Scalper1 News

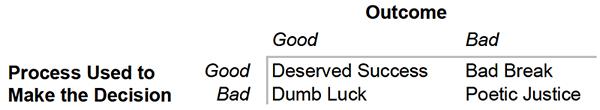

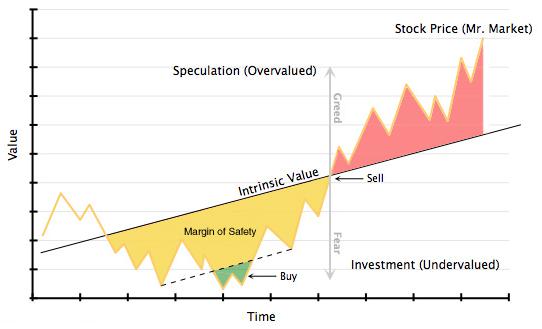

Summary What it means to be a gambler and you are likely one as well. Characteristics of a gambling investor that you should be aware of. Simple ways to avoid future losses that are easier said than done. I have a confession. I’m a gambler. Well, before you jump articles, let me explain what I mean by being a gambler. The Gambler Gamblers are “investors” who, more likely than not, invest in companies using gut feelings and baseless pseudo-scientific calculations to back their decisions. But more than that, gamblers are nervous, impulsive and tend to always jump the gun. Successful investors have their minds under control through experience, genetics, or just sheer will power. For years, psychologists have studied what constitutes human decision-making. They discovered that humans are pretty much systematically irrational. We tend to consistently act in an irrational manner in certain situations and when making certain decisions. When this discovery was later applied to investing, the field of behavioral finance was born. Rediff This Motley Fool article also tackles the phenomenon called cognitive dissonance: It’s the term psychologists use for the uncomfortable feeling you get when having two conflicting thoughts at the same time. “Smoking is bad for me. I’m going to go smoke.” Is it possible to become a real investor rather than just be a gambler? Yes. So How Do You Stop Gambling? First, recognize the need for improvement. Do not be content with what you already have. Always strive to know more and always strive for the best. If you don’t want to be a gambler, then you should get your emotions under control by knowing your tendencies when the going gets tough. Here’s a previous article I wrote about the need to understand your emotions . But what about the following? Blaming Wall Street Do you blame Wall Street for your investment decisions to feel better? Instead, learning from your failure can only improve you as an investor. Holding on to Losing Stocks Too Long Do you hold on to a losing stock just to prove you are right? Ask yourself, is this just a matter of stubborn pride or is there a fundamental reasoning to this decision. Wanting People to Say What You Want to Hear: Confirmation Bias Are you looking for articles or people to confirm your thoughts on a particular investment? Do you Google phrases like “no need for vaccination”? Naturally, since your keywords are so specific, the results you get will match what you want to find. Overconfidence – The Silent Killer Here’s the kicker. Overconfidence. Total certainty or greater certainty than circumstances warrant Get on a good roll and you feel like you can conquer the world. Confidence is important, but overconfidence is a killer. Bill Gates said: Success is a lousy teacher. It seduces the smart people into thinking they can’t lose. Lesson of the Day? Follow the chart below. Avoid being emotional, biased and overconfident. The side effect of this is that more people will like you too. The best advice I hear from veteran investors is to know yourself. Know your own quirks and be objective about it. Listen to different opinions by always having an open mind. Easier said than done of course. I’ve greatly reduced bad gambling decisions over the years with the use of checklists , processes, and cold hard facts with my analysis tools. But I’d be lying if I say that I was 100% perfect. Disclosure: The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it. The author has no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Summary What it means to be a gambler and you are likely one as well. Characteristics of a gambling investor that you should be aware of. Simple ways to avoid future losses that are easier said than done. I have a confession. I’m a gambler. Well, before you jump articles, let me explain what I mean by being a gambler. The Gambler Gamblers are “investors” who, more likely than not, invest in companies using gut feelings and baseless pseudo-scientific calculations to back their decisions. But more than that, gamblers are nervous, impulsive and tend to always jump the gun. Successful investors have their minds under control through experience, genetics, or just sheer will power. For years, psychologists have studied what constitutes human decision-making. They discovered that humans are pretty much systematically irrational. We tend to consistently act in an irrational manner in certain situations and when making certain decisions. When this discovery was later applied to investing, the field of behavioral finance was born. Rediff This Motley Fool article also tackles the phenomenon called cognitive dissonance: It’s the term psychologists use for the uncomfortable feeling you get when having two conflicting thoughts at the same time. “Smoking is bad for me. I’m going to go smoke.” Is it possible to become a real investor rather than just be a gambler? Yes. So How Do You Stop Gambling? First, recognize the need for improvement. Do not be content with what you already have. Always strive to know more and always strive for the best. If you don’t want to be a gambler, then you should get your emotions under control by knowing your tendencies when the going gets tough. Here’s a previous article I wrote about the need to understand your emotions . But what about the following? Blaming Wall Street Do you blame Wall Street for your investment decisions to feel better? Instead, learning from your failure can only improve you as an investor. Holding on to Losing Stocks Too Long Do you hold on to a losing stock just to prove you are right? Ask yourself, is this just a matter of stubborn pride or is there a fundamental reasoning to this decision. Wanting People to Say What You Want to Hear: Confirmation Bias Are you looking for articles or people to confirm your thoughts on a particular investment? Do you Google phrases like “no need for vaccination”? Naturally, since your keywords are so specific, the results you get will match what you want to find. Overconfidence – The Silent Killer Here’s the kicker. Overconfidence. Total certainty or greater certainty than circumstances warrant Get on a good roll and you feel like you can conquer the world. Confidence is important, but overconfidence is a killer. Bill Gates said: Success is a lousy teacher. It seduces the smart people into thinking they can’t lose. Lesson of the Day? Follow the chart below. Avoid being emotional, biased and overconfident. The side effect of this is that more people will like you too. The best advice I hear from veteran investors is to know yourself. Know your own quirks and be objective about it. Listen to different opinions by always having an open mind. Easier said than done of course. I’ve greatly reduced bad gambling decisions over the years with the use of checklists , processes, and cold hard facts with my analysis tools. But I’d be lying if I say that I was 100% perfect. Disclosure: The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it. The author has no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Scalper1 News