Scalper1 News

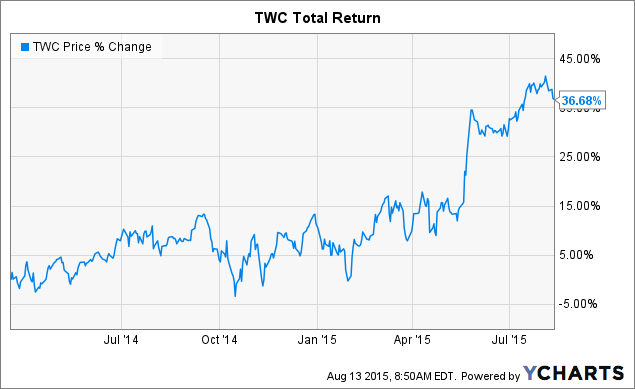

Merger Arbitrage Interview Series continues. Global mergers on record pace in 2015. Chris DeMuth, writer of the new M&A Daily. Global mergers and acquisitions are on pace this year to hit the highest level on record. That may be why interest in deal stocks is running pretty high on Seeking Alpha. The merger arbitrage blog on the site is one of the most popular with more than 1000 comments so far this year. I recently started a Merger Arbitrage Interview Series on Seeking Alpha. Earlier this week, we heard from MergerBrief founder Carl Barnick . In this installment, we hear from Chris DeMuth Jr., author of the new M&A Daily. Special Situations and Arbs: You run the most popular premium service on Seeking Alpha, Sifting The World, and you recently started a daily merger arbitrage product called M&A Daily. Can you explain what you hope to accomplish with this? Chris DeMuth Jr.: I started the new M&A Daily to offer top news on deal activity as well as my $0.02 on investment opportunities surrounding those deals. The great idea to start this came from Eli Hoffmann , Seeking Alpha’s new CEO. This is Seeking Alpha’s first contributor-generated newsletter. It will feature the option for readers to have it sent straight to their inboxes when it is published. I started researching M&A transactions in 1999 and have been doing so ever since, so I hope that this will be a great new outlet for using some of my experience and enthusiasm that I have in regard to this topic. Thank you, Eli, for the chance to launch this product and roll it out to a much wider audience starting next week. SSA: Is M&A Daily geared to readers that trade M&A stocks or the general SA reader? CDM : It is geared to anyone interested in M&A – corporate insiders, financial and legal advisors, as well as merger arbitrageurs and other investors. SSA: What attracted you to merger arbitrage initially? CDM: My first job involved public policy research in DC. I conducted regulatory and antitrust analysis and tracked litigation and legislation for well-known hedge funds and banks. A lot of the work revolved around policy-sensitive issues such as asbestos and tobacco. About half of the job was analytical and about half was investigative. I read a lot of SEC filings, but I also would know who checked into what hotels and where their planes landed. What attracted me to initially focus on merger arbitrage were some of the people involved at the top hedge funds and prop desks at the time. I wanted to learn from them while I worked for them. SSA: How do you think a merger arbitrage strategy will perform in the upcoming downturn, whenever that is? CDM: The market is precariously expensive and a collapse would be unsurprising. Merger arbitrage should do fine, as long as exposures are sized appropriately. SSA: How do years of experience make a merger arbitrage trader better? CDM: A lot of this business is highly practical. After years of experience, one gets to know the relevant personnel much better. SSA: Do you invest in the deals you write about on SA? CDM: Yes, without exception. The only reason why I have the time and energy to discuss ideas on SA is because it is so highly redundant with what I am doing anyway – seeking mispriced securities for Rangeley Capital, sharing edgy and actionable ideas with StW , and then disseminating more general ideas to the mass market on SA. SSA: Do you prefer cash or stock deals? CDM: I have no preference. I like cash; I like stock. The only thing that I need is a substantial discount to the probability-weighted outcomes. As Warren Buffett says, Take the probability of loss times the amount of possible loss from the probability of gain times the amount of possible gain. That is what we’re trying to do. It’s imperfect, but that’s what it’s all about. SSA: Do you attempt to hedge cash deals? If so how? CDM: No. Instead, I am extremely picky about which deals I get involved in. In terms of playing defense, I use selectivity, cash, and disciplined sizing. SSA: Do you use leverage? CDM: Rarely and sparingly. The last time that I was substantially leveraged was March 2009. As of today, I have a substantial cash position. SSA: Do you utilize the options market in respect to M&A? If so how? CDM: Yes, the options market is quite useful for M&A-related positions. We frequently have information or judgment that leads us to a high level of confidence on a deal likelihood or its price or its date, without confidence in other aspects of a potential deal. Options allow us to more precisely isolate the aspects of a given investment where we have an advantage. When I write up deal targets such as here , I typically include a section that I call Event Driven Investing with Equity Options. The idea is to find opportunities where typical options pricing models fail to take into account salient aspects of corporate events. SSA: Do you invest in pre-deal rumors? If so, how do you decide which ones to invest in and which ones to pass on? CDM: I have never invested in a situation that could be accurately characterized as a rumor. We do, however, invest in non-definitive deals. I look for targets that are trading beneath to only slightly above their intrinsic value as standalone