Scalper1 News

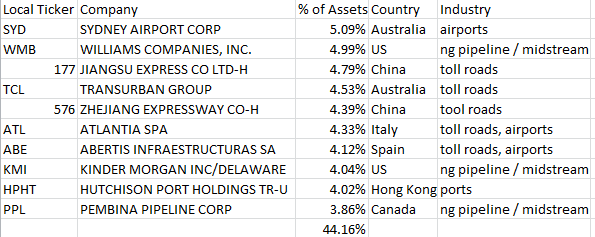

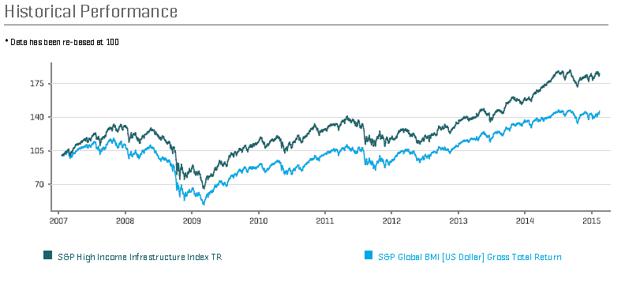

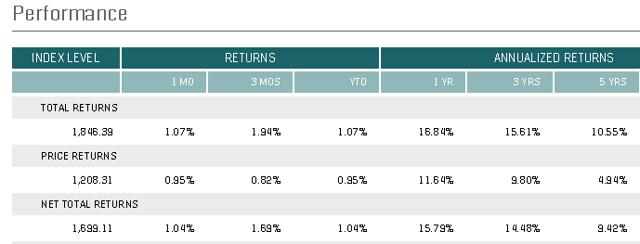

Backdated data suggests GHII could have a yield of 4.1%, vs a current yield of 2.06% for EMIF and 1.86% for PXR. GHII’s annual fees are almost half of EMIF and PXR. GHII’s has a more balanced portfolio with 20% of assets in the U.S. Many investors, myself included, use ETFs where investing in individual securities is difficult. A great example is the asset class of emerging market companies focusing on infrastructure. Infrastructure is broadly defined as those businesses involved in utilities, communications, transportation, port facilities, sewage, and water. Infrastructure is vital to the economic vitality and growth of any country. There is a new ETF in town that offers a bit of a twist on this theme. The Guggenheim High Yield Infrastructure ETF (NYSEARCA: GHII ) was launched last week and offers exposure to higher dividend income and a more diverse portfolio than its peers do. Guggenheim High Yield Infrastructure ETF is a replication of the S&P High Income Infrastructure Index, which are also components of the S&P Global BMI. A description from their website: The S&P High Income Infrastructure Index is designed to serve as a benchmark for yield-seeking equity investors looking for infrastructure exposure. The index is composed of the 50 highest-dividend-paying companies within the S&P Global BMI that operate in the energy, transportation, and utilities sectors. According to Oxford Economics and PwC, project global infrastructure spending will top nearly $78 trillion in 2014 and 2015 combined, with about 60% of that coming out of the Asia Pacific. GHII’s index allocates just over half its weight to utilities stocks, a third of its weight to the transportation/industrial sectors and 16% to energy names. The United States accounts for about 20% of initial geographical allocation while the rest of the fund is spread out over both developed and emerging markets. The next largest markets are Australia with 14% of allocation, China with 9%, and Spain and Italy with 8% each. However, many of these companies are multi-national and could have substantial assets in non-local market opportunities. It is important investors appreciate the portfolio of 50 stocks are rebalanced every 6 months. Due to this attribute, the composition, yield, and geographic diversity will change over time. Below is a review of the top 10 holdings of GHII, as listed on their website, listing the percentage of initial allocation, country of stock listing and the general industrial segment. The top 10 holdings represent almost half of the total allocation. There are two widely-held alternative global infrastructure ETFs: The iShares S&P Emerging Markets Infrastructure Index Fund (NASDAQ: EMIF ) and The PowerShares Emerging Markets Infrastructure ETF (NYSEARCA: PXR ). EMIF contains a higher percentage of utilities and infrastructure operators and PXR is heavily weighted to infrastructure construction. GHII exposure is 16% energy, 33% transportation and 51% utility vs a more balanced 15%, 45%, and 40%, respectively, for EMIF. PXR invests 61% in steel, construction firms and construction materials, and 90% of assets are invested in industrials and materials firms. GHII and EMIF are heavy to infrastructure operators while PXR is heavy to infrastructure builders. ETF Insight Comments posted on ETF.com: Newly launched GHII enters the global infrastructure space with a competitive fee and a strong emphasis on dividend yield. Like its peers, the fund invests in industries within the energy,transportation and utility sectors. GHII’s yield focus sets it apart from competitors; however, the fund does not just hold the dividend payers, it screens out all but 50 stocks with the highest dividend yield, and weights stocks by yield too. As such, we expect the fund to handily beat our benchmark and most-if not all-segment funds on yield, but not necessarily on total return. GHII does not screen for dividend sustainability, and like other yield-focused plays, may be adversely affected by rising interest rates. Still, assuming the fund can garner viable assets and liquidity, the fund will be an attractive take on the space for income-oriented investors. One of the main differences compared to other infrastructure ETFs is GHII’s focus on income. GHII’s backdating of performance shows an average yield of 4.15% on a 12-month basis, 4.68% on a 3-yr basis and 4.48% on a 5-yr basis. This compares quite favorable to its