Scalper1 News

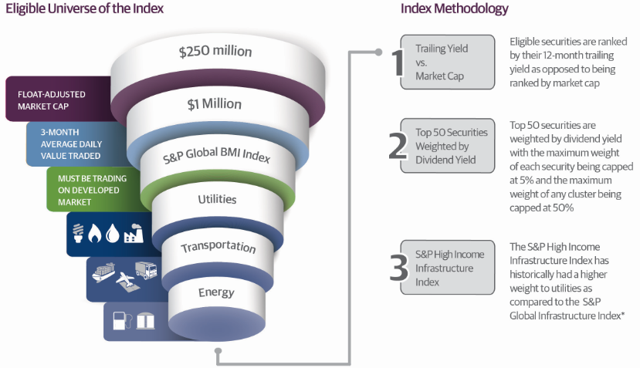

Summary Investors play the boom in infrastructure with sector-related ETFs. Guggenheim Investments recently launched a new yield-weighted infrastructure ETF. A closer look on the infrastructure industry. By Todd Shriber & Tom Lydon Due to an expected boom in global infrastructure, investors can choose from multiple infrastructure exchange-traded funds, several of which also offer compelling dividend yields. The new Guggenheim High Income Infrastructure ETF (NYSEArca: GHII ) , which debuts today, takes a different, unique approach to infrastructure. Eschewing traditional market capitalization weighting, GHII looks to solidify its status as an option for income investors by weighing its components on the basis of trailing 12-month yield. “GHII is the first yield-weighted infrastructure ETF to come to market. The new ETF tracks the S&P High Income Infrastructure Index, which is composed of the 50 highest-dividend-paying companies within the S&P Global BMI that operate in the energy, transportation, and utilities sectors,” according to S&P Dow Jones Indices . The index is home to 50 companies, including three firms listed outside the U.S. in the top 10 holdings. Names familiar to U.S. investors found in GHII’s underlying index include Williams Companies (NYSE: WMB ) and Kinder Morgan (NYSE: KMI ), which have an average dividend yield of 4.6%. GHII’s index allocates just over half its weight to utilities stocks, a third of its weight to the industrial sector, and 16.3% to energy names. Some new ETFs are afflicted with poor timing, particularly thematic funds, but that does not appear to be the case with GHII as the fund debuts at a time when governments all over the world are talking about boosting infrastructure spending. “Governments are increasing fiscal expenditures to update and expand infrastructure projects. For instance, The Obama administration has proposed $478 billion in spending on roads, bridges, ports and other key transportation nodes,” reports Jeffrey Sparshott for the Wall Street Journal . “While infrastructure investment will continue to be needed even after the economy reaches full employment, time is running out to make these needed investments under ideal economic conditions,” the White House budget said. “Oxford Economics and PwC project global infrastructure spending will top nearly $78 trillion between 2014 and 2015, with about 60% of that coming out of the Asia Pacific,” the Wall Street Journal reports. As Guggenheim notes, demand for infrastructure assets remains durable regardless of economic conditions and market factors. “The infrastructure asset class offers investors the opportunity to realize enhanced return and capital appreciation. Offering strong cash flow potential, assets with typically long lifespans, as well as relatively low volatility and significant barriers to entry, infrastructure provides investors with access to an emerging segment of the market aligned with the global recovery,” said the issuer. GHII Index Information (click to enlarge) Chart Courtesy: Guggenheim ETF Trends editorial team contributed to this post. Disclosure: The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it. The author has no business relationship with any company whose stock is mentioned in this article. Additional disclosure: Mr. Lydon serves as an independent trustee of certain mutual funds and ETFs that are managed by Guggenheim Investments; however, any opinions or forecasts expressed herein are solely those of Mr. Lydon and not those of Guggenheim Funds, Guggenheim Investments, Guggenheim Specialized Products, LLC or any of their affiliates. Scalper1 News

Summary Investors play the boom in infrastructure with sector-related ETFs. Guggenheim Investments recently launched a new yield-weighted infrastructure ETF. A closer look on the infrastructure industry. By Todd Shriber & Tom Lydon Due to an expected boom in global infrastructure, investors can choose from multiple infrastructure exchange-traded funds, several of which also offer compelling dividend yields. The new Guggenheim High Income Infrastructure ETF (NYSEArca: GHII ) , which debuts today, takes a different, unique approach to infrastructure. Eschewing traditional market capitalization weighting, GHII looks to solidify its status as an option for income investors by weighing its components on the basis of trailing 12-month yield. “GHII is the first yield-weighted infrastructure ETF to come to market. The new ETF tracks the S&P High Income Infrastructure Index, which is composed of the 50 highest-dividend-paying companies within the S&P Global BMI that operate in the energy, transportation, and utilities sectors,” according to S&P Dow Jones Indices . The index is home to 50 companies, including three firms listed outside the U.S. in the top 10 holdings. Names familiar to U.S. investors found in GHII’s underlying index include Williams Companies (NYSE: WMB ) and Kinder Morgan (NYSE: KMI ), which have an average dividend yield of 4.6%. GHII’s index allocates just over half its weight to utilities stocks, a third of its weight to the industrial sector, and 16.3% to energy names. Some new ETFs are afflicted with poor timing, particularly thematic funds, but that does not appear to be the case with GHII as the fund debuts at a time when governments all over the world are talking about boosting infrastructure spending. “Governments are increasing fiscal expenditures to update and expand infrastructure projects. For instance, The Obama administration has proposed $478 billion in spending on roads, bridges, ports and other key transportation nodes,” reports Jeffrey Sparshott for the Wall Street Journal . “While infrastructure investment will continue to be needed even after the economy reaches full employment, time is running out to make these needed investments under ideal economic conditions,” the White House budget said. “Oxford Economics and PwC project global infrastructure spending will top nearly $78 trillion between 2014 and 2015, with about 60% of that coming out of the Asia Pacific,” the Wall Street Journal reports. As Guggenheim notes, demand for infrastructure assets remains durable regardless of economic conditions and market factors. “The infrastructure asset class offers investors the opportunity to realize enhanced return and capital appreciation. Offering strong cash flow potential, assets with typically long lifespans, as well as relatively low volatility and significant barriers to entry, infrastructure provides investors with access to an emerging segment of the market aligned with the global recovery,” said the issuer. GHII Index Information (click to enlarge) Chart Courtesy: Guggenheim ETF Trends editorial team contributed to this post. Disclosure: The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it. The author has no business relationship with any company whose stock is mentioned in this article. Additional disclosure: Mr. Lydon serves as an independent trustee of certain mutual funds and ETFs that are managed by Guggenheim Investments; however, any opinions or forecasts expressed herein are solely those of Mr. Lydon and not those of Guggenheim Funds, Guggenheim Investments, Guggenheim Specialized Products, LLC or any of their affiliates. Scalper1 News

Scalper1 News