Scalper1 News

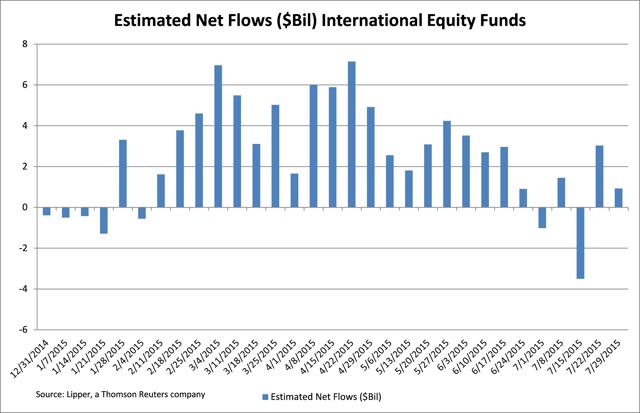

By Tom Roseen Despite the flight to safety and what many market pundits might have expected-a subsequent uptick in flows to money market funds, for the second week in three investors were net redeemers of fund assets (including those of conventional funds and exchange-traded funds [ETFs]), withdrawing a net $6.2 billion for the fund-flows week ended, Wednesday, July 29. Investors pulled money out of all four of Lipper’s major macro-groups, redeeming $3.5 billion from taxable bond funds, $1.8 billion from equity funds, $0.9 billion from money market funds, and $73 million from municipal bond funds. Weak earnings reports from bellwether stocks such as American Express (NYSE: AXP ), Caterpillar (NYSE: CAT ), and 3M (NYSE: MMM ), accompanied by a hangover from China’s market meltdown, outweighed a drop in weekly applications for unemployment benefits to the lowest level since 1973. Investors shrugged off a better-than-expected earnings report from Amazon and ignored the Anthem (NYSE: ANTM )-Cigna (NYSE: CI ) M&A news and the announcement that Greek officials had approved a second set of austerity measures. Instead, investors focused on the continued decline in oil, the selloff in commodities, concerns over a decline in global economic growth, and a housing report that showed the largest slowdown in single-family-home sales in seven months. Ho-hum economic data and sketchy guidance from U.S. firms during the flows week initially led investors to safe-haven plays, especially after the Shanghai Composite’s largest one-day slide (-8.5%) since February 2007. Despite a better-than-expected June durable goods report, investors took a wait-and-see approach ahead of the two-day Federal Open Market Committee meeting, leading to a small rally in U.S. Treasuries. However, in the last two days of the flows week U.S. stocks rallied after China stocks showed a more tempered decline and oil prices rose for the first time in five sessions. On Wednesday, July 29, the Dow marked its fifth straight session of triple-digit moves, this time to the upside after the Federal Reserve left itself wiggle room to raise rates as early as September, citing a continuation of solid gains in the job market. Investors cheered Citrix’s better-than-expected earnings report, Chinese stocks moved higher, and crude oil had its second biggest one-day gain for July, with futures rising 1.7% for the day. Nonetheless, the Dow Jones Industrial Daily Reinvested Average still finished the flows week down 0.56%. (click to enlarge) Source: Lipper, a Thomson Reuters company Interestingly, fund investors collectively kept their foot on the gas pedal for a few risk-on plays, injecting net new money into international equity funds (+$0.9 billion), health/biotechnology funds (+$0.6 billion), mid-cap funds (+$0.2 billion), and science & technology funds (+$0.1 billion). Except for small net flows into government/Treasury funds (+$0.4 billion) during the week, the typical safe-haven plays didn’t attract net new money as investors appeared to be waiting on the policy statement by the Fed to plan their next steps. Year to date, international equity funds (including traditional funds and ETFs) have attracted $135.1 billion of net new money, while their domestic equity counterparts have suffered net redemptions to the tune of $54.7 billion. Scalper1 News

By Tom Roseen Despite the flight to safety and what many market pundits might have expected-a subsequent uptick in flows to money market funds, for the second week in three investors were net redeemers of fund assets (including those of conventional funds and exchange-traded funds [ETFs]), withdrawing a net $6.2 billion for the fund-flows week ended, Wednesday, July 29. Investors pulled money out of all four of Lipper’s major macro-groups, redeeming $3.5 billion from taxable bond funds, $1.8 billion from equity funds, $0.9 billion from money market funds, and $73 million from municipal bond funds. Weak earnings reports from bellwether stocks such as American Express (NYSE: AXP ), Caterpillar (NYSE: CAT ), and 3M (NYSE: MMM ), accompanied by a hangover from China’s market meltdown, outweighed a drop in weekly applications for unemployment benefits to the lowest level since 1973. Investors shrugged off a better-than-expected earnings report from Amazon and ignored the Anthem (NYSE: ANTM )-Cigna (NYSE: CI ) M&A news and the announcement that Greek officials had approved a second set of austerity measures. Instead, investors focused on the continued decline in oil, the selloff in commodities, concerns over a decline in global economic growth, and a housing report that showed the largest slowdown in single-family-home sales in seven months. Ho-hum economic data and sketchy guidance from U.S. firms during the flows week initially led investors to safe-haven plays, especially after the Shanghai Composite’s largest one-day slide (-8.5%) since February 2007. Despite a better-than-expected June durable goods report, investors took a wait-and-see approach ahead of the two-day Federal Open Market Committee meeting, leading to a small rally in U.S. Treasuries. However, in the last two days of the flows week U.S. stocks rallied after China stocks showed a more tempered decline and oil prices rose for the first time in five sessions. On Wednesday, July 29, the Dow marked its fifth straight session of triple-digit moves, this time to the upside after the Federal Reserve left itself wiggle room to raise rates as early as September, citing a continuation of solid gains in the job market. Investors cheered Citrix’s better-than-expected earnings report, Chinese stocks moved higher, and crude oil had its second biggest one-day gain for July, with futures rising 1.7% for the day. Nonetheless, the Dow Jones Industrial Daily Reinvested Average still finished the flows week down 0.56%. (click to enlarge) Source: Lipper, a Thomson Reuters company Interestingly, fund investors collectively kept their foot on the gas pedal for a few risk-on plays, injecting net new money into international equity funds (+$0.9 billion), health/biotechnology funds (+$0.6 billion), mid-cap funds (+$0.2 billion), and science & technology funds (+$0.1 billion). Except for small net flows into government/Treasury funds (+$0.4 billion) during the week, the typical safe-haven plays didn’t attract net new money as investors appeared to be waiting on the policy statement by the Fed to plan their next steps. Year to date, international equity funds (including traditional funds and ETFs) have attracted $135.1 billion of net new money, while their domestic equity counterparts have suffered net redemptions to the tune of $54.7 billion. Scalper1 News

Scalper1 News