Scalper1 News

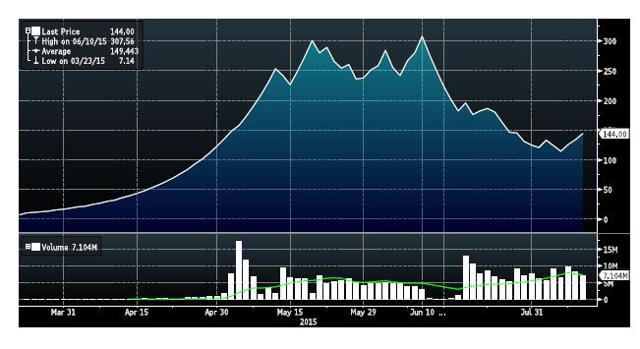

By Kevin Murphy The extreme price volatility experienced of late by the Chinese market has led to the introduction of a variety of measures, including the suspension of trading in numerous companies that we highlighted in Crash course and Key take-away . Almost everything we have read on the subject has painted this kind of market manipulation as an unequivocally bad thing but might there not be a contrarian view? Of course there might and, as instinctive contrarians, here on The Value Perspective, we are happy to offer it. So, would a market where investors are not being quoted stock prices every millisecond really be such a bad thing? To test that idea, let’s imagine a parallel universe where stock quotes happen, say, once a week and see if there are any investment lessons we might take from that. Much of the extraordinary rise seen in China’s markets was driven by what is known in some quarters as ‘momentum’ and in others, less politely, as ‘greater fool theory’ – the idea that, no matter how high a price you pay for a stock, there will always be someone out there with one or two fewer IQ points, who will be prepared to take it off your hands. This does not, of course, always prove to be so. For a very recent example, take a look at the following chart, which shows the trading volumes and price journey of shares in the audio and video entertainment business Baofeng Beijing Technology – the Chinese YouTube, so to speak – after it floated in March. You can see that trading volumes only really picked up after the share price had risen exponentially. (click to enlarge) Source: Bloomberg August 2015 What that suggests – aside from that plenty of people will be out of the money after Baofeng’s recent falls – is that investors can often focus on a stock more because of its price journey than anything that underpins it fundamentally. As such, those investors who thought it a good idea to buy Baofeng at 380x its prospective earnings would have needed to find themselves a particularly sizable fool. So the first investment lesson we might take from our parallel universe and its markedly less frenetic stock market is that, once the constant opportunity to sell on shares is removed, investors have to think a little harder about business fundamentals. Their ability – or, perhaps more accurately, their belief that they will be able – to find a greater fool will have been significantly reduced. A second investment lesson relates to time horizons, which, as regular visitors to will know, we think about a lot on The Value Perspective. Warren Buffett once observed: “I never attempt to make money on the stock market. I buy on the assumption that they could close the market the next day and not reopen it for five years.” As it happens, five years is also the average length of time we own a share. Our focus on business valuation and the margin of safety that it offers means that, here on The Value Perspective, we would not to be too concerned about having to operate in a market that did not quote prices every second of every day – though we of course acknowledge our investors always feel happier knowing they can access their money when they wish. So does this all mean we yearn to operate in that parallel universe and its more considered stock market, where one might expect to see a much greater focus from investors on business fundamentals and longer time horizons? Absolutely not. That would see a lot more people encroaching on our investment turf. As contrarians, we are – this time – perfectly happy with the status quo. Scalper1 News

By Kevin Murphy The extreme price volatility experienced of late by the Chinese market has led to the introduction of a variety of measures, including the suspension of trading in numerous companies that we highlighted in Crash course and Key take-away . Almost everything we have read on the subject has painted this kind of market manipulation as an unequivocally bad thing but might there not be a contrarian view? Of course there might and, as instinctive contrarians, here on The Value Perspective, we are happy to offer it. So, would a market where investors are not being quoted stock prices every millisecond really be such a bad thing? To test that idea, let’s imagine a parallel universe where stock quotes happen, say, once a week and see if there are any investment lessons we might take from that. Much of the extraordinary rise seen in China’s markets was driven by what is known in some quarters as ‘momentum’ and in others, less politely, as ‘greater fool theory’ – the idea that, no matter how high a price you pay for a stock, there will always be someone out there with one or two fewer IQ points, who will be prepared to take it off your hands. This does not, of course, always prove to be so. For a very recent example, take a look at the following chart, which shows the trading volumes and price journey of shares in the audio and video entertainment business Baofeng Beijing Technology – the Chinese YouTube, so to speak – after it floated in March. You can see that trading volumes only really picked up after the share price had risen exponentially. (click to enlarge) Source: Bloomberg August 2015 What that suggests – aside from that plenty of people will be out of the money after Baofeng’s recent falls – is that investors can often focus on a stock more because of its price journey than anything that underpins it fundamentally. As such, those investors who thought it a good idea to buy Baofeng at 380x its prospective earnings would have needed to find themselves a particularly sizable fool. So the first investment lesson we might take from our parallel universe and its markedly less frenetic stock market is that, once the constant opportunity to sell on shares is removed, investors have to think a little harder about business fundamentals. Their ability – or, perhaps more accurately, their belief that they will be able – to find a greater fool will have been significantly reduced. A second investment lesson relates to time horizons, which, as regular visitors to will know, we think about a lot on The Value Perspective. Warren Buffett once observed: “I never attempt to make money on the stock market. I buy on the assumption that they could close the market the next day and not reopen it for five years.” As it happens, five years is also the average length of time we own a share. Our focus on business valuation and the margin of safety that it offers means that, here on The Value Perspective, we would not to be too concerned about having to operate in a market that did not quote prices every second of every day – though we of course acknowledge our investors always feel happier knowing they can access their money when they wish. So does this all mean we yearn to operate in that parallel universe and its more considered stock market, where one might expect to see a much greater focus from investors on business fundamentals and longer time horizons? Absolutely not. That would see a lot more people encroaching on our investment turf. As contrarians, we are – this time – perfectly happy with the status quo. Scalper1 News

Scalper1 News