Scalper1 News

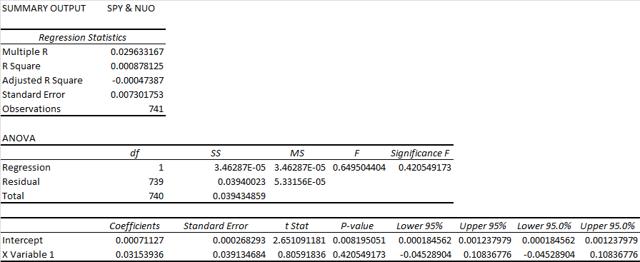

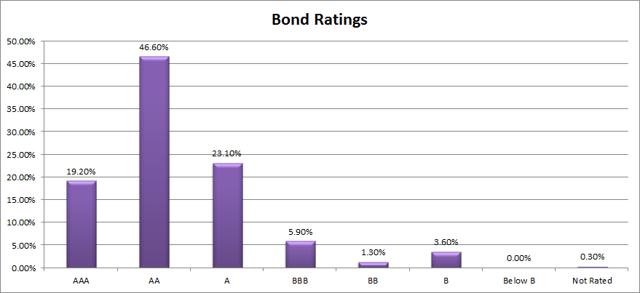

Summary I’m taking a look at NUO as a candidate for inclusion in my ETF portfolio. I don’t like the expense ratio. The correlation to SPY is almost nothing and it is based on reasonable trade volumes. The credit ratings of the portfolio seem fine, but the high duration and persistent discount to NAV concern me. I’m not assessing any tax impacts. Investors should check their own situation for tax exposure. Investors should be seeking to improve their risk adjusted returns. I’m a big fan of using ETFs to achieve the risk adjusted returns relative to the portfolios that a normal investor can generate for themselves after trading costs. I’m working on building a new portfolio and I’m going to be analyzing several of the ETFs that I am considering for my personal portfolio. One of the funds that I’m considering is the Nuveen Ohio Quality Income Municipal Fund (NYSE: NUO ). I’ll be performing a substantial portion of my analysis along the lines of modern portfolio theory, so my goal is to find ways to minimize costs while achieving diversification to reduce my risk level. What does NUO do? NUO attempts to provide current income that is exempted from regular federal and Ohio income tax. At least 80% of the assets are invested in investment grade municipal bonds. The other 20% may be invested in bonds that are not rated if the investment adviser believes their characteristics are similar to those of investment grade municipal bonds. NUO falls under the category of “Muni Ohio.” Does NUO provide diversification benefits to a portfolio? Each investor may hold a different portfolio, but I use the SPDR S&P 500 Trust ETF (NYSEARCA: SPY ) as the basis for my analysis. I believe SPY, or another large cap U.S. fund with similar properties, represents the reasonable first step for many investors designing an ETF portfolio. Therefore, I start my diversification analysis by seeing how it works with SPY. I start with an ANOVA table: (click to enlarge) The correlation is beautiful at 3%. Extremely low levels of correlation are wonderful for establishing a more stable portfolio. For equity securities an extremely low correlation is frequently only found when there are substantial issues with trading volumes that may distort the statistics. Bonds should have dramatically lower levels of correlation, but I’m still quite happy with this. NUO is an ETF that is heavily invested in bonds, so the low correlation for it should be less surprising than a similar correlation from an ETF that is invested in equity. Standard deviation of daily returns (dividend adjusted, measured since January 2012) The standard deviation is .6859% for NUO. For SPY, it is .7300% for the same period. SPY usually beats other ETFs in this regard. However, I would have hoped for a little less volatility. The real test for a bond portfolio is looking at the duration and seeing how vulnerable it is to changes in interest rates. Liquidity looks acceptable Average trading volume isn’t very high, a bit over 22,000, but that also isn’t low enough to be a major concern for me. It is higher than I had expected when I saw the low correlation and saw that the bond was being designed for tax exemption for a single state. I thought liquidity might be weaker because of the more specialized nature of the ETF, but it isn’t too bad in my opinion. In my sample period of nearly 3 years, there were no days in which the dividend adjusted close was exactly equal to the value it had on the previous day. The lack of days with no change suggests that low liquidity is not driving the low correlation. Mixing it with SPY I also run comparisons on the standard deviation of daily returns for the portfolio assuming that the portfolio is combined with the S&P 500. For research, I assume daily rebalancing because it dramatically simplifies the math. With a 50/50 weighting in a portfolio holding only SPY and NUO, the standard deviation of daily returns across the entire portfolio is .5082%. With 80% in SPY and 20% in NUO, the standard deviation of the portfolio would have been .6038%. If an investor wanted to use NUO as a supplement to their portfolio, the standard deviation across the portfolio with 95% in SPY and 5% in NUO would have been .6954%. Why I use standard deviation of daily returns I don’t believe historical returns have predictive power for future returns, but I do believe historical values for standard deviations of returns relative to other ETFs have some predictive power on future risks and correlations. Yield & Taxes The distribution rate is 5.72%. This ETF could be worth considering for retiring investors. I like to see strong yields for retiring portfolios because I don’t want to touch the principal. By investing in ETFs I’m removing some of the human emotions, such as panic. Since this is an investment in bonds through an ETF, over the long term capital appreciation should not be expected. In my opinion, investing in SPY provides a reasonable level of dividend yield with a substantial amount of average appreciation over time. For a retiring investor, it may be desirable to have stronger yields at the cost of appreciation. One way to do that is to include some bond ETFs. I intend to include quite a few of them in my portfolio. The exposure level will probably be in the 20 to 30% range. Some advisors would suggest that I should have fewer bonds since I am so far away from retirement, but I believe the lower correlation makes it imperative to include at least a small bond position in reaching the efficient frontier. I’m not a CPA or CFP, so I’m not assessing any tax impacts. The description of the ETF states that it intends to produce income that is exempt from taxation in Ohio, but I am not qualified to determine if that goal is being met. The portfolio I am constructed will be in a tax advantaged account, so I am not concerned about avoiding taxes on interest, dividends, or gains. Expense Ratio The ETF is posting 2.15 % for a gross expense ratio, and 1.10% for a net expense ratio. I want diversification, I want stability, and I don’t want to pay for them. This is what I would consider an unattractive expense ratio. Market to NAV The ETF is at a 9.66% discount to NAV currently. Premiums or discounts to NAV can change very quickly so investors should check prior to putting in an order. Over the last month the average discount was 9.56% and over the last year it was 6.78%. I’m curious about the reason for that substantial discount. Normally I would expect fair market values for the individual investments used in calculating NAV, but I’m curious about this one. It may be fun to look for anything that would merit that discount. Credit Ratings The bond ratings aren’t too bad in my opinion, but I’m also currently holding a fund filled with junk bonds. Many readers may have much higher requirements for credit ratings when investing in debt. (click to enlarge) Conclusion I’m currently screening a large volume of ETFs for my own portfolio. The portfolio I’m building is through Schwab. I have a strong preference for researching ETFs that are free to trade in my account, so most of my research will be on ETFs that fall under the “ETF OneSource” program. I have not seen this ETF listed for the OneSource program. I love the correlation, but I’ll need to test the correlation with other bond ETFs as I work to select a batch of bond ETFs that are neither highly correlated to the market nor to each other. I do have a few major concerns here. The first is that I don’t want to give up any yield to acquire tax free status on bonds that are going into a tax advantaged account. The second is that the expense ratio feels really high. The third is that discount to NAV is both substantial and sustained, so I would want to find the cause of the discount. The fourth is that the average effective duration is 8.84 years. One of the reasons I use junk bonds is so I can acquire a respectable yield while maintaining a substantially lower duration. I’m not expecting NUO to make the final cut, but I’m going to keep on my list because I want to see how it performs relative to other bond ETFs in the portfolio simulations. Additional disclosure: Information in this article represents the opinion of the analyst. All statements are represented as opinions, rather than facts, and should not be construed as advice to buy or sell a security. Ratings of “outperform” and “underperform” reflect the analyst’s estimation of a divergence between the market value for a security and the price that would be appropriate given the potential for risks and returns relative to other securities. The analyst does not know your particular objectives for returns or constraints upon investing. All investors are encouraged to do their own research before making any investment decision. Information is regularly obtained from Yahoo Finance, Google Finance, and SEC Database. If Yahoo, Google, or the SEC database contained faulty or old information it could be incorporated into my analysis. The analyst holds a diversified portfolio including mutual funds or index funds which may include a small long exposure to the stock. Scalper1 News

