Gold miner Newmont Mining Corporation NEM is scheduled to report fourth-quarter 2016 results after the closing bell on Feb 21.

Last quarter, the company’s earnings were in line with the Zacks Consensus Estimate. Newmont has beaten the Zacks Estimate in two of the trailing four quarters, with an average positive surprise of 11.9%.

Let’s see how things are shaping up prior to this announcement.

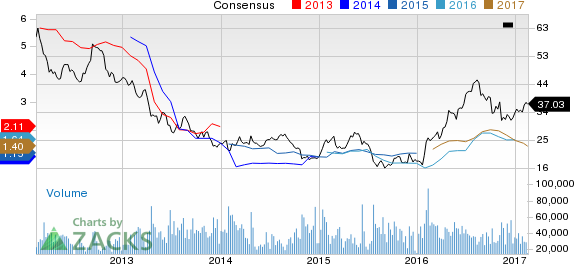

Newmont Mining Corporation Price and Consensus

Newmont Mining Corporation Price and Consensus | Newmont Mining Corporation Quote

Factors to Consider

Newmont anticipates gold production in the range of 4.8-5 million ounces in 2016 factoring in increased production at CC&V, Tanami, Merian and Long Canyon. Copper production has been forecast to be between 40,000-60,000 tons for 2016, with stable production expected at Phoenix and Boddington. The company, in October, also reduced its capital spending guidance for 2016 to between $ 970 million and $ 1.2 billion which include sustaining capital expenditure of between $ 550 million and $ 600 million.

The company, in December, announced it is likely to record non-cash impairment charge in the range of $ 1 billion to $ 1.2 billion in the fourth-quarter 2016 due to costs associated with the closure of its Yanacocha gold mine in Peru. This may weigh on its fourth-quarter earnings.

Newmont continues to invest in a number of growth projects including Long Canyon in Nevada and Merian in Suriname. Newmont remains optimistic about its Long Canyon project in Nevada. The mine recently reached commercial production and is expected to produce between 100,000 and 150,000 ounces of gold annually over an eight-year mine life.

The company has also initiated commercial production from its Phoenix copper leach project in Nevada. Moreover, Newmont’s Merian project recently started commercial production. During the mine’s first five years of operation, Newmont expects average annual production between 400,000 and 500,000 attributable ounces of gold.

Newmont is also moving ahead with its Tanami expansion project in Australia which is expected to improve gold production at the mine to 425,000 to 475,000 ounces per year. The expansion is expected to come on stream in 2017.

Newmont is also making notable progress with its cost and efficiency improvement programs. The company remains on track to meet its cost target for 2016. Successful cost reductions are allowing the company to generate positive free cash flow. The company generated free cash flow of $ 240 million in the third quarter of 2016, a roughly 51% year-over-year rise.

Newmont, in Aug 2015, closed the acquisition of Cripple Creek & Victor CC&V gold mine in Colorado from AngloGold Ashanti Ltd. for $ 820 million. The acquisition provides an opportunity for Newmont to improve mine life. With this acquisition, it can add profitable gold production and save direct mining costs by up to 10% through improved productivity and optimization. The company expects gold production from CC&V to average between 350,000 and 400,000 ounces in 2016, at AISC in the range of $ 600-$ 650.

However, Newmont is exposed to a volatile gold price environment and challenges in the copper market. Oversupply in the market also poses a threat on copper prices .

Newmont’s shares have underperformed the Mining-Gold industry over the past three months. The company’s shares have gained 14.9% over this period compared with the industry’s gain of 19.2%.

Earnings Whispers

Our proven model does not conclusively show that Newmont is likely to beat estimates this quarter. This is because a stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) for this to happen. This is not the case here, as you will see below:

Zacks ESP : Earnings ESP for Newmont is -13.16%. This is because the Most Accurate estimate is at 33 cents while the Zacks Consensus Estimate stands at 38 cents.

Zacks Rank : Newmont carries a Zacks Rank #3. Though a Zacks Rank #3 increases the predictive power of ESP, the company’s negative ESP makes surprise prediction difficult.

Concurrently, we caution against Sell-rated stocks (#4 or 5) going into the earnings announcement, especially when the company is seeing negative estimate revisions.

Stocks to Consider

Here are some companies in the basic materials space you may want to consider as our model shows that these have the right combination of elements to post an earnings beat this quarter:

Intrepid Potash Inc IPI has Earnings ESP of +20% and carries a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Glatfelter GLT has an Earnings ESP of +8.33% and a Zacks Rank #2.

Iamgold Corp. IAG has an Earnings ESP of +100% and a Zacks Rank #3.

Just Released – Driverless Cars: Your Roadmap to Mega-Profits Today

In this latest Special Report, Zacks’ Aggressive Growth Strategist Brian Bolan explores a full-blown technological breakthrough in the making – autonomous cars. He also spotlights 8 stocks with tremendous gain potential to feed off this phenomenon. Click to see the stocks right now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Intrepid Potash, Inc (IPI): Free Stock Analysis Report

Newmont Mining Corporation (NEM): Free Stock Analysis Report

Iamgold Corporation (IAG): Free Stock Analysis Report

Glatfelter (GLT): Free Stock Analysis Report

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Plantations International