Scalper1 News

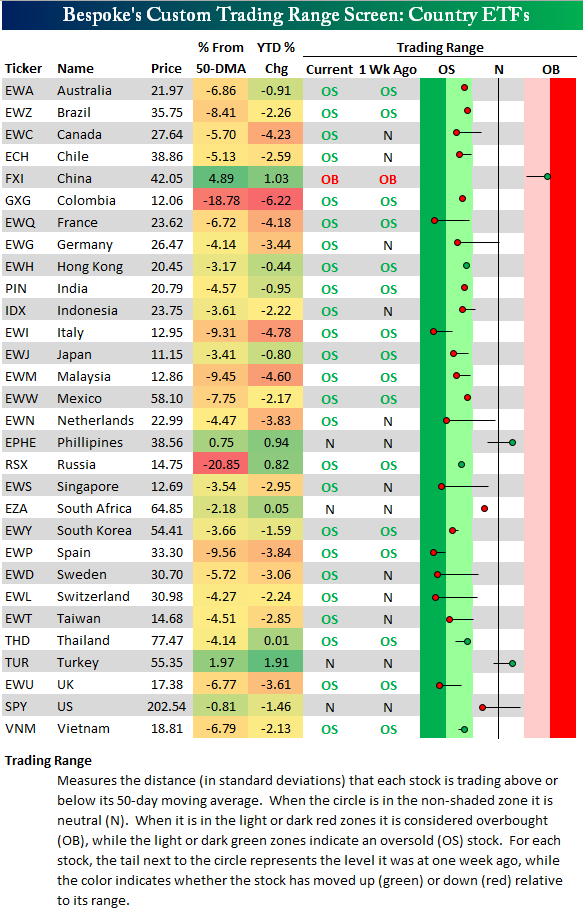

The action in global stocks over the last few days has left 25 of the 30 largest country ETFs in oversold territory. Below is our trading range screen highlighting the trend. For each ETF in the screen below, the black vertical “N” line represents its 50-day moving average. Moves into the red zone are considered “overbought”, while moves into the green zone are considered “oversold”. Throughout this bull market, oversold levels have generally offered up good buying opportunities, but there’s always the risk that the “buy the dip” trade will finally fail to pan out. The only country ETF on the list that is currently in overbought territory is FXI (China). Two others – Phillipines (NYSEARCA: EPHE ) and Turkey (NYSEARCA: TUR ) – are above their 50-day moving averages, while South Africa (NYSEARCA: EZA ) and the US (NYSEARCA: SPY ) are below their 50-days but not oversold. Some of the most oversold countries at the moment include France (NYSEARCA: EWQ ), Italy (NYSEARCA: EWI ), Spain (NYSEARCA: EWP ), Sweden (NYSEARCA: EWD ), Switzerland (NYSEARCA: EWL ) and the UK (NYSEARCA: EWU ) – all Euro-area markets. Just a few countries are in the green for the year, while most are down in the 1-3% range. Some of the country ETFs that have already seen 4%+ declines in 2015 include Canada (NYSEARCA: EWC ), Italy ( EWI ), Malaysia (NYSEARCA: EWM ), France ( EWQ ) and Colombia (NYSEARCA: GXG ). While the Russian ETF (NYSEARCA: RSX ) is still 20% below its 50-day, it’s actually one of the few countries that’s up on the year. Now that you’ve read this, are you Bullish or Bearish on ? Bullish Bearish Sentiment on ( ) Thanks for sharing your thoughts. Why are you ? Submit & View Results Skip to results » Share this article with a colleague Scalper1 News

The action in global stocks over the last few days has left 25 of the 30 largest country ETFs in oversold territory. Below is our trading range screen highlighting the trend. For each ETF in the screen below, the black vertical “N” line represents its 50-day moving average. Moves into the red zone are considered “overbought”, while moves into the green zone are considered “oversold”. Throughout this bull market, oversold levels have generally offered up good buying opportunities, but there’s always the risk that the “buy the dip” trade will finally fail to pan out. The only country ETF on the list that is currently in overbought territory is FXI (China). Two others – Phillipines (NYSEARCA: EPHE ) and Turkey (NYSEARCA: TUR ) – are above their 50-day moving averages, while South Africa (NYSEARCA: EZA ) and the US (NYSEARCA: SPY ) are below their 50-days but not oversold. Some of the most oversold countries at the moment include France (NYSEARCA: EWQ ), Italy (NYSEARCA: EWI ), Spain (NYSEARCA: EWP ), Sweden (NYSEARCA: EWD ), Switzerland (NYSEARCA: EWL ) and the UK (NYSEARCA: EWU ) – all Euro-area markets. Just a few countries are in the green for the year, while most are down in the 1-3% range. Some of the country ETFs that have already seen 4%+ declines in 2015 include Canada (NYSEARCA: EWC ), Italy ( EWI ), Malaysia (NYSEARCA: EWM ), France ( EWQ ) and Colombia (NYSEARCA: GXG ). While the Russian ETF (NYSEARCA: RSX ) is still 20% below its 50-day, it’s actually one of the few countries that’s up on the year. Now that you’ve read this, are you Bullish or Bearish on ? Bullish Bearish Sentiment on ( ) Thanks for sharing your thoughts. Why are you ? Submit & View Results Skip to results » Share this article with a colleague Scalper1 News

Scalper1 News