Scalper1 News

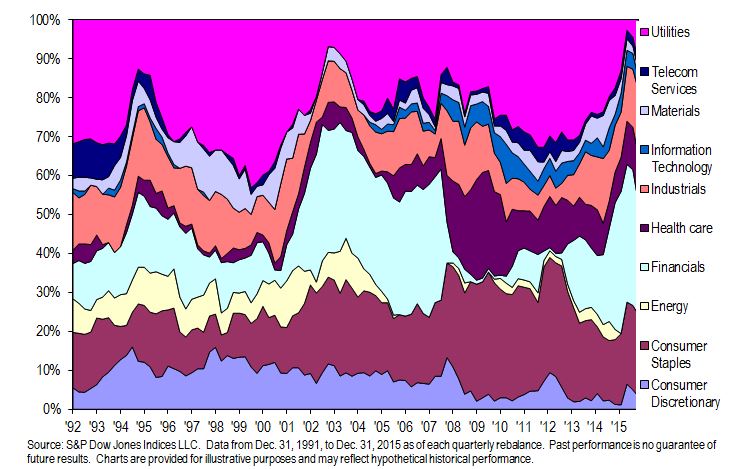

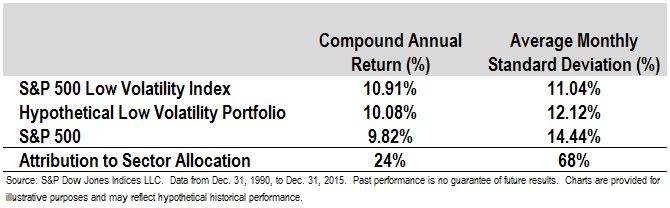

By Fei Mei Chan Low volatility strategies were a popular and growing category in 2015, and if the first several days of 2016 are any indication, it wouldn’t be surprising to see their popularity continue in the New Year. That said, the topic of low volatility investing often comes with much discourse. A frequent argument is that a low volatility tilt is very similar, if not synonymous, to a bet on a small number of sectors or industries. In its 25-year history, the S&P 500 Low Volatility Index has often had high concentration in low volatile sectors – most frequently Utilities, Financials, and Consumer Staples. The index seeks out the least volatile stocks – with no sector constraints – so having large positions in sectors with relatively lower risk is not surprising. However, there’s more to the low volatility story than a sector bet . As an exercise, we produce a hypothetical low volatility portfolio whose sector weights match those of the S&P 500 Low Volatility Index but whose sector returns match those of the complete S&P 500. The hypothetical results tell us to what extent Low Vol’s results come from sector tilts alone, vs. stock selection within sectors. As shown below, over the last 25 years, the hypothetical portfolio’s standard deviation was between those of the S&P 500 and the S&P 500 Low Volatility Index. Being in the Low Vol’s sectors during this period accounted for more than two-thirds of the total volatility reduction achieved by the S&P 500 Low Volatility Index. In the same period, the return increment attributed to being in the “correct” sector was only 24%. More than three-quarters of Low Vol’s outperformance is idiosyncratic to its stock selection methodology. We’re not alone in arguing for the existence of the low volatility effect independent of sector impacts. Baker, Bradley, and Taliaferro , in decomposing the low risk anomaly, found that stock selection contributed to higher alpha, while the contribution from industry selection was negligible. Asness, Frazzini and Pedersen concluded that even holding the industry effect neutral, low volatility bets exhibited positive returns. The implication of all this research is that a sector tilt can’t account for all the performance differentials of low volatility. To assume that the two strategies are synonymous is to leave something on the table. Disclosure: © S&P Dow Jones Indices LLC 2015. Indexology® is a trademark of S&P Dow Jones Indices LLC (SPDJI). S&P® is a trademark of Standard & Poor’s Financial Services LLC and Dow Jones® is a trademark of Dow Jones Trademark Holdings LLC, and those marks have been licensed to S&P DJI. This material is reproduced with the prior written consent of S&P DJI. For more information on S&P DJI and to see our full disclaimer, visit www.spdji.com/terms-of-use . Scalper1 News

By Fei Mei Chan Low volatility strategies were a popular and growing category in 2015, and if the first several days of 2016 are any indication, it wouldn’t be surprising to see their popularity continue in the New Year. That said, the topic of low volatility investing often comes with much discourse. A frequent argument is that a low volatility tilt is very similar, if not synonymous, to a bet on a small number of sectors or industries. In its 25-year history, the S&P 500 Low Volatility Index has often had high concentration in low volatile sectors – most frequently Utilities, Financials, and Consumer Staples. The index seeks out the least volatile stocks – with no sector constraints – so having large positions in sectors with relatively lower risk is not surprising. However, there’s more to the low volatility story than a sector bet . As an exercise, we produce a hypothetical low volatility portfolio whose sector weights match those of the S&P 500 Low Volatility Index but whose sector returns match those of the complete S&P 500. The hypothetical results tell us to what extent Low Vol’s results come from sector tilts alone, vs. stock selection within sectors. As shown below, over the last 25 years, the hypothetical portfolio’s standard deviation was between those of the S&P 500 and the S&P 500 Low Volatility Index. Being in the Low Vol’s sectors during this period accounted for more than two-thirds of the total volatility reduction achieved by the S&P 500 Low Volatility Index. In the same period, the return increment attributed to being in the “correct” sector was only 24%. More than three-quarters of Low Vol’s outperformance is idiosyncratic to its stock selection methodology. We’re not alone in arguing for the existence of the low volatility effect independent of sector impacts. Baker, Bradley, and Taliaferro , in decomposing the low risk anomaly, found that stock selection contributed to higher alpha, while the contribution from industry selection was negligible. Asness, Frazzini and Pedersen concluded that even holding the industry effect neutral, low volatility bets exhibited positive returns. The implication of all this research is that a sector tilt can’t account for all the performance differentials of low volatility. To assume that the two strategies are synonymous is to leave something on the table. Disclosure: © S&P Dow Jones Indices LLC 2015. Indexology® is a trademark of S&P Dow Jones Indices LLC (SPDJI). S&P® is a trademark of Standard & Poor’s Financial Services LLC and Dow Jones® is a trademark of Dow Jones Trademark Holdings LLC, and those marks have been licensed to S&P DJI. This material is reproduced with the prior written consent of S&P DJI. For more information on S&P DJI and to see our full disclaimer, visit www.spdji.com/terms-of-use . Scalper1 News

Scalper1 News