peers with 2.06% current yield for EMIF and 1.86% for PXR. On a performance basis, GHII has offered a better total return than the complete BMI Index. According to the Index website, a $10,000 investment in The S&P High Income Infrastructure Index in 2007 would be worth $17,500 while the total S&P BMI Index would have grown to $14,000. In addition, backdating the performance shows a potential substantial out performance than either EMIF or PDX. Below are two charts from S&P concerning its indexes: (click to enlarge) (click to enlarge) According to Morningstar, EMIF’s 1-yr total return is 6.36%, 3-yr total return is 2.81% and 5-yr total return is 5.51%. PXR has generated total returns of 1.59%, -0.52% and -0.57%, respectively. GHII charges 0.45% fees vs 0.75% for both EMIF and PXR. More information on GHII can be found at their website here and in their press release here [pdf]. The underlying S&P index factsheet is linked here . Investors should be aware of the impact of a rising or falling dollar on foreign stock ETFs. Usually, foreign stocks perform better in times of a falling U.S. Dollar than in times of a rising U.S. Dollar, and the trend since last May has been strength in the U.S. Dollar. While individual currencies may move higher or lower than the underlying trend in the USD Index, the impact on exchanging foreign share prices and dividend paid from foreign currencies to USD should not be overlooked. Based on just a 5% move in the USD either higher or lower, the yield could vary from 3.94% to 4.37%, everything else being equal. In addition, many foreign companies pay their dividend on an annual or semi-annual basis and the amount of the dividend can be more variable based on actual earnings. Income seeking, longer-term contrarian investors who believe the days of U.S. Dollar strength may be waning could be intrigued by the potential boost in the conversion of foreign cash dividends to U.S. Dollars during falling exchange rate trends. For investors looking for more stable international dividend exposure should review GHII. A combination of EMIF and GHII covers quite a bit of ground internationally with little overlap of positions. I have taken this avenue. Author’s Note: Please review disclosure in Author’s profile. Disclosure: The author is long GHII EMIF. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Backdated data suggests GHII could have a yield of 4.1%, vs a current yield of 2.06% for EMIF and 1.86% for PXR. GHII’s annual fees are almost half of EMIF and PXR. GHII’s has a more balanced portfolio with 20% of assets in the U.S. Many investors, myself included, use ETFs where investing in individual securities is difficult. A great example is the asset class of emerging market companies focusing on infrastructure. Infrastructure is broadly defined as those businesses involved in utilities, communications, transportation, port facilities, sewage, and water. Infrastructure is vital to the economic vitality and growth of any country. There is a new ETF in town that offers a bit of a twist on this theme. The Guggenheim High Yield Infrastructure ETF (NYSEARCA: GHII ) was launched last week and offers exposure to higher dividend income and a more diverse portfolio than its peers do. Guggenheim High Yield Infrastructure ETF is a replication of the S&P High Income Infrastructure Index, which are also components of the S&P Global BMI. A description from their website: The S&P High Income Infrastructure Index is designed to serve as a benchmark for yield-seeking equity investors looking for infrastructure exposure. The index is composed of the 50 highest-dividend-paying companies within the S&P Global BMI that operate in the energy, transportation, and utilities sectors. According to Oxford Economics and PwC, project global infrastructure spending will top nearly $78 trillion in 2014 and 2015 combined, with about 60% of that coming out of the Asia Pacific. GHII’s index allocates just over half its weight to utilities stocks, a third of its weight to the transportation/industrial sectors and 16% to energy names. The United States accounts for about 20% of initial geographical allocation while the rest of the fund is spread out over both developed and emerging markets. The next largest markets are Australia with 14% of allocation, China with 9%, and Spain and Italy with 8% each. However, many of these companies are multi-national and could have substantial assets in non-local market opportunities. It is important investors appreciate the portfolio of 50 stocks are rebalanced every 6 months. Due to