Scalper1 News

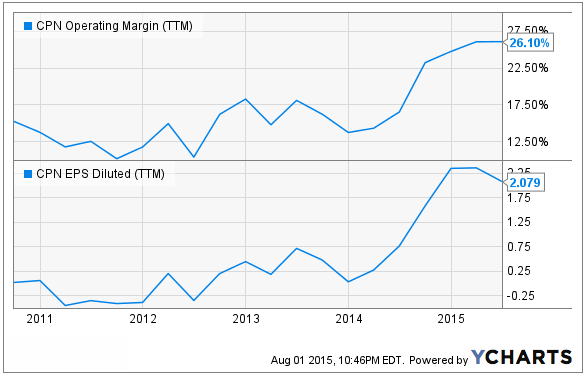

Summary The company is trading at TTM P/E of 8.8x. Environmentally operations mean that the company will face less regulatory issues. Increase in EPS is the result of favorable macro-conditions, increasing the Commodity Margin. In this series I will select a low P/E stock to analyze. I define low P/E as anywhere from 5x to 10x, as any lower and we may be looking at special situations. Calpine Corporation (NYSE: CPN ) is a U.S. power producer. The company primarily operates natural gas-fired and geothermal power plants and sells wholesale energy to corporate customers. Natural gas-fired generators use gas as fuel to power turbines while geothermal powered generators harness energy from hot water below Earth’s surface. At the end of 2014, the company had 88 plants in total. After beating its second quarter earnings, share shot up 10%. But the company is still trading at a TTM P/E ratio of 8.8x, well within our selection criteria. Let’s explore further and see if there may be an opportunity. The Business While the company generates power from renewable sources (geothermal) as well as fossil fuel (natural gas), the two methods share the common characteristic of being environmentally friendly. How geothermal energy is good for the environment is self-explanatory, but it may surprise you that natural gas is actually one of the cleanest fossil fuel options for electricity generation, emissions are virtually zero. Why is this important? In an increasingly stringent regulatory environment, non-environmentally friendly power generating methods (e.g. coal) are facing some tough challenges . This means that Calpine will not face similar legal issues in the future, decreasing the risk for shareholders. Making Sense Of The Numbers As evident by the above chart, revenue has been increasing since FYE 2012. However, this is not attributed to a larger turnover (i.e. electricity generation), as power generated did not vary much from year to year. The company generated 112 MMWh of power in 2012, 102 MMWh in 2013, and 100 MMWh in 2014. As you can see, the amount of power generated actually decreased, yet revenue still went up. This is possible because the price that the company gets per MWh fluctuates. This is called the Commodity Margin and it is impacted by a plethora of factors such as price of natural gas, economic growth, and environmental regulation. In a sense, this risk can be compared to the commodity risk faced by all energy producing companies. For the last couple of years, the company has benefited from favorable macro-factors (e.g. falling natural gas prices) that allowed it to increase its Commodity Margin. What does this mean? This means that earnings can be quite volatile. From the chart below we can see that both the operating margin and the EPS swings wildly from year to year. Conclusion The company does not face imminent challenges from regulators and should be around for a long time, but its financial results do not share the same outlook. The surge in EPS that the company experienced over the past couple of years can be largely attributed to extrinsic factors. This is the risk that you must be willing to bear if you want to invest in a wholesale power company. While favorable macro-environment factors will benefit the company (as they have done so for the past three years), the company cannot generate predictable earnings in the future, meaning that the low P/E ratio today does not necessarily translate to a cheap stock. Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Summary The company is trading at TTM P/E of 8.8x. Environmentally operations mean that the company will face less regulatory issues. Increase in EPS is the result of favorable macro-conditions, increasing the Commodity Margin. In this series I will select a low P/E stock to analyze. I define low P/E as anywhere from 5x to 10x, as any lower and we may be looking at special situations. Calpine Corporation (NYSE: CPN ) is a U.S. power producer. The company primarily operates natural gas-fired and geothermal power plants and sells wholesale energy to corporate customers. Natural gas-fired generators use gas as fuel to power turbines while geothermal powered generators harness energy from hot water below Earth’s surface. At the end of 2014, the company had 88 plants in total. After beating its second quarter earnings, share shot up 10%. But the company is still trading at a TTM P/E ratio of 8.8x, well within our selection criteria. Let’s explore further and see if there may be an opportunity. The Business While the company generates power from renewable sources (geothermal) as well as fossil fuel (natural gas), the two methods share the common characteristic of being environmentally friendly. How geothermal energy is good for the environment is self-explanatory, but it may surprise you that natural gas is actually one of the cleanest fossil fuel options for electricity generation, emissions are virtually zero. Why is this important? In an increasingly stringent regulatory environment, non-environmentally friendly power generating methods (e.g. coal) are facing some tough challenges . This means that Calpine will not face similar legal issues in the future, decreasing the risk for shareholders. Making Sense Of The Numbers As evident by the above chart, revenue has been increasing since FYE 2012. However, this is not attributed to a larger turnover (i.e. electricity generation), as power generated did not vary much from year to year. The company generated 112 MMWh of power in 2012, 102 MMWh in 2013, and 100 MMWh in 2014. As you can see, the amount of power generated actually decreased, yet revenue still went up. This is possible because the price that the company gets per MWh fluctuates. This is called the Commodity Margin and it is impacted by a plethora of factors such as price of natural gas, economic growth, and environmental regulation. In a sense, this risk can be compared to the commodity risk faced by all energy producing companies. For the last couple of years, the company has benefited from favorable macro-factors (e.g. falling natural gas prices) that allowed it to increase its Commodity Margin. What does this mean? This means that earnings can be quite volatile. From the chart below we can see that both the operating margin and the EPS swings wildly from year to year. Conclusion The company does not face imminent challenges from regulators and should be around for a long time, but its financial results do not share the same outlook. The surge in EPS that the company experienced over the past couple of years can be largely attributed to extrinsic factors. This is the risk that you must be willing to bear if you want to invest in a wholesale power company. While favorable macro-environment factors will benefit the company (as they have done so for the past three years), the company cannot generate predictable earnings in the future, meaning that the low P/E ratio today does not necessarily translate to a cheap stock. Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Scalper1 News