Scalper1 News

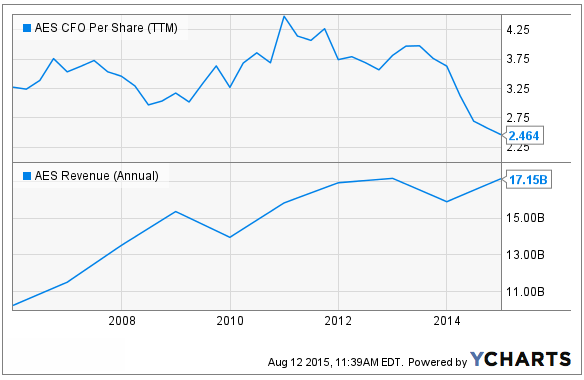

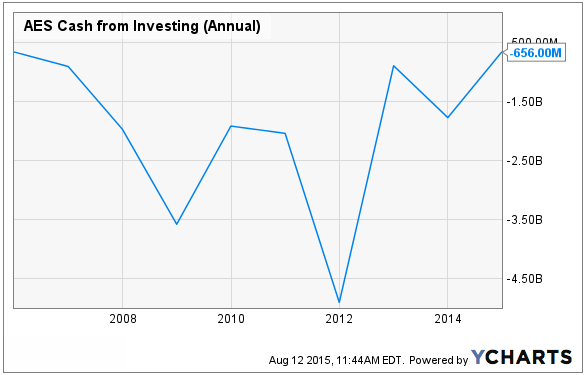

Summary Shares are currently trading at a P/E of 9.7x. Business are very stable due to contracts and low competition. However, the company has a poor record of asset allocation. In this series, I will select a low P/E stock to analyze. I define low P/E as anywhere from 5x to 10x, as any lower and we may be looking at special situations. Read the last edition here ! The AES Corporation (NYSE: AES ) is a diversified utility company whose operation spans across the globe. It has facilities in the U.S., Andes, Brazil, MCAC (Mexico, Central America, and Caribbean), Europe, and Asia. The company generates income from two lines of business, power generation and electricity distribution, this allows the company to capture profits across the value chain. Despite the company’s comprehensive offering, the stock meandered for years, and is currently trading at a TTM P/E of 9.7x. For an established and stable business, this is no doubt a low multiple. So is there a good justification? Stable Businesses The company’s power generation business currently sources from a variety of fuel types. Around 35% of the company’s plants are fueled by gas, 30% by coal, 29% by renewables, and 5% by oil, diesel, or petroleum coke. Evidently, the majority of the electricity is generated from environmentally friendly resources (natural gas and renewables), this is important as the governments around the world are imposing increasingly stringent environmental regulations. The power generation segment also operates on contracts. Although they are not decades long, the company’s average contract term is around 7 years, so they do provide stability in the medium term. The utility business primarily sells electricity directly to consumers (the power generation segment sells to corporate customers or other utility companies). This means that demand is not correlated to the general well-being of the economy, as consumers will use electricity no matter what. In addition, the company’s utility subsidiaries are often the sole distributors in their respective areas. This means that there is very little direct competition and it is unlikely that new entrants would want to compete with an established business that has already invested an enormous amount of capital on infrastructure. This provides a sustainable competitive advantage for the utility business. What I Don’t Like Despite revenue growth, the company has not been able to maintain the same level of profitability. This means that the management has not been keen on picking the right assets to invest in. In the graph above we can visualize the impact (or lack thereof) of growth. Over 10 years, revenue has risen 67% from $10.25 billion in 2005 to $17.15 billion in 2014. However, operating cash flow per share did not grow at all. This means that growth has not delivered any value to shareholders. In the chart below, we can see that the company has spent significant cash on various investments, which corresponds to the revenue growth. Without a corresponding rise in operating cash flow, I believe that the management is incapable of conducting proper asset allocation. Despite having a stable business, this alone makes me believe that the current P/E ratio is justified. Unless we see a management shakeup, I do not think that The AES Corporation would be a good investment. Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Summary Shares are currently trading at a P/E of 9.7x. Business are very stable due to contracts and low competition. However, the company has a poor record of asset allocation. In this series, I will select a low P/E stock to analyze. I define low P/E as anywhere from 5x to 10x, as any lower and we may be looking at special situations. Read the last edition here ! The AES Corporation (NYSE: AES ) is a diversified utility company whose operation spans across the globe. It has facilities in the U.S., Andes, Brazil, MCAC (Mexico, Central America, and Caribbean), Europe, and Asia. The company generates income from two lines of business, power generation and electricity distribution, this allows the company to capture profits across the value chain. Despite the company’s comprehensive offering, the stock meandered for years, and is currently trading at a TTM P/E of 9.7x. For an established and stable business, this is no doubt a low multiple. So is there a good justification? Stable Businesses The company’s power generation business currently sources from a variety of fuel types. Around 35% of the company’s plants are fueled by gas, 30% by coal, 29% by renewables, and 5% by oil, diesel, or petroleum coke. Evidently, the majority of the electricity is generated from environmentally friendly resources (natural gas and renewables), this is important as the governments around the world are imposing increasingly stringent environmental regulations. The power generation segment also operates on contracts. Although they are not decades long, the company’s average contract term is around 7 years, so they do provide stability in the medium term. The utility business primarily sells electricity directly to consumers (the power generation segment sells to corporate customers or other utility companies). This means that demand is not correlated to the general well-being of the economy, as consumers will use electricity no matter what. In addition, the company’s utility subsidiaries are often the sole distributors in their respective areas. This means that there is very little direct competition and it is unlikely that new entrants would want to compete with an established business that has already invested an enormous amount of capital on infrastructure. This provides a sustainable competitive advantage for the utility business. What I Don’t Like Despite revenue growth, the company has not been able to maintain the same level of profitability. This means that the management has not been keen on picking the right assets to invest in. In the graph above we can visualize the impact (or lack thereof) of growth. Over 10 years, revenue has risen 67% from $10.25 billion in 2005 to $17.15 billion in 2014. However, operating cash flow per share did not grow at all. This means that growth has not delivered any value to shareholders. In the chart below, we can see that the company has spent significant cash on various investments, which corresponds to the revenue growth. Without a corresponding rise in operating cash flow, I believe that the management is incapable of conducting proper asset allocation. Despite having a stable business, this alone makes me believe that the current P/E ratio is justified. Unless we see a management shakeup, I do not think that The AES Corporation would be a good investment. Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Scalper1 News