Scalper1 News

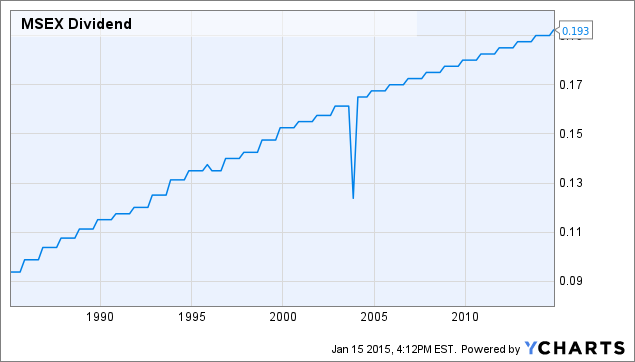

The shares currently sport a yield of about 3.5%. Utilities are notorious for being a great defensive play. Estimates for 2015 point to continued strong growth. Middlesex Water (NASDAQ: MSEX ) is a lightly followed water utility company based in New Jersey. The company operates in NJ as well as a couple of the surrounding states providing water related services. I found Middlesex while looking for attractive yields that are sustainable. Middlesex most definitely meets both of those traits. The company is worth a deeper look and at least an add to a watchlist. So the obvious first, the yield is nice at 3.5%. The company has had dividend growth for the past 42 years according to Dividend.com , most recently announcing an increase this past November. This increase puts the annual dividend at 77 cents a share with a current payout ratio of about 70%. While this may seem a bit high I don’t believe with a utility company like Middlesex it is something to be concerned with especially with the history of payments the company has. Below is the chart of the quarterly dividend growth since the late ’80s. Clearly other than the one disruption, which was for one quarter, there is a consistent uptrend. MSEX Dividend data by YCharts The company’s growth in general looks pretty as well. Both revenue and earnings have seen nice increases over the past few years and this trend also looks to be continuing. Year Revenue EPS 2013 $114.85M $1.03 2014 $117.29M(Est) $1.12 2015 $121.77M(Est) $1.19 (Sources for data and estimates: FT.com ) Using the estimates we see between 2013 and 2015 revenue is expected to increase another 6%, and EPS are expected to rise another 15.5%. EPS in 2015 of $1.19 would point to a payout ratio close to 64%, which means it will obviously practical for the dividend to be increased again. The great part about Middlesex is the fact that it is a great defensive play. There has been a crazy amount of noise that we are fast approaching a bear market with many companies way overvalued. I can’t argue with that last part. There are plenty of companies in this market overvalued. I also can’t say if there is a bear market coming or if there will just be a short-term correction. I do know that history tells us whatever the economic environment is Middlesex still performs well. The market has been up and down dozen of times in the past 42 years. Middlesex was still able to increase its dividend all those years. The fact is that water and water-related services will never go out of style. The barriers to entry are high so Middlesex doesn’t need to be overly concerned about competition as well. For a company that has done business since 1897 I don’t foresee any major problems anytime soon. In conclusion, I think Middlesex is a great play in a potentially rocky market. The yield is attractive at these levels and if the shares drop back a little more I think it would be a extremely good opportunity to pick some up. This year the company will celebrate its 118th birthday and likely increase its dividend for a 43rd year. Additional disclosure: Always do your own research before investing. Now that you’ve read this, are you Bullish or Bearish on ? Bullish Bearish Sentiment on ( ) Thanks for sharing your thoughts. Why are you ? Submit & View Results Skip to results » Share this article with a colleague Scalper1 News

The shares currently sport a yield of about 3.5%. Utilities are notorious for being a great defensive play. Estimates for 2015 point to continued strong growth. Middlesex Water (NASDAQ: MSEX ) is a lightly followed water utility company based in New Jersey. The company operates in NJ as well as a couple of the surrounding states providing water related services. I found Middlesex while looking for attractive yields that are sustainable. Middlesex most definitely meets both of those traits. The company is worth a deeper look and at least an add to a watchlist. So the obvious first, the yield is nice at 3.5%. The company has had dividend growth for the past 42 years according to Dividend.com , most recently announcing an increase this past November. This increase puts the annual dividend at 77 cents a share with a current payout ratio of about 70%. While this may seem a bit high I don’t believe with a utility company like Middlesex it is something to be concerned with especially with the history of payments the company has. Below is the chart of the quarterly dividend growth since the late ’80s. Clearly other than the one disruption, which was for one quarter, there is a consistent uptrend. MSEX Dividend data by YCharts The company’s growth in general looks pretty as well. Both revenue and earnings have seen nice increases over the past few years and this trend also looks to be continuing. Year Revenue EPS 2013 $114.85M $1.03 2014 $117.29M(Est) $1.12 2015 $121.77M(Est) $1.19 (Sources for data and estimates: FT.com ) Using the estimates we see between 2013 and 2015 revenue is expected to increase another 6%, and EPS are expected to rise another 15.5%. EPS in 2015 of $1.19 would point to a payout ratio close to 64%, which means it will obviously practical for the dividend to be increased again. The great part about Middlesex is the fact that it is a great defensive play. There has been a crazy amount of noise that we are fast approaching a bear market with many companies way overvalued. I can’t argue with that last part. There are plenty of companies in this market overvalued. I also can’t say if there is a bear market coming or if there will just be a short-term correction. I do know that history tells us whatever the economic environment is Middlesex still performs well. The market has been up and down dozen of times in the past 42 years. Middlesex was still able to increase its dividend all those years. The fact is that water and water-related services will never go out of style. The barriers to entry are high so Middlesex doesn’t need to be overly concerned about competition as well. For a company that has done business since 1897 I don’t foresee any major problems anytime soon. In conclusion, I think Middlesex is a great play in a potentially rocky market. The yield is attractive at these levels and if the shares drop back a little more I think it would be a extremely good opportunity to pick some up. This year the company will celebrate its 118th birthday and likely increase its dividend for a 43rd year. Additional disclosure: Always do your own research before investing. Now that you’ve read this, are you Bullish or Bearish on ? Bullish Bearish Sentiment on ( ) Thanks for sharing your thoughts. Why are you ? Submit & View Results Skip to results » Share this article with a colleague Scalper1 News

Scalper1 News