY I also run comparison on the standard deviation of daily returns for the portfolio assuming that the portfolio is combined with the S&P 500. For research, I assume daily rebalancing because it dramatically simplifies the math. With a 50/50 weighting in a portfolio holding only SPY and SCHD, the standard deviation of daily returns across the entire portfolio is 0.7124%. That is a very attractive risk position for a portfolio that only contains two ETFs. Why I use standard deviation of daily returns I don’t believe historical returns have predictive power for future returns, but I do believe historical values for standard deviations of returns relative to other ETFs have some predictive power on future risks and correlations. Yield The distribution yield is 2.52%. The SEC 30 day yield is 2.84%. For a dividend investor that wanted to minimize trading costs, that is a fairly strong yield on an ETF with less systematic risk than SPY. Expense Ratio The ETF is posting .07% for an expense ratio, which is very low. Market to NAV The ETF is trading at a .05% premium to NAV currently, but that is fairly close. A twentieth of one percent is not exposing an investor to a large risk in that regard. This value can change suddenly, so investors should check before submitting a trade. Largest Holdings The biggest holdings are around 4 to 5% of the portfolio. I prepared the following chart to break it down: (click to enlarge) I’m fairly happy with the construction of the top of the portfolio. At present, I’m not very optimistic on Verizon (NYSE: VZ ) or AT&T (NYSE: T ) because I think the industry risk is still being priced into the companies after Sprint (NYSE: S ) became much more aggressive. However, in the longer term (5 to 20 years) I think it makes sense to include them in the fund. Conclusion I’m currently screening a large volume of ETFs for my own portfolio. I’ll do a little more digging on SCHD later and post what I find. The portfolio I’m building is through Schwab, so I’m able to trade SCHD with no commissions. I have a strong preference for researching ETFs that are free to trade in my account. I’m expecting that SCHD will end up with a significant position in my portfolio. Scalper1 News

Scalper1 News