Scalper1 News

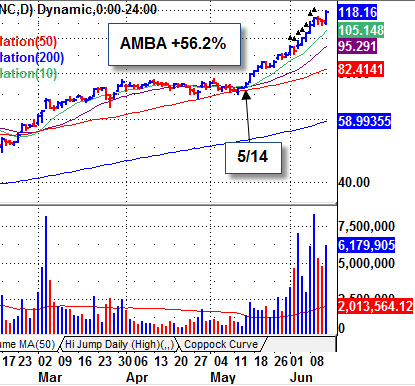

Quick profits for members continue at www.selfishinvesting.com. A few examples: +48% gain in SKX, members notified 4/22 at 74.8, current price: 110.71 +56.2 gain in AMBA, members notified 5/14 at 75.63, current price 118.16 +36.5% gain in SUPN, members notified 5/21 at 13.26, current price 18.1 Note that the above stocks could have been partially sold as they wended their way higher but then bought back in some cases. That said, this is a market of taking profits when a stock gets ahead of itself in price relative to its overall chart and general market. Thus it is important to keep stops tight. Here are some examples: VRX = members notified 4/29 at 212.03. Current price: 229.64. It has also violated its 10dma. But on 5/22 and 5/28 as stated in a prior webinar, VRX was getting ahead of itself in context with its chart, so there was nothing wrong taking profits on these days which would have netted profits of roughly +12% and +14% assuming one sold around the closing price. REGN = members notified 5/8 at 481.29. Current price: 492.29. In a prior webinar, we said REGN was possibly getting ahead of itself on 5/20, so taking some profits is not a bad idea. REGN closed at 516 on 5/21. Taking profits on 5/21 or on the following Monday would have resulted in gains of roughly +7%, not bad considering one was only invested in the stock for 10 days. Also, not all stocks can be quick winners such as SKX, AMBA, and SUPN shown above. But by hitting enough singles, one is liable to hit some doubles and triples. VRX then traded sideways, bolted higher on 6/5, but then gapped lower on 6/10 opening at 505.73. VRX should have then been completely sold at the open, no questions asked. When a stock gaps lower as much as VRX did, it is time to EXIT. CI = members notified over the weekend after the 5/22 closing price of 135.86. Current price: 137.31. CI clearly was ahead of itself on 5/29 when it was up as much as +7% on the day. Given its price history, profits could have been taken on 5/29 or the following Monday on 6/1. It has since had a normal and expected pullback. AYI = members notified on 4/29 at 168.98. Current price: 181.57. On 5/13, AYI was clearly getting ahead of itself as it peaked at 183.53, thus some profits could have been taken. AYI has since traded sideways on a mild pullback. The time value in taking profits on 5/13 is substantial. A month later, AYI is trading roughly at a similar price to 5/13. As one can see, the time value in netting a profit is substantial to any trading account as it sometimes can take less than a month to be up nicely in a stock. But as we have advised many times, the key over the last couple of years has been to take profits when you have them in context with the overall chart and general market. By âbaby-steppingâ his account in this manner, the co-founder of Virtue of Selfish Investing, Gil Morales, was able to achieved a triple digit percentage return in 2014. And some of our members have told us of their trading account victories despite the challenging QE-driven market. And being able to adjust to market environments greatly sharpens oneâs trading ability. Scalper1 News

Quick profits for members continue at www.selfishinvesting.com. A few examples: +48% gain in SKX, members notified 4/22 at 74.8, current price: 110.71 +56.2 gain in AMBA, members notified 5/14 at 75.63, current price 118.16 +36.5% gain in SUPN, members notified 5/21 at 13.26, current price 18.1 Note that the above stocks could have been partially sold as they wended their way higher but then bought back in some cases. That said, this is a market of taking profits when a stock gets ahead of itself in price relative to its overall chart and general market. Thus it is important to keep stops tight. Here are some examples: VRX = members notified 4/29 at 212.03. Current price: 229.64. It has also violated its 10dma. But on 5/22 and 5/28 as stated in a prior webinar, VRX was getting ahead of itself in context with its chart, so there was nothing wrong taking profits on these days which would have netted profits of roughly +12% and +14% assuming one sold around the closing price. REGN = members notified 5/8 at 481.29. Current price: 492.29. In a prior webinar, we said REGN was possibly getting ahead of itself on 5/20, so taking some profits is not a bad idea. REGN closed at 516 on 5/21. Taking profits on 5/21 or on the following Monday would have resulted in gains of roughly +7%, not bad considering one was only invested in the stock for 10 days. Also, not all stocks can be quick winners such as SKX, AMBA, and SUPN shown above. But by hitting enough singles, one is liable to hit some doubles and triples. VRX then traded sideways, bolted higher on 6/5, but then gapped lower on 6/10 opening at 505.73. VRX should have then been completely sold at the open, no questions asked. When a stock gaps lower as much as VRX did, it is time to EXIT. CI = members notified over the weekend after the 5/22 closing price of 135.86. Current price: 137.31. CI clearly was ahead of itself on 5/29 when it was up as much as +7% on the day. Given its price history, profits could have been taken on 5/29 or the following Monday on 6/1. It has since had a normal and expected pullback. AYI = members notified on 4/29 at 168.98. Current price: 181.57. On 5/13, AYI was clearly getting ahead of itself as it peaked at 183.53, thus some profits could have been taken. AYI has since traded sideways on a mild pullback. The time value in taking profits on 5/13 is substantial. A month later, AYI is trading roughly at a similar price to 5/13. As one can see, the time value in netting a profit is substantial to any trading account as it sometimes can take less than a month to be up nicely in a stock. But as we have advised many times, the key over the last couple of years has been to take profits when you have them in context with the overall chart and general market. By âbaby-steppingâ his account in this manner, the co-founder of Virtue of Selfish Investing, Gil Morales, was able to achieved a triple digit percentage return in 2014. And some of our members have told us of their trading account victories despite the challenging QE-driven market. And being able to adjust to market environments greatly sharpens oneâs trading ability. Scalper1 News

Scalper1 News