On Jan 10, 2017, Zacks Investment Research upgraded Monsanto Company MON to a Zacks Rank #2 (Buy) from a Zacks Rank #3 (Hold). Going by the Zacks model, Zacks Rank #2 companies are likely to perform better than the broader market over the upcoming quarters.

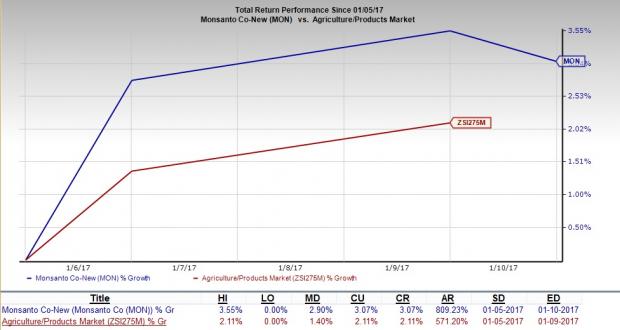

Post first-quarter fiscal 2017 earnings release (Jan 5, 2017), Monsanto’s stock recorded a return of 3.07% – outperforming 2.11% return provided by the Zacks categorized Agriculture/Products industry.

Why the Upside?

Monsanto reported better-than-expected first-quarter fiscal 2017 results. Quarterly adjusted earnings (from ongoing business) came in at 21 cents, as against the Zacks Consensus Estimate of a loss of 4 cents and the year-ago loss of 11 cents per share. The improvement came on the back of sturdy market responses to the Intacta Roundup Ready 2 PRO technology and Roundup Ready 2 Xtend Soybeans, as well as record corn seed volumes. These positive factors are likely to drive the company’s top- and bottom-line growth, over the long term.

Notably, the agreements inked with the Broad Institute (inked in Sep 2016 and Jan 2017) and Dow AgroSciences (inked in Oct 2016) are anticipated to unlock novel technological capabilities for Monsanto. These deals would likely enhance the company’s existing product portfolio and aid it in tapping the booming market demand of the global seeds, traits and agricultural chemicals’ industry.

Monsanto also believes that its buyout deal with Bayer AG BAYRY would open up a tranche of business opportunities in the near term. This is because Bayer’s non-imitable crop protection business association would boost Monsanto’s business in the market. Along with Bayer, Monsanto aims to propel innovation for farmers around the world, develop advanced integrated optimized solutions for the cultivators and provide new offerings in the market which would be highly beneficial for farmers. Monsanto intends to close the deal with Bayer by the fall of fiscal 2017.

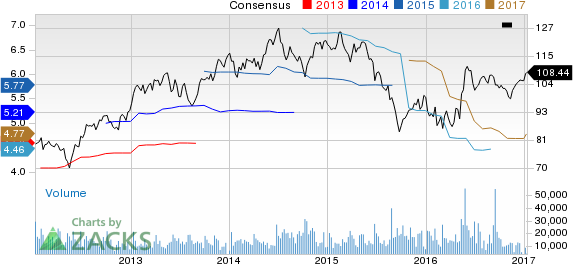

Over the last seven days, the Zacks Consensus Estimate for the stock has been revised upwards for both fiscal 2017 and 2018.

Monsanto Company Price and Consensus

Monsanto Company Price and Consensus | Monsanto Company Quote

Key Picks

Some other favorably placed stocks within the industry are listed below:

The Chemours Company CC has a whopping average earnings surprise of 153.83% for the last four quarters and currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here .

Daqo New Energy Corp. DQ also flaunts a Zacks Rank #1 and has an average earnings surprise of 112.94% for the trailing four quarters.

Zacks’ Top 10 Stocks for 2017

In addition to the stocks discussed above, would you like to know about our 10 finest buy-and-hold tickers for the entirety of 2017?

Who wouldn’t? As of early December, the 2016 Top 10 produced 5 double-digit winners including oil and natural gas giant Pioneer Natural Resources which racked up a stellar +50% gain. The new list is painstakingly hand-picked from 4,400 companies covered by the Zacks Rank. Be among the very first to see it>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Bayer AG (BAYRY): Free Stock Analysis Report

DAQO New Energy Corp. (DQ): Free Stock Analysis Report

Monsanto Company (MON): Free Stock Analysis Report

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Plantations International