Summary I’m taking a look at NUO as a candidate for inclusion in my ETF portfolio. I don’t like the expense ratio. The correlation to SPY is almost nothing and it is based on reasonable trade volumes. The credit ratings of the portfolio seem fine, but the high duration and persistent discount to NAV concern me. I’m not assessing any tax impacts. Investors should check their own situation for tax exposure. Investors should be seeking to improve their risk adjusted returns. I’m a big fan of using ETFs to achieve the risk adjusted returns relative to the portfolios that a normal investor can generate for themselves after trading costs. I’m working on building a new portfolio and I’m going to be analyzing several of the ETFs that I am considering for my personal portfolio. One of the funds that I’m considering is the Nuveen Ohio Quality Income Municipal Fund (NYSE: NUO ). I’ll be performing a substantial portion of my analysis along the lines of modern portfolio theory, so my goal is to find ways to minimize costs while achieving diversification to reduce my risk level. What does NUO do? NUO attempts to provide current income that is exempted from regular federal and Ohio income tax. At least 80% of the assets are invested in investment grade municipal bonds. The other 20% may be invested in bonds that are not rated if the investment adviser believes their characteristics are similar to those of investment grade municipal bonds. NUO falls under the category of “Muni Ohio.” Does NUO provide diversification benefits to a portfolio? Each investor may hold a different portfolio, but I use the SPDR S&P 500 Trust ETF (NYSEARCA: SPY ) as the basis for my analysis. I believe SPY, or another large cap U.S. fund with similar properties, represents the reasonable first step for many investors designing an ETF portfolio. Therefore, I start my diversification analysis by seeing how it works with SPY. I start with an ANOVA table: (click to enlarge) The correlation is beautiful at 3%. Extremely low levels of correlation are wonderful for establishing a more stable portfolio. For equity securities an extremely low correlation is frequently only found when there are substantial issues with trading volumes that may distort the statistics. Bonds should have dramatically lower levels of correlation, but I’m still quite happy with this. NUO is an ETF that is heavily invested in bonds, so the low correlation for it should be less surprising than a similar correlation from an ETF that is invested in equity. Standard deviation of daily returns (dividend adjusted, measured since January 2012) The standard deviation is .6859% for NUO. For SPY, it is .7300% for the same period. SPY usually beats other ETFs in this regard. However, I would have hoped for a little less volatility. The real test for a bond portfolio is looking at the duration and seeing how vulnerable it is to changes in interest rates. Liquidity looks acceptable Average trading volume isn’t very high, a bit over 22,000, but that also isn’t low enough to be a major concern for me. It is higher than I had expected when I saw the low correlation and saw that the bond was being designed for tax exemption for a single state. I thought liquidity might be weaker because of the more specialized nature of the ETF, but it isn’t too bad in my opinion. In my sample period of nearly 3 years, there were no days in which the dividend adjusted close was exactly equal to the value it had on the previous day. The lack of days with no change suggests that low liquidity is not driving the low correlation. Mixing it with SPY I also run comparisons on the standard deviation of daily returns for the portfolio assuming that the portfolio is combined with the S&P 500. For research, I assume daily rebalancing because it dramatically simplifies the math. With a 50/50 weighting in a portfolio holding only SPY and NUO, the standard deviation of daily returns across the entire portfolio is .5082%. With 80% in SPY and 20% in NUO, the standard deviation of the portfolio would have been .6038%. If an investor wanted to use NUO as a supplement to their portfolio, the standard deviation across the portfolio with 95% in SPY and 5% in NUO would have been .6954%. Why I use standard deviation of daily returns I don’t believe historical returns have predictive power for future returns, but I do believe historical values for standard deviations of returns relative to other ETFs have some predictive power on future risks and correlations. Yield & Taxes The distribution rate is 5.72%. This ETF