Monsanto Company MON reported better-than-expected first-quarter fiscal 2017 (ended Nov 30, 2016) results.

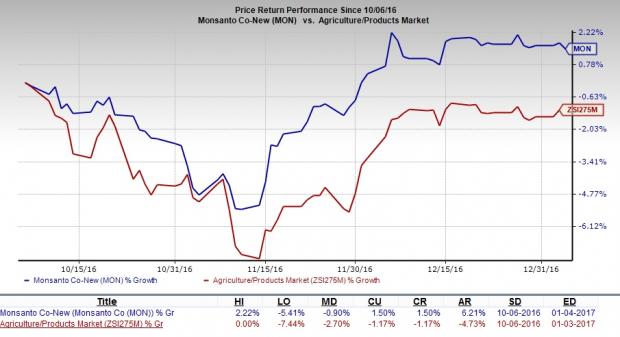

Over the last three months, shares of this Zacks Rank #2 (Buy) stock recorded a return of 1.50% – outperforming the negative return of 1.17% recorded by the Zacks categorized Agriculture/Products industry.

Adjusted earnings from ongoing business came in at 21 cents per share in the fiscal first quarter. The bottom line surpassed the Zacks Consensus Estimate of a loss of 4 cents and turned around from the year-ago loss of 11 cents. The company mentioned that quarterly earnings had improved on the back of robust South American business and higher demand for innovative products.

Revenues

In the fiscal first quarter, Monsanto generated revenues of $ 2,650 million, up 19.4% year over year.

On a segmental basis, revenues from Seeds and Genomics were up by 32.1% year over year to $ 1,848 million. Revenues from Agricultural Productivity declined 2.2% year over year to $ 802 million.

Cost & Margins

Monsanto’s cost of sales increased 5.5% year over year to $ 1,391 million. Gross margin expanded 690 basis points (bps) to 47.5%.

Operating expenses decreased 13.7% year over year to $ 1,012 million. Interest expenses were down 5.4% to $ 136 million.

Balance Sheet and Cash Flow

Monsanto exited the quarter with cash and cash equivalents of $ 2,129 million as against $ 1,676 million recorded at the end of fiscal 2016. Long-term debt was $ 8,047 million as against $ 7,453 recorded on Aug 31, 2016.

In the reported quarter, Monsanto generated cash of $ 1,463 million from operating activities as against $ 1,363 million generated in the year-ago period. Capital spending was down 2.8% year over year to $ 317 million. Dividend payments in the quarter totaled $ 237 million.

Free cash flow at the end of the fiscal first quarter was $ 1.1 billion, higher than $ 1 billion recorded in the year-ago period.

Outlook

Monsanto anticipates generating adjusted earnings within the range of $ 4.50-$ 4.90 per share in fiscal 2017, on an ongoing basis.

Monsanto is aimed at boosting its business on the back of improved core seeds and genomics business, strategic management of agricultural productivity segment’s trade, meaningful restructuring and appropriate investments.

The company believes that its agreement to merge with Bayer AG BAYRY would open up a trench of opportunities by the end of calendar year 2017.

New Genome-Editing Licensing Covenant

On Jan 4, 2017, Monsanto declared that it has inked a new global licensing deal with the Broad Institute of MIT and Harvard, for utilizing the unique CRISPR-Cpf1 genome-editing technology on agricultural platform. This move would further fortify Monsanto’s genome-editing tools’ collection. Further details of the agreement have not been disclosed in the market.

Monsanto stated that the new technology is more user friendly and flexible. It would boost farmers’ crop yield more efficiently, moving ahead.

Key Picks

Two other favorably placed stocks within the industry are listed below:

The Chemours Company CC has a whopping average earnings surprise of 153.83% for the last four quarters and currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here .

Daqo New Energy Corp. DQ also flaunts a Zacks Rank #1 and has an average earnings surprise of 112.94% for the trailing four quarters.

Zacks’ Best Private Investment Ideas

In addition to the recommendations that are available to the public on our website, how would you like to follow all Zacks’ private buys and sells in real time?

Our experts cover all kinds of trades… from value to momentum . . . from stocks under $ 10 to ETF and option moves . . . from stocks that corporate insiders are buying up to companies that are about to report positive earnings surprises. You can even look inside exclusive portfolios that are normally closed to new investors.

Starting today, for the next month, you can have unrestricted access. Click here for Zacks’ private trades >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

BAYER A G -ADR (BAYRY): Free Stock Analysis Report

DAQO NEW ENERGY (DQ): Free Stock Analysis Report

MONSANTO CO-NEW (MON): Free Stock Analysis Report

CHEMOURS COMPNY (CC): Free Stock Analysis Report

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Plantations International