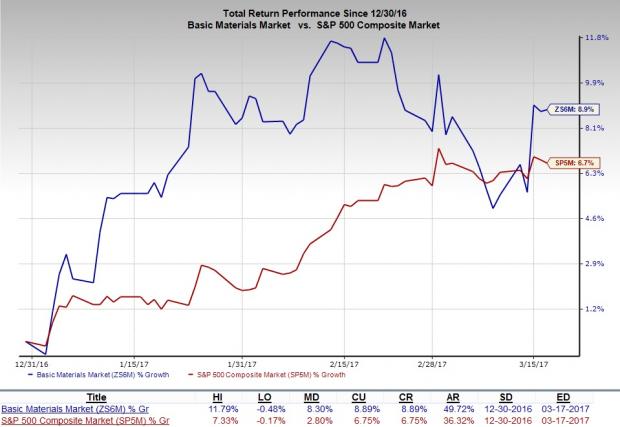

The broader Materials Select sector SPDR XLB has gained 5.31%, since Jan 1, 2017. The upside was driven by stellar performances of major materials stock like Monsanto Company MON . Notably, the Zacks categorized Basic Materials sector gained 8.89% on a year-to-date basis, outperforming 6.75% return yielded by the benchmark S&P 500 index.

Booming Chinese and U.S. infrastructure spending is likely to raise demand for construction materials and metals. Meanwhile, the chemicals industry is in the middle of numerous pending mergers & acquisitions, which are expected to close by the fall of this year. All these are anticipated to drive the earnings growth rates of several materials stocks in the equity universe.

What’s the Enduring Strategy?

We believe that it would not be wise to bet your money on just any basic material stock.

If we just stick to the script and focus on time-tested screens, we are likely to find fantastic stock ideas. And when it comes to the script, growth stocks have always narrated the most magnificent stories, haven’t they?

Our Growth Style Score condenses all the essential metrics from a company’s financial statements to get a true sense of the quality and sustainability of its growth. Our research shows that stocks with Growth Style Scores of ‘A,’ when combined with a Zacks Rank #1 (Strong Buy) or #2 (Buy), offer the best investment opportunities in the growth investing space. You can see the complete list of today’s Zacks #1 Rank stocks here .

Initiate with Monsanto

Monsanto currently carries a Zacks Rank #2 and a Growth Score ‘A’. Notably, the stock’s projected earnings growth rate for fiscal 2018 is 11.50%, higher than the Agriculture – Products industry’s projected growth rate of 5.80%.

We expect Monsanto’s near-term performance to improve on the back of Bayer AG’s BAYRY buyout deal. The largest all-cash deal ($ 66 billion), which awaits regulatory approvals, is anticipated to close by the end of 2017. The transaction is likely to open up a number of opportunities for the company. This, in turn, would propel Monsanto’s growth.

In line with this buyout deal, Monsanto intends to enhance its product portfolio and offer innovative solutions to farmers. Major issues such as food scarcity and rapid climate changes are expected to be addressed more promptly with such services.

3 Other High-Flying Picks

We have narrowed down three other impressive basic material stocks, each currently sporting a Zacks Rank #1 and a Growth score ‘A.’

Univar Inc. UNVR is a global distributer of commodity as well as specialty chemical products. The stock’s projected earnings growth rate for 2017 is 44.20%, remarkably higher than the Chemical – Diversified industry’s projected growth rate of 6.60%.

Lundin Mining Corporation LUNMF ) is a premium diversified base metals mining company. The stock’s projected earnings growth rate for 2017 is 725.00%, way higher than the Mining – Non Ferrous industry’s projected growth rate of 36.30%.

Aperam APEMY is a renowned manufacturer and retailer of stainless, and specialty steel products. The stock’s projected earnings growth rate for this year is 49.80%, higher than the Steel – Producers industry’s projected growth rate of 32.10%.

Zacks’ 2017 IPO Watch List

Before looking into the stocks mentioned above, you may want to get a head start on potential tech IPOs that are popping up on Zacks’ radar. Imagine being in the first wave of investors to jump on a company with almost unlimited growth potential? This Special Report gives you the current scoop on 5 that may go public at any time.

One has driven from 0 to a $ 68 billion valuation in 8 years. Four others are a little less obvious but already show jaw-dropping growth. Download this IPO Watch List today for free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Bayer AG (BAYRY): Free Stock Analysis Report

SPDR-MATLS SELS (XLB): ETF Research Reports

Monsanto Company (MON): Free Stock Analysis Report

Univar Inc. (UNVR): Free Stock Analysis Report

Aperam (APEMY): Free Stock Analysis Report

Lundin Mining Corp. (LUNMF): Free Stock Analysis Report

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Plantations International