Scalper1 News

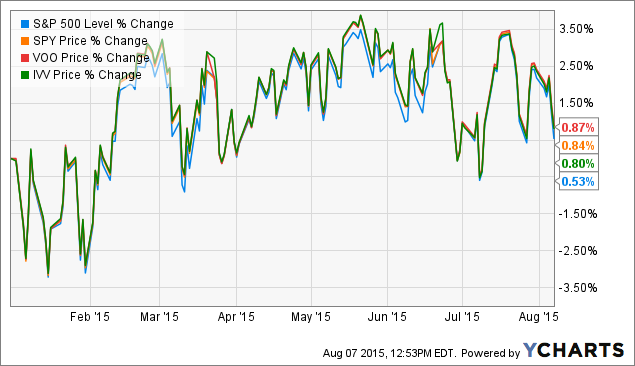

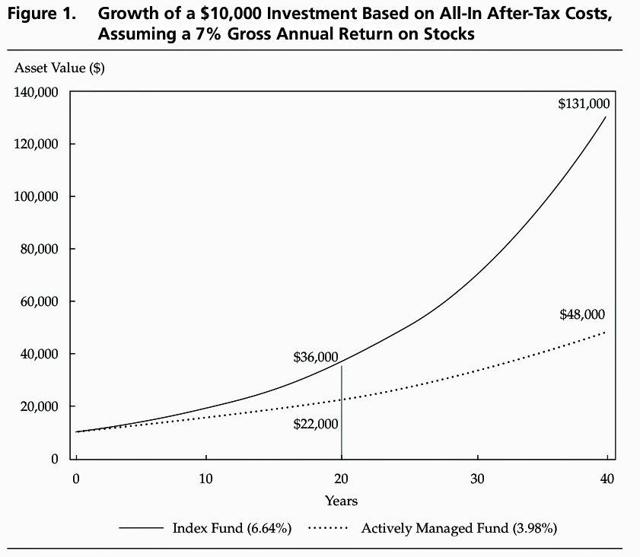

Summary An S&P 500 ETF should be the cornerstone of a well-diversified long term portfolio. I will compare the most widely known S&P 500 ETF SPY against two viable alternatives IVV and VOO. The metrics I will use are as follows: expense, historical performance, portfolio composition, total assets, volume, yield, NAV, standard deviation, and correlation. … Which is recommending that you buy the index and call it day. Boring? Perhaps. Sexy? Nope. You know what is nice though? Not having to work until you die because you were unable to save enough money for retirement. Having money to send your children to college. What else? Not getting ripped off by some “savvy money manager” that charges predatory fees. Sure you can Seek Alpha all your life, but who do you listen to? Why pay exorbitant fees for hit or miss advice? There is an optimal investment opportunity out there, and best of all, you only need access to a brokerage account to buy into it. It is called a low-cost S&P 500 ETF. Premise I firmly believe an index fund like the S&P 500 ETF (NYSEARCA: SPY ) should be a core part of a balanced long-term portfolio. The S&P 500 is comprised of 500 of the healthiest, strongest, and most widely traded stocks on the market. Investing in an S&P 500 ETF gives the investor diversified exposure to this valuable class of equities while mitigating single stock risk. I mentioned in another article that the S&P 500’s historical long term annual returns (assuming a 20-year time frame) have ranged from 5.5% to 18% . S&P averages roughly 10% returns year over year. Holding a long term-position in an ETF like SPY is intuitively the best investing decision you could ever make (I will likely write several additional articles on this subject). However, in this particular article I will focus solely on cross-analyzing and comparing the 3 primary S&P 500 ETFs available. I personally hold a long position in SPY, but I think it’s valuable to consider two alternatives iShares Core S&P 500 ETF (NYSEARCA: IVV ) and Vanguard S&P 500 ETF (NYSEARCA: VOO ). Correlation The first thing I look for in an ETF is a strong correlation to its underlying index. SPY, IVV, and VOO all display a direct and positive correlation to the S&P 500, so thankfully tracking error is not going to be a major issue. Historical Performance & My Biggest Concern Comparable returns have always grouped closely together. Interestingly, each ETF has tended to marginally outperform the S&P 500 index in the short and long run. In the last five years the index and each ETF saw around 14.75% returns annually. However, I believe this percentage is uncharacteristically high due to persistently and artificially low interest rates. This phenomenon is mostly guided by Fed backed programs which I believe have produced inflationary upward pressure on stock prices. My biggest concern for this ETF is that the stock market as a whole appears overvalued, and a market correction does not seem unfeasible (at least in the short term). As a long term investor, I am maintaining my position, but do not be surprised if these ETFs do not have future returns on par with the last five years. Comparing Key Metrics As I mentioned, I own SPY . However, I love this class of ETF, so I will not be offended if you choose to buy VOO or IVV instead. I do unequivocally recommend a long position in at least one of these. Key Metrics SPY IVV VOO NAV 208.46 209.72 191.13 Total Assets 175.95 Bil 69.8 Bil 34.33 Bil Average Volume 115.9 Mil 4.1 Mil 1.6 Mil 12-Mo. Yield 1.92% 1.99% 1.96% Expense Ratio 0.09% 0.07% 0.05% Standard Deviation 8.55% 8.56% 8.56% At first glance, SPY is the most expensive choice and offers the lowest 12-Month yield. Additionally, if you reexamine the charts I included above, you will see that VOO outperforms both IVV and SPY in the long term. However, I believe SPY derives additional value from its high liquidity. This liquidity attracts institutional investors which in turn works to lower expense. After extensive research I found that SPY is more cumbersome