< div i.d. =" articleText" legibility=" 77.484858681023" >< img

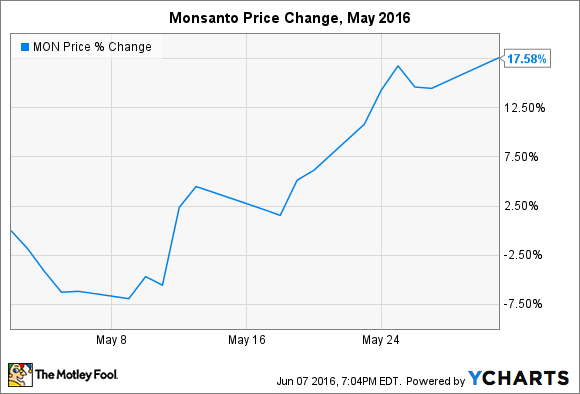

category =” articleImgLg” alt=” Corn” src=” https://www.scalper1.com/wp-content/uploads/2016/06/corn_large.jpg”/ > Image resource: Getty Images. What: Contributes from agricultural innovation leader Monsanto (NYSE: MON) increased virtually 18 %in Might after German corporation Bayer AG made a first buyout promotion from $ 40 billion, after that observed that up with an impressive $ 62 billion proposal that will possess brought in entrepreneurs $ 122 each contribute. Monsanto refused each deals.

< a href=" http://ycharts.com/companies/MON/chart/" rel=" nofollow" >< img class

=” articleImgLg “alt=” MON Chart” src= “https://www.scalper1.com/wp-content/uploads/2016/06/b5b93327234c004614c0ab23475c0b35.png”/ >< a href=" http://ycharts.com/companies/MON" rel =" nofollow "> MON data through< a href=" http://ycharts.com/ "rel=" nofollow" > YCharts. Thus exactly what: Broach a potential merger are actually barely unexpected at this aspect. Because late 2014, reduced asset rates, exclusively grain as well as chemical costs, have led to improved dryness and also anxiety for seed as well as agrochemical business, which have actually reacted with spontaneous merging arrangements. The Dow Chemical Provider and also DuPont introduced a $ 130 billion merger in late 2015, while Syngenta accepted merge with ChemChina previously in 2012. Analysts and some entrepreneurs recommended Monsanto to use the trend, but after cannot court Syngenta throughout 2015 as well as the 1st fourth from 2016, administration decided to concentrate on internal R&D tasks and growth potential customers.

While the second promotion was actually dramatically above the very first, Bayer was definitely flexing excess from its annual report. German real estate investors really did not react kindly to measurements of the offer, which will need to be actually paid for virtually entirely with debt. On top of that, a merger will generate a firm with 30% market share from the farming seed market. That likely wouldn’t go by regulators and antitrust legislations, requiring challenging choices about spinouts and divestments– as Dow and also DuPont financiers have actually found out. Bayer sought to name Monsanto’s bluff along with a $ 40 billion acquistion deal, yet management didn’t blink. < a href= "http://www.fool.com/investing/general/2016/05/18/bayer-offered-40-billion-for-monsanto-why-investor.aspx?&utm_campaign=article&utm_medium=feed&utm_source=nasdaq" rel =" nofollow" > That excellented updates for investors paid attention to the long-term growth leads, particularly taking into consideration the significant market value in R&D jobs leaving the pipeline for real-world markets in the following couple of years. Bayer adhered to along with a $ 62 billion offer, which Monsanto considered but essentially turned away.

Then what: Capitalists could be actually confident that Monsanto– and its near-term and long-lasting growth leads– costs significantly much more than $ 40 billion. Saying “no” to $ 62 billion for $ 122 per share might be actually harder, however I assume the company may still attain a market appraisal at the very least that high with its own efforts within the following couple of years. While peers are stuck having fun along with agrochemicals, Monsanto is going to be actually releasing ingenious items that reduce agricultural inputs and also place it in a course from its personal. Naturally, if existing headwinds continue to persist, I wouldn’t be surprised if the supply repaid at minimum some of its increases in the around term.

A top secret billion-dollar equity possibility

The globe’s largest technology business overlooked to reveal you one thing, yet a couple of Exchange experts and the Fool really did not miss out on a trump: There is actually a tiny business that’s powering their new devices as well as the coming change in innovation. And also our team think its inventory rate possesses nearly endless space to manage for early, in-the-know real estate investors! To become one from all of them, < a href

=” http://www.fool.com/mms/mark/ecap-foolcom-apple-wearable?aid=6965&source=irbeditxt0000017&ftm_cam=rb-wearable-d&ftm_pit=2692&ftm_veh=article_pitch&utm_campaign=article&utm_medium=feed&utm_source=nasdaq” rel=” nofollow” > only visit this site. The sights and also point of views revealed within are the viewpoints as well as point of views from the author and also carry out certainly not always reveal those of Nasdaq, Inc.

Newest Articles Plantations International