Monsanto Company MON reported better-than-expected fourth-quarter fiscal 2016 (ended Aug 31, 2016) results.

Adjusted earnings from ongoing business came in at 7 cents per share in fiscal fourth quarter. The bottom line surpassed the Zacks Consensus Estimate of a loss of 2 cents and turned around from the year-ago loss of 19 cents per share.

Adjusted earnings for fiscal 2016 were $ 4.48 per share against $ 5.73 per share reported in the previous year.

Revenues

In fiscal fourth quarter, Monsanto generated revenues of $ 2,562 million, up 8.8% year over year. The top line also exceeded the Zacks Consensus Estimate of $ 2,354 million.

On a segmental basis, revenues from Seeds and Genomics were up by 25.1% year over year to $ 1,565 million. Revenues from Agricultural Productivity declined 9.7% year over year to $ 997 million.

Revenues for full-year fiscal 2016 were $ 13,502 against $ 15,001 recorded in the previous year. The year-over-year decline was experienced due to currency headwinds and weak product prices.

Cost & Margins

Monsanto’s cost of sales increased 4.8% year over year to $ 1,424 million. Gross margin expanded 210 basis points (bps) to 44.4%.

Operating expenses, which account for 54.8% of the total revenue, decreased 9.8% year over year to $ 1,403 million. Interest expenses plunged 20% to $ 104 million.

Balance Sheet and Cash Flow

Monsanto exited fiscal fourth quarter with cash and cash equivalents of $ 1,676 million as against $ 3,701 million recorded in fiscal 2015 end. Long-term debt was $ 7,453 million against $ 8,429 recorded in Aug 31, 2015.

In the quarter, Monsanto generated cash of $ 2,588 million from operating activities as against $ 3,108 million generated in the year-ago period. Capital spending was down 4.6% year over year to $ 923 million. Dividend payments in the quarter totaled $ 964 million.

Free cash flow at the end of fiscal 2016 was $ 1.7 billion, higher than $ 2.1 billion recorded in the year-ago period.

Outlook

Monsanto projects to generate adjusted earnings within the range of $ 4.50-$ 4.90 per share in fiscal 2017, on an ongoing basis. The company estimates to accrue free cash flow roughly within the range of $ 1.4-$ 1.6 billion in the upcoming fiscal year. Monsanto aims to boost its business on the back of improved core seeds and genomics business, strategic management of agricultural productivity segment’s trade, meaningful restructuring and appropriate investments.

The company intends to close its deal with Bayer AG BAYRY by the end of fiscal 2017.

Zacks Rank and Share Price

Monsanto currently carries a Zacks Rank #3 (Hold). The company’s stock price was $ 102.25 per share, nearly up 0.10% on pre-market trading basis. Clearly, the initial reaction to the release has been positive. We view the company’s better-than-expected fiscal fourth quarter figures as the primary reason responsible for this positive sentiment.

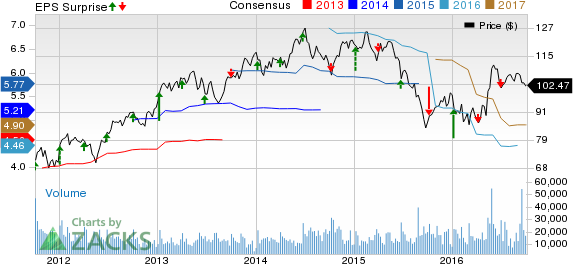

MONSANTO CO-NEW Price, Consensus and EPS Surprise

MONSANTO CO-NEW Price, Consensus and EPS Surprise | MONSANTO CO-NEW Quote

Share price of the company was $ 102.47 per share as of Oct 3, 2016.

Stocks to Consider

Some better-ranked stocks within the industry are listed below:

Limoneira Company LMNR currently sports a Zacks Rank #1 (Strong Buy). Over the last 60 days, the Zacks Consensus Estimate for the stock has been revised upward by 42.4% for fiscal 2016. You can see the complete list of today’s Zacks #1 Rank stocks here .

The Andersons, Inc. ANDE currently carries a Zacks Rank #2 (Buy). Over the last 60 days, the Zacks Consensus Estimate for the stock has moved up by 24.4% for 2016.

Confidential from Zacks

Beyond this Analyst Blog, would you like to see Zacks’ best recommendations that are not available to the public? Our Executive VP, Steve Reitmeister, knows when key trades are about to be triggered and which of our experts has the hottest hand. Click to see them now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

BAYER A G -ADR (BAYRY): Free Stock Analysis Report

MONSANTO CO-NEW (MON): Free Stock Analysis Report

ANDERSONS INC (ANDE): Free Stock Analysis Report

LIMONEIRA CO (LMNR): Free Stock Analysis Report

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Plantations International