than IVV and VOO. Each ETF is valuable in its own way which I will soon discuss. Portfolio Composition I wanted to compare each fund’s portfolio composition by sector weighting. I found that VOO, then IVV, and finally SPY (ranked best to worst) held different sector weightings. I created an excel sheet using Morningstar data to compare and contrast each. SPY SPY Portfolio Weightings Sector Weightings % Stocks Benchmark Category Avg. Basic Materials 2.76 2.99 3.26 Consumer Cyclical 11.16 12.04 11.88 Financial Services 15.63 15.21 16.26 Real Estate 2.18 3.26 2 Sensitive Communication Services 3.94 3.73 3.62 Energy 6.91 6.82 7.62 Industrials 10.73 11.31 11.57 Technology 17.9 17.36 17.05 Defensive Consumer Defensive 9.67 8.77 8.87 Healthcare 16.26 15.63 15.59 Utilities 2.87 2.87 2.29 Critics of SPY claim it is clunky and inefficiently weighted. That claim seems overly bombastic, but there is some truth to it. SPY is underweight in: Basic Materials Consumer Cyclical Real Estate Industrials Overweight in: Financial Services Communication Services Energy Technology Consumer Defensive Healthcare Equally Weighted: IVV IVV Portfolio Weightings Sector Weightings % Stocks Benchmark Category Avg. Basic Materials 2.76 2.99 3.26 Consumer Cyclical 11.16 12.04 11.88 Financial Services 15.63 15.21 16.26 Real Estate 2.19 3.26 2 Sensitive Communication Services 3.94 3.73 3.62 Energy 6.92 6.82 7.62 Industrials 10.72 11.31 11.57 Technology 17.9 17.36 17.05 Defensive Consumer Defensive 9.66 8.77 8.87 Healthcare 16.26 15.63 15.59 Utilities 2.88 2.87 2.29 IVV has portfolio allocations identical to SPY. In regards to its benchmark (S&P 500), IVV is: Underweight in: Basic Materials Consumer Cyclical Real Estate Industrials Overweight in: Financial Services Communication Services Energy Technology Consumer Defensive Healthcare Equally Weighted: VOO VOO Portfolio Weightings Sector Weightings % Stocks Benchmark Category Avg. Basic Materials 2.98 2.99 3.26 Consumer Cyclical 11 12.04 11.88 Financial Services 15.15 15.21 16.26 Real Estate 2.11 3.26 2 Sensitive Communication Services 4.02 3.73 3.62 Energy 7.85 6.82 7.62 Industrials 10.91 11.31 11.57 Technology 17.84 17.36 17.05 Defensive Consumer Defensive 9.34 8.77 8.87 Healthcare 15.97 15.63 15.59 Utilities 2.83 2.87 2.2 VOO, in my opinion, has a better allocated portfolio and more attractive weightings. Underweight in: Consumer Cyclical Real Estate Industrials Overweight in: Communication Services Energy Technology Consumer Defensive Healthcare Equally Weighted: Basic Materials Utilities (mostly) Financial Services Investment Strategy Recommendations Whichever ETF you choose, my overall recommendation will remain the same. For this reason I will mention my overall strategy before jumping into an analysis of each ETF. Buy and hold a long position and establish a DRIP ( Dividend Reinvestment Plan ). Try to make monthly contributions to increase the compounding effect over time. Do not worry or hyper focus on short term price fluctuations. It’s difficult (if not impossible) to predict what the market is going to do. In the long term, however, you should expect attractive positive returns. Additionally, you will be able to sleep better knowing you were able to mitigate single stock risk by owning a diversified ETF. SPY SPY is structurally inefficient (compared to its alternatives), but it is cheap, well-covered, and highly liquid. You really can’t go wrong with a long buy and hold position in SPY. I would recommend SPY for beginners and institutional investors. IVV IVV is cheaper than SPY and offers the highest dividend yields (marginally). IVV is also more liquid than VOO. I would recommend IVV for high net worth individuals. VOO VOO is the cheapest and most efficiently weighted option. This Vanguard ETF historically has performed the highest of the three. While, VOO is less liquid than IVV and SPY, it is still adequately liquid. VOO does a better job of tracking the underlying index. VOO is arguably the best choice of the three. I would recommend VOO for those with some investing knowledge looking to graduate from SPY. Why Bother with an S&P 500 ETF? I