companies. That way, we own any upside from deal announcements. I am less interested in paying anything for deal speculation once it is in the price. This year, two investments of mine that turned into definitive deals included Informatica (NASDAQ: INFA ) and Magnetek (NASDAQ: MAG ). SSA: What are your thoughts on holding a handful of concentrated positions vs. investing in several deals? CDM: It is fine as long as one knows what they are doing. I am fine with concentrated positions as long as there is a substantial and unambiguous asymmetry. It happens, but does not happen all the time. SSA: Both the Shire/AbbVie and Time Warner Cable/Comcast deals fell apart not that long ago. How does an arbitrageur avoid these kinds of deals? Is the regulatory process getting tougher? CDM: Both Shire (NASDAQ: SHPG ) and Time Warner Cable (NYSE: TWC ) are trading above their prices before their earlier deals were discounted by the market, so these are cautionary stories regarding fortitude, not avoidance. I bought about $7.5 million of TWC at the beginning of last year which grew to over $10 million this year, wrote about it here and here and think that it is still an opportunity. TWC data by YCharts Good things happen to cheap stocks and we ended up with a better deal after the first one failed. SSA : What do you think of the role of the activist in merger deals? CDM: It is largely positive. However, I do not see any need for a clear distinction between activists and other holders. We are all owners and should all act like it. That means we do whatever we can to maximize shareholder value. Sometimes that involves cheering on our managers in their job as stewards of our companies. Other times that means simply staying out of their way. Yet other times, it involves standing up for ourselves and fighting. The tactic should simply fit the circumstances. SSA: Can you share one or two recent merger arbitrage trades and discuss why you put the trade on? CDM: I own both Pinnacle (NYSE: PNK ) and Depomed (NASDAQ: DEPO ). Through constant and productive communication with the relevant decision makers, we concluded that the bidders were committed and their commitment would result in definitive deals. Pinnacle did. Depomed will. SSA: Is there a current deal you won’t invest in? CDM: At the right price, I would invest in any deal. Of the current deals, I think that it is reasonable to expect the Rexam (OTCQX: REXMY ) deal with Ball (NYSE: BLL ) to be blocked on antitrust grounds and it is reasonable to interpret the management-led buyout of SFX Entertainment (NASDAQ: SFXE ) as a dubious to fraudulent effort to buy a company that is worth somewhere in the neighborhood of $0.00. So those are two examples of securities that would have to be quite a bit cheaper and more analyzable to attract me. SSA: How do you decide whether to add to a position that had declined or to close the trade? CDM: Any position that moves a material amount is re-analyzed from scratch. The route that a stock took to a given price is not an input in my analysis. I look only at its upside, downside, and embedded probabilities of each possible outcome. I add to positions that are increasingly variant and close positions when the market price has converged upon a security’s intrinsic value whether it converged upwards, downwards, or sideways. SSA: May was a record for M&A activity. Domestic take-overs totaled $243B last month, besting the two previous month highs, May 2007 and January 2000. Does reading that sentence scare you? CDM: I thought that both January 2000 and May 2007 were delightful, so no. Deal activity is strong. Markets are expensive. Volatility is low. One can probably do well through a combination of cash, sizing discipline, and one of the best sets of short opportunities that I have ever seen. SSA: Is there anything else you would like to add about M&A Daily, your hedge fund or merger arbitrage in general? CDM: Seeking Alpha’s computer geniuses are hard at work setting up the M&A Daily update so that it can go out as part of a daily e-mail as soon as next week. Thank you, Daniel Hochman, for the great work behind the scenes as we get this product to our readers. I hope that the M&A community will find it useful and make it part of their routine. At Rangeley Capital, we are busily building out a new seeding platform that is going to bring on a number of talented new portfolio managers starting in the months ahead. Some of them are even people who are already well known to the Seeking Alpha readership. As far as merger arbitrage, it is just a part of what I do, but every once in a while it can get interesting and lucrative. To date, it has not been a big emphasis on Sifting the World , but it may be a bigger part of STW’s future. With bond prices at extremely high prices, it is easier to justify merger arbitrage spreads as an attractive bond substitute. If anyone wants to learn more, they should check out your terrific Merger Arbitrage Blog . Finally, thank you, Special Situations and Arbs, for taking the time to discuss merger arbitrage. I love thinking about investment ideas, so I am glad that you asked. Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Additional disclosure: Special Situations and Arbs has no positions in any stocks mentioned above. Scalper1 News

