Shares of fertilizer maker The Mosaic Company MOS touched a fresh 52-week high of $ 31.61 on Jan 12, before retracing to close the day at $ 31.41.

Mosaic has a market cap of roughly $ 11 billion and average volume of shares traded in the last three months is around 5,042.5K. The company has an expected long-term EPS growth of around 9.5%.

Over the past three months, Mosaic has outperformed the Zacks categorized Fertilizers industry, partly owing to its cost reduction measures. The company’s shares have gained around 35.7% over this period, compared with roughly 22.4% gain recorded by the industry. Mosaic is expected to gain from improving global demand for fertilizers and from its efforts to boost production capacity and acquisitions.

Mosaic’s $ 575 million cost-cutting program is well on track amid a challenging operating environment. Gains from the company’s cost-cutting actions offset headwinds from lower fertilizer prices in the third quarter of 2016. The company has lowered its guidance for selling, general and administrative (SG&A) expense for 2016 to $ 315-$ 330 million from the initial guidance of $ 350-$ 370 million.

Mosaic also see improving global demand for nutrients. Potash demand is expected to rise with the signing of new contracts with Chinese customers that will trigger demand from other major consumer markets including India. Moreover, the company sees a more stable operating environment in 2017 and anticipates higher demand for both phosphate and potash.

The company should also gain from strategic acquisitions. The buyout of CF Industries’ assets expanded Mosaic’s phosphate business and production capacity of the nutrient in Florida. The acquisition increased Mosaic’s annual phosphates capacity to roughly 11.5 million tons. Moreover, the acquisition of Archer Daniels Midland Company’s fertilizer distribution business has expanded its annual distribution capability in South America to around 6 million metric tons of crop nutrients from roughly 4 million metric tons.

Mosiac also recently announced the $ 2.5 billion buyout of Brazil-based Vale S.A.’s Vale Fertilizantes business. With this acquisition, the company will be the leading fertilizer manufacturing and distribution company in Brazil. The deal is expected to help the company to capitalize on the rapidly growing Brazilian agricultural market and improving business conditions. It is projected to generate more than $ 80 million of post-tax synergies.

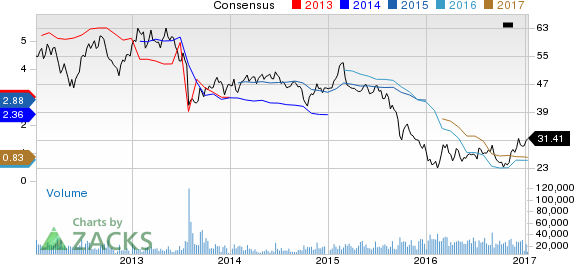

Mosaic Company (The) Price and Consensus

Mosaic Company (The) Price and Consensus | Mosaic Company (The) Quote

Mosaic currently carries a Zacks Rank #3 (Hold).

Stocks to Consider

Better-ranked companies in the fertilizer space include CF Industries Holdings CF sporting a Zacks Rank #1 (Strong Buy), and Scotts Miracle-Gro Company SMG and Sociedad Quimica y Minera SQM , both carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here .

CF Industries has an expected long-term growth of around 2.1%

Scotts Miracle-Gro Company has an expected long-term growth of 12.1%.

Sociedad Quimica y Minera has an expected earnings growth of around 24.5% for the current year

The Best Place to Start Your Stock Search

Today, you are invited to download the full list of 220 Zacks Rank #1 “Strong Buy” stocks – absolutely free of charge. Since 1988, Zacks Rank #1 stocks have nearly tripled the market, with average gains of +26% per year. Plus, you can access the list of portfolio-killing Zacks Rank #5 “Strong Sells” and other private research. See these stocks free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

CF Industries Holdings, Inc. (CF): Free Stock Analysis Report

Sociedad Quimica y Minera S.A. (SQM): Free Stock Analysis Report

Mosaic Company (The) (MOS): Free Stock Analysis Report

Scotts Miracle-Gro Company (The) (SMG): Free Stock Analysis Report

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Plantations International