could talk endlessly on this subject. I’ve already written a little bit about it, but the short answer boils down to this. Seeking alpha is a difficult, risky, and sometimes perilous journey fraught with misunderstanding, bad advice, and cognitive bias . There are a few intelligent individuals out there (and on this site) that have been able to beat the market. For the most part, however, most investors do not beat the S&P 500 . So why not just buy into it? Money managers generally do not beat the S&P 500, and they will charge you a management fee that significantly bites into your returns over time. To illustrate this, let me include one of my favorite graphs. It is easy to fall into the arms of professional money managers because we are intimidated by their financial expertise and “insider knowledge.” Often they will rationalize their exorbitant and predatory fees with backwards logic. Just invest in the index. I promise you’ll be better off. Conclusion Buy and hold a long term position in either SPY, IVV, or VOO. It could be the best investment decision you will ever make. If you don’t want to fruitlessly waste time trying to beat the market; if you don’t want to fall prey to faulty investment advice or get gouged by fees; if you want to manage risk and make money with minimal financial knowledge – invest in the index. I’m really not leading you astray here. I’m not the first person to make this recommendation and I hope I’m not the last. Don’t believe me? Listen to what Warren Buffett has to say. In regards to instructions Buffett laid out in his will, “My advice to the trustee could not be more simple: Put 10% of cash in short-term government bonds and 90% in a very low-cost S&P 500 index fund” Side note: He recommended Vanguard Afterwards : Follow me down the rabbit hole as I cover a variety of Index ETFs (Vanguard or otherwise) to perfect your portfolio. In spite of Buffett’s advice, there is a whole world of high performing, highly diversified, low cost ETFs that deserve some attention. Disclosure: I am/we are long SPY. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Summary An S&P 500 ETF should be the cornerstone of a well-diversified long term portfolio. I will compare the most widely known S&P 500 ETF SPY against two viable alternatives IVV and VOO. The metrics I will use are as follows: expense, historical performance, portfolio composition, total assets, volume, yield, NAV, standard deviation, and correlation. … Which is recommending that you buy the index and call it day. Boring? Perhaps. Sexy? Nope. You know what is nice though? Not having to work until you die because you were unable to save enough money for retirement. Having money to send your children to college. What else? Not getting ripped off by some “savvy money manager” that charges predatory fees. Sure you can Seek Alpha all your life, but who do you listen to? Why pay exorbitant fees for hit or miss advice? There is an optimal investment opportunity out there, and best of all, you only need access to a brokerage account to buy into it. It is called a low-cost S&P 500 ETF. Premise I firmly believe an index fund like the S&P 500 ETF (NYSEARCA: SPY ) should be a core part of a balanced long-term portfolio. The S&P 500 is comprised of 500 of the healthiest, strongest, and most widely traded stocks on the market. Investing in an S&P 500 ETF gives the investor diversified exposure to this valuable class of equities while mitigating single stock risk. I mentioned in another article that the S&P 500’s historical long term annual returns (assuming a 20-year time frame) have ranged from 5.5% to 18% . S&P averages roughly 10% returns year over year. Holding a long term-position in an ETF like SPY is intuitively the best investing decision you could ever make (I will likely write several additional articles on this subject). However, in this particular article I will focus solely on cross-analyzing and comparing the 3 primary S&P 500 ETFs available. I personally hold a long position in SPY, but I think it’s valuable to consider two alternatives iShares Core S&P 500 ETF (NYSEARCA: IVV ) and Vanguard S&P 