Merger Arbitrage Interview Series continues. Global mergers on record pace in 2015. Chris DeMuth, writer of the new M&A Daily. Global mergers and acquisitions are on pace this year to hit the highest level on record. That may be why interest in deal stocks is running pretty high on Seeking Alpha. The merger arbitrage blog on the site is one of the most popular with more than 1000 comments so far this year. I recently started a Merger Arbitrage Interview Series on Seeking Alpha. Earlier this week, we heard from MergerBrief founder Carl Barnick . In this installment, we hear from Chris DeMuth Jr., author of the new M&A Daily. Special Situations and Arbs: You run the most popular premium service on Seeking Alpha, Sifting The World, and you recently started a daily merger arbitrage product called M&A Daily. Can you explain what you hope to accomplish with this? Chris DeMuth Jr.: I started the new M&A Daily to offer top news on deal activity as well as my $0.02 on investment opportunities surrounding those deals. The great idea to start this came from Eli Hoffmann , Seeking Alpha’s new CEO. This is Seeking Alpha’s first contributor-generated newsletter. It will feature the option for readers to have it sent straight to their inboxes when it is published. I started researching M&A transactions in 1999 and have been doing so ever since, so I hope that this will be a great new outlet for using some of my experience and enthusiasm that I have in regard to this topic. Thank you, Eli, for the chance to launch this product and roll it out to a much wider audience starting next week. SSA: Is M&A Daily geared to readers that trade M&A stocks or the general SA reader? CDM : It is geared to anyone interested in M&A – corporate insiders, financial and legal advisors, as well as merger arbitrageurs and other investors. SSA: What attracted you to merger arbitrage initially? CDM: My first job involved public policy research in DC. I conducted regulatory and antitrust analysis and tracked litigation and legislation for well-known hedge funds and banks. A lot of the work revolved around policy-sensitive issues such as asbestos and tobacco. About half of the job was analytical and about half was investigative. I read a lot of SEC filings, but I also would know who checked into what hotels and where their planes landed. What attracted me to initially focus on merger arbitrage were some of the people involved at the top hedge funds and prop desks at the time. I wanted to learn from them while I worked for them. SSA: How do you think a merger arbitrage strategy will perform in the upcoming downturn, whenever that is? CDM: The market is precariously expensive and a collapse would be unsurprising. Merger arbitrage should do fine, as long as exposures are sized appropriately. SSA: How do years of experience make a merger arbitrage trader better? CDM: A lot of this business is highly practical. After years of experience, one gets to know the relevant personnel much better. SSA: Do you invest in the deals you write about on SA? CDM: Yes, without exception. The only reason why I have the time and energy to discuss ideas on SA is because it is so highly redundant with what I am doing anyway – seeking mispriced securities for Rangeley Capital, sharing edgy and actionable ideas with StW , and then disseminating more general ideas to the mass market on SA. SSA: Do you prefer cash or stock deals? CDM: I have no preference. I like cash; I like stock. The only thing that I need is a substantial discount to the probability-weighted outcomes. As Warren Buffett says, Take the probability of loss times the amount of possible loss from the probability of gain times the amount of possible gain. That is what we’re trying to do. It’s imperfect, but that’s what it’s all about. SSA: Do you attempt to hedge cash deals? If so how? CDM: No. Instead, I am extremely picky about which deals I get involved in. In terms of playing defense, I use selectivity, cash, and disciplined sizing. SSA: Do you use leverage? CDM: Rarely and sparingly. The last time that I was substantially leveraged was March 2009. As of today, I have a substantial cash position. SSA: Do you utilize the options market in respect to M&A? If so how? CDM: Yes, the options market is quite useful for M&A-related positions. We frequently have information or judgment that leads us to a high level of confidence on a deal likelihood or its price or its date, without confidence in other aspects of a potential deal. Options allow us to more precisely isolate the aspects of a given investment where we have an advantage. When I write up deal targets such as here , I typically include a section that I call Event Driven Investing with Equity Options. The idea is to find opportunities where typical options pricing models fail to take into account salient aspects of corporate events. SSA: Do you invest in pre-deal rumors? If so, how do you decide which ones to invest in and which ones to pass on? CDM: I have never invested in a situation that could be accurately characterized as a rumor. We do, however, invest in non-definitive deals. I look for targets that are trading beneath to only slightly above their intrinsic value as standalone companies. That way, we own any upside from