this attribute, the composition, yield, and geographic diversity will change over time. Below is a review of the top 10 holdings of GHII, as listed on their website, listing the percentage of initial allocation, country of stock listing and the general industrial segment. The top 10 holdings represent almost half of the total allocation. There are two widely-held alternative global infrastructure ETFs: The iShares S&P Emerging Markets Infrastructure Index Fund (NASDAQ: EMIF ) and The PowerShares Emerging Markets Infrastructure ETF (NYSEARCA: PXR ). EMIF contains a higher percentage of utilities and infrastructure operators and PXR is heavily weighted to infrastructure construction. GHII exposure is 16% energy, 33% transportation and 51% utility vs a more balanced 15%, 45%, and 40%, respectively, for EMIF. PXR invests 61% in steel, construction firms and construction materials, and 90% of assets are invested in industrials and materials firms. GHII and EMIF are heavy to infrastructure operators while PXR is heavy to infrastructure builders. ETF Insight Comments posted on ETF.com: Newly launched GHII enters the global infrastructure space with a competitive fee and a strong emphasis on dividend yield. Like its peers, the fund invests in industries within the energy,transportation and utility sectors. GHII’s yield focus sets it apart from competitors; however, the fund does not just hold the dividend payers, it screens out all but 50 stocks with the highest dividend yield, and weights stocks by yield too. As such, we expect the fund to handily beat our benchmark and most-if not all-segment funds on yield, but not necessarily on total return. GHII does not screen for dividend sustainability, and like other yield-focused plays, may be adversely affected by rising interest rates. Still, assuming the fund can garner viable assets and liquidity, the fund will be an attractive take on the space for income-oriented investors. One of the main differences compared to other infrastructure ETFs is GHII’s focus on income. GHII’s backdating of performance shows an average yield of 4.15% on a 12-month basis, 4.68% on a 3-yr basis and 4.48% on a 5-yr basis. This compares quite favorable to its peers with 2.06% current yield for EMIF and 1.86% for PXR. On a performance basis, GHII has offered a better total return than the complete BMI Index. According to the Index website, a $10,000 investment in The S&P High Income Infrastructure Index in 2007 would be worth $17,500 while the total S&P BMI Index would have grown to $14,000. In addition, backdating the performance shows a potential substantial out performance than either EMIF or PDX. Below are two charts from S&P concerning its indexes: (click to enlarge) (click to enlarge) According to Morningstar, EMIF’s 1-yr total return is 6.36%, 3-yr total return is 2.81% and 5-yr total return is 5.51%. PXR has generated total returns of 1.59%, -0.52% and -0.57%, respectively. GHII charges 0.45% fees vs 0.75% for both EMIF and PXR. More information on GHII can be found at their website here and in their press release here [pdf]. The underlying S&P index factsheet is linked here . Investors should be aware of the impact of a rising or falling dollar on foreign stock ETFs. Usually, foreign stocks perform better in times of a falling U.S. Dollar than in times of a rising U.S. Dollar, and the trend since last May has been strength in the U.S. Dollar. While individual currencies may move higher or lower than the underlying trend in the USD Index, the impact on exchanging foreign share prices and dividend paid from foreign currencies to USD should not be overlooked. Based on just a 5% move in the USD either higher or lower, the yield could vary from 3.94% to 4.37%, everything else being equal. In addition, many foreign companies pay their dividend on an annual or semi-annual basis and the amount of the dividend can be more variable based on actual earnings. Income seeking, longer-term contrarian investors who believe the days of U.S. Dollar strength may be waning could be intrigued by the potential boost in the conversion of foreign cash dividends to U.S. Dollars during falling exchange rate trends. For investors looking for more stable international dividend exposure should review GHII. A combination of EMIF and GHII covers quite a bit of ground internationally with little overlap of positions. I have taken this avenue. Author’s Note: Please review disclosure in Author’s profile. Disclosure: The author is long GHII EMIF. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Scalper1 News