could be worth considering for retiring investors. I like to see strong yields for retiring portfolios because I don’t want to touch the principal. By investing in ETFs I’m removing some of the human emotions, such as panic. Since this is an investment in bonds through an ETF, over the long term capital appreciation should not be expected. In my opinion, investing in SPY provides a reasonable level of dividend yield with a substantial amount of average appreciation over time. For a retiring investor, it may be desirable to have stronger yields at the cost of appreciation. One way to do that is to include some bond ETFs. I intend to include quite a few of them in my portfolio. The exposure level will probably be in the 20 to 30% range. Some advisors would suggest that I should have fewer bonds since I am so far away from retirement, but I believe the lower correlation makes it imperative to include at least a small bond position in reaching the efficient frontier. I’m not a CPA or CFP, so I’m not assessing any tax impacts. The description of the ETF states that it intends to produce income that is exempt from taxation in Ohio, but I am not qualified to determine if that goal is being met. The portfolio I am constructed will be in a tax advantaged account, so I am not concerned about avoiding taxes on interest, dividends, or gains. Expense Ratio The ETF is posting 2.15 % for a gross expense ratio, and 1.10% for a net expense ratio. I want diversification, I want stability, and I don’t want to pay for them. This is what I would consider an unattractive expense ratio. Market to NAV The ETF is at a 9.66% discount to NAV currently. Premiums or discounts to NAV can change very quickly so investors should check prior to putting in an order. Over the last month the average discount was 9.56% and over the last year it was 6.78%. I’m curious about the reason for that substantial discount. Normally I would expect fair market values for the individual investments used in calculating NAV, but I’m curious about this one. It may be fun to look for anything that would merit that discount. Credit Ratings The bond ratings aren’t too bad in my opinion, but I’m also currently holding a fund filled with junk bonds. Many readers may have much higher requirements for credit ratings when investing in debt. (click to enlarge) Conclusion I’m currently screening a large volume of ETFs for my own portfolio. The portfolio I’m building is through Schwab. I have a strong preference for researching ETFs that are free to trade in my account, so most of my research will be on ETFs that fall under the “ETF OneSource” program. I have not seen this ETF listed for the OneSource program. I love the correlation, but I’ll need to test the correlation with other bond ETFs as I work to select a batch of bond ETFs that are neither highly correlated to the market nor to each other. I do have a few major concerns here. The first is that I don’t want to give up any yield to acquire tax free status on bonds that are going into a tax advantaged account. The second is that the expense ratio feels really high. The third is that discount to NAV is both substantial and sustained, so I would want to find the cause of the discount. The fourth is that the average effective duration is 8.84 years. One of the reasons I use junk bonds is so I can acquire a respectable yield while maintaining a substantially lower duration. I’m not expecting NUO to make the final cut, but I’m going to keep on my list because I want to see how it performs relative to other bond ETFs in the portfolio simulations. Additional disclosure: Information in this article represents the opinion of the analyst. All statements are represented as opinions, rather than facts, and should not be construed as advice to buy or sell a security. Ratings of “outperform” and “underperform” reflect the analyst’s estimation of a divergence between the market value for a security and the price that would be appropriate given the potential for risks and returns relative to other securities. The analyst does not know your particular objectives for returns or constraints upon investing. All investors are encouraged to do their own research before making any investment decision. Information is regularly obtained from Yahoo Finance, Google Finance, and SEC Database. If Yahoo, Google, or the SEC database contained faulty or old information it could be incorporated into my analysis. The analyst holds a diversified portfolio including mutual funds or index funds which may include a small long exposure to the stock. Scalper1 News

Scalper1 News