Scalper1 News

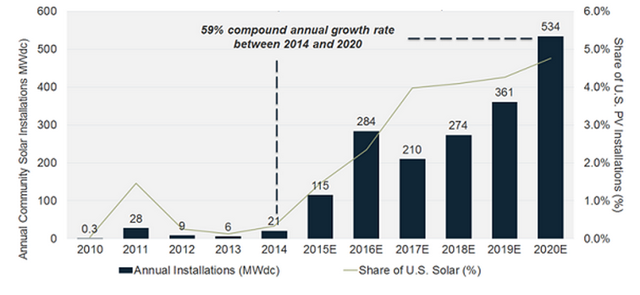

Summary NRG Energy is jumping into community solar, making it one of the first companies to enter into this promising market. NRG Energy holds many unique advantages in the community solar segment, making it highly competitive against even the likes of SolarCity. The company’s growing distributed solar operations comes with many risks, most notable in the form of long-term unknowns. The community solar concept is rapidly gaining steam, with some leading solar companies jumping into this space over the past few months. Given that community solar covers the renters’ market, which consists of 108 million individuals in the U.S. alone, its sudden emergence is not so surprising. Financing in the solar industry has finally reached a stage where community solar is not only feasible, but attractive for solar companies. While there are many more complexities involved in this solar market compared to the residential or utility-scale solar markets, it should still see explosive growth in the near term. NRG Energy (NYSE: NRG ) has been the latest company to enter into the community solar market, which is not surprising given its ambitions in distributed solar. The company recently launched a 1 MW project (connected to 200 homes), which will serve as a pilot to more community solar projects in the future. With 100 MW of shared community solar projects already in its pipeline, NRG Energy clearly has big community solar ambitions. This marks the first time that NRG Energy has been able to penetrate a major solar market so early on, which should add more upside to the company’s already undervalued stock. First Mover’s Advantage The community solar market has just recently opened up, which means that NRG Energy has a huge opportunity to cement itself early on as a dominant presence. Given the immense size of the U.S. renters’ market alone, the company should be able to experience some serious growth in this arena. While the current community solar market is nearly nonexistent, this market is expected to grow at ~60% per annum until 2020. This would mean that the community solar segment should grow approximately twice as fast as the general industry during this time period. While dominating the community solar segment will certainly not be easy for NRG Energy, the company has all the tools to do so. With the operational capabilities and expertise of its NRG Home and NRG Renew business segments, the company could even compete with the likes of SolarCity (NASDAQ: SCTY ) on this front. In fact, NRG Energy’s 100 MW community solar pipeline is equivalent to that of SolarCity’s . Given that SolarCity was the first company to make a truly impactful entrance into community solar, this shows how ambitious and forward-looking NRG Energy is. GTM Research predicts that community solar will be a half-GW market (annual) by 2020. (click to enlarge) Source: GTM Research Unique Advantages NRG Energy has some major advantages over its competitors on the community solar, and more generally, distributed solar front. First, the company already has a huge customer base off of which to leverage for its distributed/community solar business. The company also has stronger relationships with electricity companies compared to its solar pure play peers, which should allow it to expand its community solar segment more rapidly. Given that cooperation with utilities will likely prove key to dominating the community solar segment, NRG Energy definitely has an edge on this front. With NRG Energy’s enormous distributed solar ambitions, it is easy to forget that the company is one of the largest fossil fuel power companies in the world. In fact, the company has a whopping ~47 GW of operational assets, which would also give the company a financing edge over its pure play solar competitors. As such, NRG Energy will almost certainly be one of the front-runners in the highly promising community solar segment. While NRG Energy’s pure play solar competitors may be more well versed in the solar arena, NRG Energy’s own unique advantages more than make up for this. Obstacles The community solar segment is still basically unexplored, which means that first movers like NRG Energy are taking on more risk. Despite the sudden surge of competitors in this arena, the community solar business model is still new. As NRG Energy is planning to make the community solar segment a sizable portion of its business down the road, the company will likely funnel a lot of its resources into this arena. Given the unknowns associated with community solar, entering into this segment is relatively risky. More generally, there are also many long-term questions about the solar leasing model used by NRG Energy. How the long-term plays out for solar leases is incredibly important for the company as it is making a huge transition to renewables, and is planning to make distributed solar one of its focal points. Regardless of such unknowns, the potential rewards of involving itself in this solar segment far outweigh the risks. NRG Energy’s transition from a fossil fuel-centric power company to one more focused around renewables should prove to be extremely smart on balance. Conclusion NRG Energy has faced a yearlong downturn, which can largely be attributed to the instability experienced by the fossil fuels industry during this time. Although many investors still view NRG Energy as part of the fossil fuels sector, the majority of the company’s long-term prospects lie in its growing renewables sector, namely solar. Given the sheer potential of its distributed solar business alone, NRG Energy is undervalued at a market valuation of $7.2B . NRG Energy is slated to be one of SolarCity’s largest competitors, which speaks to the potential that NRG Energy’s solar segment holds. The company’s entrance into community solar just reinforces its place within the future energy landscape. Disclosure: I am/we are long SCTY. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Summary NRG Energy is jumping into community solar, making it one of the first companies to enter into this promising market. NRG Energy holds many unique advantages in the community solar segment, making it highly competitive against even the likes of SolarCity. The company’s growing distributed solar operations comes with many risks, most notable in the form of long-term unknowns. The community solar concept is rapidly gaining steam, with some leading solar companies jumping into this space over the past few months. Given that community solar covers the renters’ market, which consists of 108 million individuals in the U.S. alone, its sudden emergence is not so surprising. Financing in the solar industry has finally reached a stage where community solar is not only feasible, but attractive for solar companies. While there are many more complexities involved in this solar market compared to the residential or utility-scale solar markets, it should still see explosive growth in the near term. NRG Energy (NYSE: NRG ) has been the latest company to enter into the community solar market, which is not surprising given its ambitions in distributed solar. The company recently launched a 1 MW project (connected to 200 homes), which will serve as a pilot to more community solar projects in the future. With 100 MW of shared community solar projects already in its pipeline, NRG Energy clearly has big community solar ambitions. This marks the first time that NRG Energy has been able to penetrate a major solar market so early on, which should add more upside to the company’s already undervalued stock. First Mover’s Advantage The community solar market has just recently opened up, which means that NRG Energy has a huge opportunity to cement itself early on as a dominant presence. Given the immense size of the U.S. renters’ market alone, the company should be able to experience some serious growth in this arena. While the current community solar market is nearly nonexistent, this market is expected to grow at ~60% per annum until 2020. This would mean that the community solar segment should grow approximately twice as fast as the general industry during this time period. While dominating the community solar segment will certainly not be easy for NRG Energy, the company has all the tools to do so. With the operational capabilities and expertise of its NRG Home and NRG Renew business segments, the company could even compete with the likes of SolarCity (NASDAQ: SCTY ) on this front. In fact, NRG Energy’s 100 MW community solar pipeline is equivalent to that of SolarCity’s . Given that SolarCity was the first company to make a truly impactful entrance into community solar, this shows how ambitious and forward-looking NRG Energy is. GTM Research predicts that community solar will be a half-GW market (annual) by 2020. (click to enlarge) Source: GTM Research Unique Advantages NRG Energy has some major advantages over its competitors on the community solar, and more generally, distributed solar front. First, the company already has a huge customer base off of which to leverage for its distributed/community solar business. The company also has stronger relationships with electricity companies compared to its solar pure play peers, which should allow it to expand its community solar segment more rapidly. Given that cooperation with utilities will likely prove key to dominating the community solar segment, NRG Energy definitely has an edge on this front. With NRG Energy’s enormous distributed solar ambitions, it is easy to forget that the company is one of the largest fossil fuel power companies in the world. In fact, the company has a whopping ~47 GW of operational assets, which would also give the company a financing edge over its pure play solar competitors. As such, NRG Energy will almost certainly be one of the front-runners in the highly promising community solar segment. While NRG Energy’s pure play solar competitors may be more well versed in the solar arena, NRG Energy’s own unique advantages more than make up for this. Obstacles The community solar segment is still basically unexplored, which means that first movers like NRG Energy are taking on more risk. Despite the sudden surge of competitors in this arena, the community solar business model is still new. As NRG Energy is planning to make the community solar segment a sizable portion of its business down the road, the company will likely funnel a lot of its resources into this arena. Given the unknowns associated with community solar, entering into this segment is relatively risky. More generally, there are also many long-term questions about the solar leasing model used by NRG Energy. How the long-term plays out for solar leases is incredibly important for the company as it is making a huge transition to renewables, and is planning to make distributed solar one of its focal points. Regardless of such unknowns, the potential rewards of involving itself in this solar segment far outweigh the risks. NRG Energy’s transition from a fossil fuel-centric power company to one more focused around renewables should prove to be extremely smart on balance. Conclusion NRG Energy has faced a yearlong downturn, which can largely be attributed to the instability experienced by the fossil fuels industry during this time. Although many investors still view NRG Energy as part of the fossil fuels sector, the majority of the company’s long-term prospects lie in its growing renewables sector, namely solar. Given the sheer potential of its distributed solar business alone, NRG Energy is undervalued at a market valuation of $7.2B . NRG Energy is slated to be one of SolarCity’s largest competitors, which speaks to the potential that NRG Energy’s solar segment holds. The company’s entrance into community solar just reinforces its place within the future energy landscape. Disclosure: I am/we are long SCTY. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Scalper1 News