500 ETF (NYSEARCA: VOO ). Correlation The first thing I look for in an ETF is a strong correlation to its underlying index. SPY, IVV, and VOO all display a direct and positive correlation to the S&P 500, so thankfully tracking error is not going to be a major issue. Historical Performance & My Biggest Concern Comparable returns have always grouped closely together. Interestingly, each ETF has tended to marginally outperform the S&P 500 index in the short and long run. In the last five years the index and each ETF saw around 14.75% returns annually. However, I believe this percentage is uncharacteristically high due to persistently and artificially low interest rates. This phenomenon is mostly guided by Fed backed programs which I believe have produced inflationary upward pressure on stock prices. My biggest concern for this ETF is that the stock market as a whole appears overvalued, and a market correction does not seem unfeasible (at least in the short term). As a long term investor, I am maintaining my position, but do not be surprised if these ETFs do not have future returns on par with the last five years. Comparing Key Metrics As I mentioned, I own SPY . However, I love this class of ETF, so I will not be offended if you choose to buy VOO or IVV instead. I do unequivocally recommend a long position in at least one of these. Key Metrics SPY IVV VOO NAV 208.46 209.72 191.13 Total Assets 175.95 Bil 69.8 Bil 34.33 Bil Average Volume 115.9 Mil 4.1 Mil 1.6 Mil 12-Mo. Yield 1.92% 1.99% 1.96% Expense Ratio 0.09% 0.07% 0.05% Standard Deviation 8.55% 8.56% 8.56% At first glance, SPY is the most expensive choice and offers the lowest 12-Month yield. Additionally, if you reexamine the charts I included above, you will see that VOO outperforms both IVV and SPY in the long term. However, I believe SPY derives additional value from its high liquidity. This liquidity attracts institutional investors which in turn works to lower expense. After extensive research I found that SPY is more cumbersome than IVV and VOO. Each ETF is valuable in its own way which I will soon discuss. Portfolio Composition I wanted to compare each fund’s portfolio composition by sector weighting. I found that VOO, then IVV, and finally SPY (ranked best to worst) held different sector weightings. I created an excel sheet using Morningstar data to compare and contrast each. SPY SPY Portfolio Weightings Sector Weightings % Stocks Benchmark Category Avg. Basic Materials 2.76 2.99 3.26 Consumer Cyclical 11.16 12.04 11.88 Financial Services 15.63 15.21 16.26 Real Estate 2.18 3.26 2 Sensitive Communication Services 3.94 3.73 3.62 Energy 6.91 6.82 7.62 Industrials 10.73 11.31 11.57 Technology 17.9 17.36 17.05 Defensive Consumer Defensive 9.67 8.77 8.87 Healthcare 16.26 15.63 15.59 Utilities 2.87 2.87 2.29 Critics of SPY claim it is clunky and inefficiently weighted. That claim seems overly bombastic, but there is some truth to it. SPY is underweight in: Basic Materials Consumer Cyclical Real Estate Industrials Overweight in: Financial Services Communication Services Energy Technology Consumer Defensive Healthcare Equally Weighted: IVV IVV Portfolio Weightings Sector Weightings % Stocks Benchmark Category Avg. Basic Materials 2.76 2.99 3.26 Consumer Cyclical 11.16 12.04 11.88 Financial Services 15.63 15.21 16.26 Real Estate 2.19 3.26 2 Sensitive Communication Services 3.94 3.73 3.62 Energy 6.92 6.82 7.62 Industrials 10.72 11.31 11.57 Technology 17.9 17.36 17.05 Defensive Consumer Defensive 9.66 8.77 8.87 Healthcare 16.26 15.63 15.59 Utilities 2.88 2.87 2.29 IVV has portfolio allocations identical to SPY. In regards to its benchmark (S&P 500), IVV is: Underweight in: Basic Materials Consumer Cyclical Real Estate Industrials Overweight in: Financial Services Communication Services Energy Technology Consumer Defensive Healthcare Equally Weighted: VOO VOO Portfolio Weightings Sector Weightings % Stocks Benchmark Category Avg. Basic Materials 2.98 2.99 3.26 Consumer Cyclical 11 12.04 11.88 Financial Services 15.15 15.21 16.26 Real Estate 2.11 3.26 2 Sensitive Communication Services 4.02 3.73 3.62 Energy 7.85 6.82 7.62 