Scalper1 News

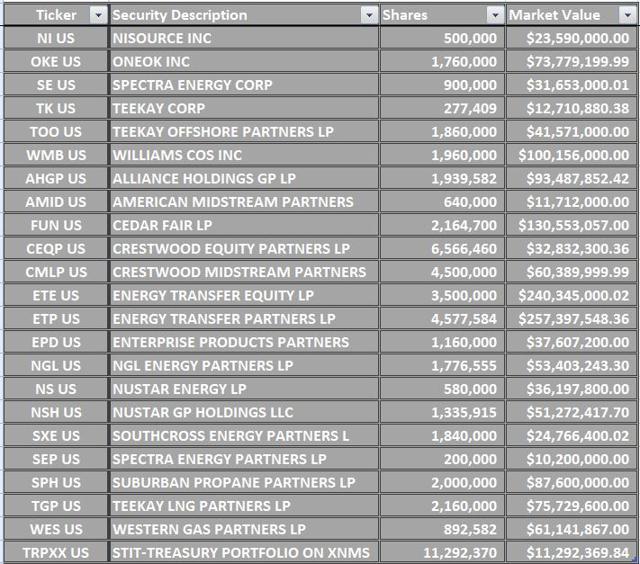

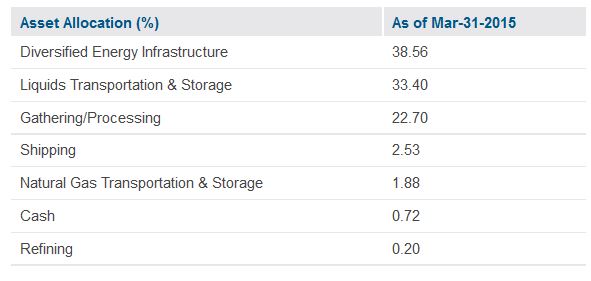

Two MLP CEFs that offer yields over 7% at current prices. Using these CEFs allows one to keep them in an IRA or Tax protected account without concern over the $1000.00 UBTI limit. Both of these CEFs is currently selling below NAV. This is the third article to cover various CEFs, ETFs and ETNs that cover high return issues like MLPs and REITs that are useful for an IRA and/or other tax deferred accounts. The first article in the series is here and the second is here . This piece examines several funds that were suggested in the comments section of my first article, NML and CEM . Neuberger Berman MLP Income Fund distributes payments monthly and currently pays $0.105 per share on the last day of the month. At a price of around $16.00 per share, the fund offers nearly an 8% yield. The chart below indicates that the fund is selling at its low for the year. (click to enlarge) Source: Interactive Brokers NML originated on 3/25/2013 as a CEF and the value of the fund has increased just short of 6% over the past 2 years. The fund is selling at about an 8% discount to NAV since the NAV was $18.43 as of 6/18/2015 and sold for about $17.00 per share on the same date. The CEF’s holdings as of 5/31/2015 are displayed below: (click to enlarge) Source: Neuberger Berman Web Site The current list of holdings is showing either a yield that is the same or greater than last year, which should indicate that the current dividend is relatively safe. However, there is no guarantee that there will not be decreases in the monthly payment at some future time if the prices of oil and gas don’t hold up. The managers of the fund are Douglas Rachlin with 29 years of investment experience and Yves Siegel who has 30 years of investment experience. Both managers personally own several thousand shares of the fund, assuring investors they have a vested in interest in the CEF doing well. The portfolio turnover ran at 10% for 2014 and expenses for the fund excluding income tax were 1.77%. Total expenses including income tax ran near 8%. Since the fund pays income tax on MLP earnings, one does not have to deal with a K-1 or have any concern about having this fund in an IRA. The fund uses leverage and recently updated its lending facility. The fund has the ability to finance $500 million of leverage with a $300 million floating rate facility and a $200 million fixed-rate facility. Clearbridge Energy MLP Fund Inc. (NYSE: CEM ) is a MLP closed end fund run by Legg Mason Global Asset Management. Total assets of the fund amount to $3.12 billion with quarterly distributions that have been increasing gradually since the fund was first started in 2010. Distributions started at $0.35 per share in 2010 with the latest distribution at $0.42 per share. This fund like the others covered in the series sends a 1099 at the end of year so an investor does not need to be concerned about K-1s. Michael Clarfeld, a CFA with 15 years of investment experience, Chris Eades with 23 years of investment experience and Peter Vanderlee, a CFA with 16 years of investment experience are the directors of the fund . The investment objective of the fund is to provide a high level of total return with an emphasis on cash distributions. The fund has grown both the dividend and the NAV since inception, see below: (click to enlarge) Source: Clearbridge Web Site The top 10 holdings of the fund are listed below: Source: Clearbridge Web Site One can see from the fund’s asset allocation below that it is not dependent upon drilling for oil and gas the dividend: Source: Clearbridge Web Site CEM recently completed a private placement of preferred stock and notes totaling $258 million to make new investments. So it is certain that the managers of the fund are planning to exercise leverage in the portfolio. The current expense ratio for this CEF is 2.19%. The current price of CEM is around $23.00 per share with a quarterly distribution of $0.42 per share so that the current yield of the fund is around 7.3%. The fund is selling about 7.5% below NAV just as NML is, so one can buy either of these funds at a discount to the actual worth of their holdings. The holdings of these 2 funds are somewhat different, so an investor desiring greater diversification with one’s MLP holdings could consider buying some of both funds. Conclusion: Both of these CEFs offers a yield over 7% at current market prices and is selling considerably below NAV. Although both have relatively high expense ratios, the leverage these CEFs uses helps cover these costs so that yields remain high. CEM has been in existence longer and has shown greater appreciation and growth in yield than NML and could be the better CEF. However, buying a bit of both gives one greater diversification in the MLP industry without having to deal with K-1s. Using these CEFs as well as others I have covered in the past allow one to have MLPs in a tax-protected account without the concern over the $1000.00 limit imposed by the IRS on UBTI. In addition, they also offer greater diversification and no concern about K-1s if one desires to use them in a regular account. Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Two MLP CEFs that offer yields over 7% at current prices. Using these CEFs allows one to keep them in an IRA or Tax protected account without concern over the $1000.00 UBTI limit. Both of these CEFs is currently selling below NAV. This is the third article to cover various CEFs, ETFs and ETNs that cover high return issues like MLPs and REITs that are useful for an IRA and/or other tax deferred accounts. The first article in the series is here and the second is here . This piece examines several funds that were suggested in the comments section of my first article, NML and CEM . Neuberger Berman MLP Income Fund distributes payments monthly and currently pays $0.105 per share on the last day of the month. At a price of around $16.00 per share, the fund offers nearly an 8% yield. The chart below indicates that the fund is selling at its low for the year. (click to enlarge) Source: Interactive Brokers NML originated on 3/25/2013 as a CEF and the value of the fund has increased just short of 6% over the past 2 years. The fund is selling at about an 8% discount to NAV since the NAV was $18.43 as of 6/18/2015 and sold for about $17.00 per share on the same date. The CEF’s holdings as of 5/31/2015 are displayed below: (click to enlarge) Source: Neuberger Berman Web Site The current list of holdings is showing either a yield that is the same or greater than last year, which should indicate that the current dividend is relatively safe. However, there is no guarantee that there will not be decreases in the monthly payment at some future time if the prices of oil and gas don’t hold up. The managers of the fund are Douglas Rachlin with 29 years of investment experience and Yves Siegel who has 30 years of investment experience. Both managers personally own several thousand shares of the fund, assuring investors they have a vested in interest in the CEF doing well. The portfolio turnover ran at 10% for 2014 and expenses for the fund excluding income tax were 1.77%. Total expenses including income tax ran near 8%. Since the fund pays income tax on MLP earnings, one does not have to deal with a K-1 or have any concern about having this fund in an IRA. The fund uses leverage and recently updated its lending facility. The fund has the ability to finance $500 million of leverage with a $300 million floating rate facility and a $200 million fixed-rate facility. Clearbridge Energy MLP Fund Inc. (NYSE: CEM ) is a MLP closed end fund run by Legg Mason Global Asset Management. Total assets of the fund amount to $3.12 billion with quarterly distributions that have been increasing gradually since the fund was first started in 2010. Distributions started at $0.35 per share in 2010 with the latest distribution at $0.42 per share. This fund like the others covered in the series sends a 1099 at the end of year so an investor does not need to be concerned about K-1s. Michael Clarfeld, a CFA with 15 years of investment experience, Chris Eades with 23 years of investment experience and Peter Vanderlee, a CFA with 16 years of investment experience are the directors of the fund . The investment objective of the fund is to provide a high level of total return with an emphasis on cash distributions. The fund has grown both the dividend and the NAV since inception, see below: (click to enlarge) Source: Clearbridge Web Site The top 10 holdings of the fund are listed below: Source: Clearbridge Web Site One can see from the fund’s asset allocation below that it is not dependent upon drilling for oil and gas the dividend: Source: Clearbridge Web Site CEM recently completed a private placement of preferred stock and notes totaling $258 million to make new investments. So it is certain that the managers of the fund are planning to exercise leverage in the portfolio. The current expense ratio for this CEF is 2.19%. The current price of CEM is around $23.00 per share with a quarterly distribution of $0.42 per share so that the current yield of the fund is around 7.3%. The fund is selling about 7.5% below NAV just as NML is, so one can buy either of these funds at a discount to the actual worth of their holdings. The holdings of these 2 funds are somewhat different, so an investor desiring greater diversification with one’s MLP holdings could consider buying some of both funds. Conclusion: Both of these CEFs offers a yield over 7% at current market prices and is selling considerably below NAV. Although both have relatively high expense ratios, the leverage these CEFs uses helps cover these costs so that yields remain high. CEM has been in existence longer and has shown greater appreciation and growth in yield than NML and could be the better CEF. However, buying a bit of both gives one greater diversification in the MLP industry without having to deal with K-1s. Using these CEFs as well as others I have covered in the past allow one to have MLPs in a tax-protected account without the concern over the $1000.00 limit imposed by the IRS on UBTI. In addition, they also offer greater diversification and no concern about K-1s if one desires to use them in a regular account. Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Scalper1 News