Scalper1 News

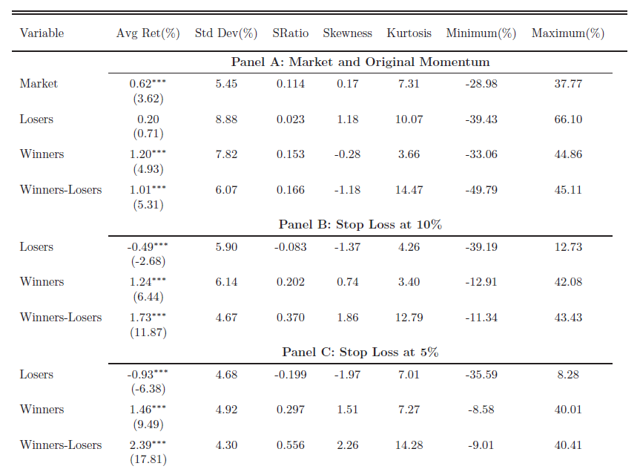

Stop losses are a form of trend following in which you switch from risky assets, such as stocks, to a risk-free or fixed income asset after there are pre-determined cumulative losses. The random walk hypothesis (RWH) was widely accepted in the 1960s and 1970s. It was synonymous with market efficiency. It effectively eliminated any academic interest in stop loss rules. Under RWH, with stock returns being independent, stop losses would decrease a strategy’s expected return. There remains a cultural affinity to RWH despite strong contrary evidence now. This may explain why there is still considerable indifference to stop loss policies and trend following in general among institutional investors, who were schooled in old academic ideas. In their paper, ” When Do Stop-Loss Rules Stop Losses? “, Kaminski and Lo (2013) show both theoretically and empirically that if stock returns have positive serial correlation (there is overwhelming evidence that they do), then stops can add value. Over monthly intervals of daily stock futures data from 1993 through 2011, the authors found that volatility-based stop loss rules could increase monthly returns 1.5% while substantially decreasing volatility. When stopped out of stocks, long-term bond futures are used as a safe harbor asset. In ” Taming Momentum Crashes: A Simple Stop-Loss Strategy “, Han, Zhou, and Zhu (2014) showed the effectiveness of a stop loss overlay applied to a momentum-based strategy. The authors examined the top decile of U.S. stocks from 1926 through 2011 based on relative strength momentum over the preceding 6 months (the authors showed similar results using 12-month momentum). They sold any stock if it dropped 10% below the beginning price of the month. They followed the same procedure for short positions. Portfolios were rebalanced monthly. This stop loss strategy raised the average monthly return from 1.01% to 1.73% (buy and hold was 0.62%) and reduced the monthly standard deviation from 6.07% to 4.67%. [1] Momentum crash risk (from short positions) was completely eliminated. The worst monthly return for buy and hold was -28.98%, while the worst monthly return for an equally weighted momentum strategy was -49.79%, showing the increased risk of applying momentum to individual stocks. The stop loss overlay improved the worst monthly return to only -11.34%. For value weighted portfolios, the maximum monthly loss for momentum and stop loss portfolios were greater at -65.34% and -23.69%, respectively. Average returns and Sharpe ratios doubled by using stops. This stop loss strategy had a positive skewness of 1.86, versus a negative skewness of -1.18 for the original momentum strategy, indicating a dramatic reduction in left tail risk when using stops. Both these papers show theoretically and empirically that risk control overlays, such as stop loss rules, can have dramatically positive effects on momentum-based strategies. This applies also to other trend following forms of risk control, such as moving average filters and absolute momentum, that may work as well or better than stops (the subject of a future post). Stop losses and other trend following methods are a way to head off some of the usual pitfalls of human judgement, such as the disposition effect, loss aversion, ambiguity aversion, and flight to safety. There is no reason why they should not be used by all momentum investors. [1] Stop loss strategies increased trading activity by 40%, but increases in return of about 70% helped overcome these high transaction costs. Scalper1 News

Stop losses are a form of trend following in which you switch from risky assets, such as stocks, to a risk-free or fixed income asset after there are pre-determined cumulative losses. The random walk hypothesis (RWH) was widely accepted in the 1960s and 1970s. It was synonymous with market efficiency. It effectively eliminated any academic interest in stop loss rules. Under RWH, with stock returns being independent, stop losses would decrease a strategy’s expected return. There remains a cultural affinity to RWH despite strong contrary evidence now. This may explain why there is still considerable indifference to stop loss policies and trend following in general among institutional investors, who were schooled in old academic ideas. In their paper, ” When Do Stop-Loss Rules Stop Losses? “, Kaminski and Lo (2013) show both theoretically and empirically that if stock returns have positive serial correlation (there is overwhelming evidence that they do), then stops can add value. Over monthly intervals of daily stock futures data from 1993 through 2011, the authors found that volatility-based stop loss rules could increase monthly returns 1.5% while substantially decreasing volatility. When stopped out of stocks, long-term bond futures are used as a safe harbor asset. In ” Taming Momentum Crashes: A Simple Stop-Loss Strategy “, Han, Zhou, and Zhu (2014) showed the effectiveness of a stop loss overlay applied to a momentum-based strategy. The authors examined the top decile of U.S. stocks from 1926 through 2011 based on relative strength momentum over the preceding 6 months (the authors showed similar results using 12-month momentum). They sold any stock if it dropped 10% below the beginning price of the month. They followed the same procedure for short positions. Portfolios were rebalanced monthly. This stop loss strategy raised the average monthly return from 1.01% to 1.73% (buy and hold was 0.62%) and reduced the monthly standard deviation from 6.07% to 4.67%. [1] Momentum crash risk (from short positions) was completely eliminated. The worst monthly return for buy and hold was -28.98%, while the worst monthly return for an equally weighted momentum strategy was -49.79%, showing the increased risk of applying momentum to individual stocks. The stop loss overlay improved the worst monthly return to only -11.34%. For value weighted portfolios, the maximum monthly loss for momentum and stop loss portfolios were greater at -65.34% and -23.69%, respectively. Average returns and Sharpe ratios doubled by using stops. This stop loss strategy had a positive skewness of 1.86, versus a negative skewness of -1.18 for the original momentum strategy, indicating a dramatic reduction in left tail risk when using stops. Both these papers show theoretically and empirically that risk control overlays, such as stop loss rules, can have dramatically positive effects on momentum-based strategies. This applies also to other trend following forms of risk control, such as moving average filters and absolute momentum, that may work as well or better than stops (the subject of a future post). Stop losses and other trend following methods are a way to head off some of the usual pitfalls of human judgement, such as the disposition effect, loss aversion, ambiguity aversion, and flight to safety. There is no reason why they should not be used by all momentum investors. [1] Stop loss strategies increased trading activity by 40%, but increases in return of about 70% helped overcome these high transaction costs. Scalper1 News

Scalper1 News