Industrials 10.91 11.31 11.57 Technology 17.84 17.36 17.05 Defensive Consumer Defensive 9.34 8.77 8.87 Healthcare 15.97 15.63 15.59 Utilities 2.83 2.87 2.2 VOO, in my opinion, has a better allocated portfolio and more attractive weightings. Underweight in: Consumer Cyclical Real Estate Industrials Overweight in: Communication Services Energy Technology Consumer Defensive Healthcare Equally Weighted: Basic Materials Utilities (mostly) Financial Services Investment Strategy Recommendations Whichever ETF you choose, my overall recommendation will remain the same. For this reason I will mention my overall strategy before jumping into an analysis of each ETF. Buy and hold a long position and establish a DRIP ( Dividend Reinvestment Plan ). Try to make monthly contributions to increase the compounding effect over time. Do not worry or hyper focus on short term price fluctuations. It’s difficult (if not impossible) to predict what the market is going to do. In the long term, however, you should expect attractive positive returns. Additionally, you will be able to sleep better knowing you were able to mitigate single stock risk by owning a diversified ETF. SPY SPY is structurally inefficient (compared to its alternatives), but it is cheap, well-covered, and highly liquid. You really can’t go wrong with a long buy and hold position in SPY. I would recommend SPY for beginners and institutional investors. IVV IVV is cheaper than SPY and offers the highest dividend yields (marginally). IVV is also more liquid than VOO. I would recommend IVV for high net worth individuals. VOO VOO is the cheapest and most efficiently weighted option. This Vanguard ETF historically has performed the highest of the three. While, VOO is less liquid than IVV and SPY, it is still adequately liquid. VOO does a better job of tracking the underlying index. VOO is arguably the best choice of the three. I would recommend VOO for those with some investing knowledge looking to graduate from SPY. Why Bother with an S&P 500 ETF? I could talk endlessly on this subject. I’ve already written a little bit about it, but the short answer boils down to this. Seeking alpha is a difficult, risky, and sometimes perilous journey fraught with misunderstanding, bad advice, and cognitive bias . There are a few intelligent individuals out there (and on this site) that have been able to beat the market. For the most part, however, most investors do not beat the S&P 500 . So why not just buy into it? Money managers generally do not beat the S&P 500, and they will charge you a management fee that significantly bites into your returns over time. To illustrate this, let me include one of my favorite graphs. It is easy to fall into the arms of professional money managers because we are intimidated by their financial expertise and “insider knowledge.” Often they will rationalize their exorbitant and predatory fees with backwards logic. Just invest in the index. I promise you’ll be better off. Conclusion Buy and hold a long term position in either SPY, IVV, or VOO. It could be the best investment decision you will ever make. If you don’t want to fruitlessly waste time trying to beat the market; if you don’t want to fall prey to faulty investment advice or get gouged by fees; if you want to manage risk and make money with minimal financial knowledge – invest in the index. I’m really not leading you astray here. I’m not the first person to make this recommendation and I hope I’m not the last. Don’t believe me? Listen to what Warren Buffett has to say. In regards to instructions Buffett laid out in his will, “My advice to the trustee could not be more simple: Put 10% of cash in short-term government bonds and 90% in a very low-cost S&P 500 index fund” Side note: He recommended Vanguard Afterwards : Follow me down the rabbit hole as I cover a variety of Index ETFs (Vanguard or otherwise) to perfect your portfolio. In spite of Buffett’s advice, there is a whole world of high performing, highly diversified, low cost ETFs that deserve some attention. Disclosure: I am/we are long SPY. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Scalper1 News