Monsanto Company MON and NRGene recently entered into a non-exclusive, multi-year global licensing agreement. This deal is based on NRGene’s premium genome-analysis technology. Under its regime, Monsanto would be predicting, comparing and selecting the best variation of genetic makeup from the massive data sets of genomic, genetic and trait information base of NRGene.

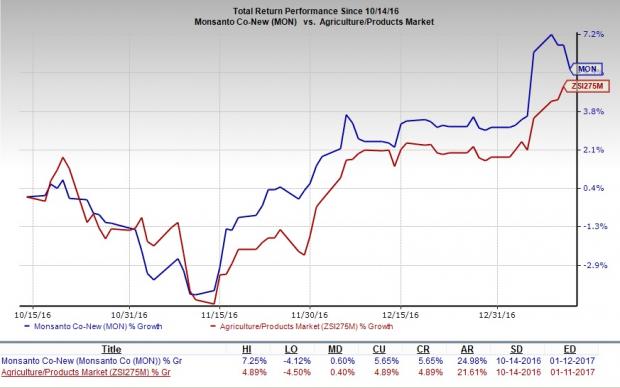

Over the last three months, Monsanto’s shares recorded a return of 5.65% – outperforming 4.89% return provided by the Zacks categorized Agricultural/Products industry.

Inside the Headlines

Monsanto uses high quality data analytics technologies for strengthening the research and development platform of its business. These technical know-how helps the company offer non-imitable varieties of high-yielding seed and hybrids to the farmers.

By utilizing NRGene’s GenoMAGIC, Monsanto intends to make plant breeders’ decisions and analysis more comprehensive in the near term. NRGene’s unique genome-analysis technology, such as GenoMAGIC, has been created by several skilled software engineers, algorithm designers, plant geneticists and plant breeders.

Such technologies are used by seed companies and prominent research & academic institutions around the world. Notably, usage of GenoMAGIC would boost Monsanto’s capability in domains of trait discovery, genome selection and genome enhancement.

This Zacks Rank #2 (Buy) company’s major annual research & development investment is focused on plant breeding through the usage of popular genome analysis technologies such as GenoMAGIC. Thus, such technological pacts would likely enhance Monsanto’s existing product portfolio moving ahead.

Stocks to Consider

Some other favorably placed stocks within the industry are listed below:

BASF SE BASFY has an average earnings surprise of 34.34% for the last four quarters and sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here .

The Chemours Company CC also boasts a Zacks Rank #1 and has a whopping average earnings surprise of 153.83% for the four trailing quarters.

CF Industries Holdings, Inc. CF has an average earnings surprise of 18.83% for the last four quarters, flaunting a Zacks Rank #1.

The Best Place to Start Your Stock Search

Today, you are invited to download the full list of 220 Zacks Rank #1 “”Strong Buy”” stocks – absolutely free of charge. Since 1988, Zacks Rank #1 stocks have nearly tripled the market, with average gains of +26% per year. Plus, you can access the list of portfolio-killing Zacks Rank #5 “”Strong Sells”” and other private research. See these stocks free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

BASF SE (BASFY): Free Stock Analysis Report

CF Industries Holdings, Inc. (CF): Free Stock Analysis Report

Monsanto Company (MON): Free Stock Analysis Report

Chemours Company (The) (CC): Free Stock Analysis Report

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Plantations International