deal announcements. I am less interested in paying anything for deal speculation once it is in the price. This year, two investments of mine that turned into definitive deals included Informatica (NASDAQ: INFA ) and Magnetek (NASDAQ: MAG ). SSA: What are your thoughts on holding a handful of concentrated positions vs. investing in several deals? CDM: It is fine as long as one knows what they are doing. I am fine with concentrated positions as long as there is a substantial and unambiguous asymmetry. It happens, but does not happen all the time. SSA: Both the Shire/AbbVie and Time Warner Cable/Comcast deals fell apart not that long ago. How does an arbitrageur avoid these kinds of deals? Is the regulatory process getting tougher? CDM: Both Shire (NASDAQ: SHPG ) and Time Warner Cable (NYSE: TWC ) are trading above their prices before their earlier deals were discounted by the market, so these are cautionary stories regarding fortitude, not avoidance. I bought about $7.5 million of TWC at the beginning of last year which grew to over $10 million this year, wrote about it here and here and think that it is still an opportunity. TWC data by YCharts Good things happen to cheap stocks and we ended up with a better deal after the first one failed. SSA : What do you think of the role of the activist in merger deals? CDM: It is largely positive. However, I do not see any need for a clear distinction between activists and other holders. We are all owners and should all act like it. That means we do whatever we can to maximize shareholder value. Sometimes that involves cheering on our managers in their job as stewards of our companies. Other times that means simply staying out of their way. Yet other times, it involves standing up for ourselves and fighting. The tactic should simply fit the circumstances. SSA: Can you share one or two recent merger arbitrage trades and discuss why you put the trade on? CDM: I own both Pinnacle (NYSE: PNK ) and Depomed (NASDAQ: DEPO ). Through constant and productive communication with the relevant decision makers, we concluded that the bidders were committed and their commitment would result in definitive deals. Pinnacle did. Depomed will. SSA: Is there a current deal you won’t invest in? CDM: At the right price, I would invest in any deal. Of the current deals, I think that it is reasonable to expect the Rexam (OTCQX: REXMY ) deal with Ball (NYSE: BLL ) to be blocked on antitrust grounds and it is reasonable to interpret the management-led buyout of SFX Entertainment (NASDAQ: SFXE ) as a dubious to fraudulent effort to buy a company that is worth somewhere in the neighborhood of $0.00. So those are two examples of securities that would have to be quite a bit cheaper and more analyzable to attract me. SSA: How do you decide whether to add to a position that had declined or to close the trade? CDM: Any position that moves a material amount is re-analyzed from scratch. The route that a stock took to a given price is not an input in my analysis. I look only at its upside, downside, and embedded probabilities of each possible outcome. I add to positions that are increasingly variant and close positions when the market price has converged upon a security’s intrinsic value whether it converged upwards, downwards, or sideways. SSA: May was a record for M&A activity. Domestic take-overs totaled $243B last month, besting the two previous month highs, May 2007 and January 2000. Does reading that sentence scare you? CDM: I thought that both January 2000 and May 2007 were delightful, so no. Deal activity is strong. Markets are expensive. Volatility is low. One can probably do well through a combination of cash, sizing discipline, and one of the best sets of short opportunities that I have ever seen. SSA: Is there anything else you would like to add about M&A Daily, your hedge fund or merger arbitrage in general? CDM: Seeking Alpha’s computer geniuses are hard at work setting up the M&A Daily update so that it can go out as part of a daily e-mail as soon as next week. Thank you, Daniel Hochman, for the great work behind the scenes as we get this product to our readers. I hope that the M&A community will find it useful and make it part of their routine. At Rangeley Capital, we are busily building out a new seeding platform that is going to bring on a number of talented new portfolio managers starting in the months ahead. Some of them are even people who are already well known to the Seeking Alpha readership. As far as merger arbitrage, it is just a part of what I do, but every once in a while it can get interesting and lucrative. To date, it has not been a big emphasis on Sifting the World , but it may be a bigger part of STW’s future. With bond prices at extremely high prices, it is easier to justify merger arbitrage spreads as an attractive bond substitute. If anyone wants to learn more, they should check out your terrific Merger Arbitrage Blog . Finally, thank you, Special Situations and Arbs, for taking the time to discuss merger arbitrage. I love thinking about investment ideas, so I am glad that you asked. Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Additional disclosure: Special Situations and Arbs has no positions in any stocks mentioned above. Scalper1 News

Scalper1 News