Lindsay Corporation LNN reported fourth-quarter fiscal 2016 (ended Aug 31, 2016) adjusted earnings of 73 cents per share, reversing its prior-year quarter’s loss of 28 cents per share. Earnings also outperformed the Zacks Consensus Estimate of 44 cents. Better-than-expected results were driven by improvement in both irrigation and infrastructure revenues. Shares of Lindsay rose around 11% to close at $ 76.93 on Oct 13.

The irrigation equipment manufacturer reported revenues of $ 133 million, ahead of the Zacks Consensus Estimate of $ 114 million. Revenues increased around 8% to $ 133 million from the year-ago quarter.

U.S. irrigation revenues went up 5% year over year to $ 57.3 million reflecting an increase in irrigation system unit volume with comparable pricing to prior year, along with a modest increase in other irrigation component revenues. International irrigation revenues edged up 1% to $ 42.6 million, including a 2% unfavorable currency impact. Increased sales in certain international project-oriented markets were offset by declines in Brazil and other markets. Total irrigation equipment revenues increased 3% year over year to $ 99.9 million.

Infrastructure revenues improved 24% to $ 33 million owing to higher Road Zipper System sales and higher unit volumes in road safety products.

Operational Update

Cost of operating revenues increased 3% year over year to $ 93 million. Gross profit surged 19% to $ 40 million from $ 33 million in the year-ago quarter. Gross margin was 30.1%, up 300 basis points (bps) from the prior-year quarter, driven by improved margin in the infrastructure segment while irrigation segment margin was consistent with prior year. Strong infrastructure margin resulted from an increase in higher-margin Road Zipper System sales as well as improved product mix and volume leverage from road safety product sales.

Operating expenses went down 9% year over year to $ 28 million in the quarter. The company posted an operating profit of $ 12 million, a substantial improvement from $ 2.8 million in the year-ago quarter. Operating margin stood at 9%, a 680 bps improvement from 2.2% in the prior year quarter.

Lindsay’s backlog as of Aug 31, 2016, was $ 50.7 million compared with $ 48 million as of Aug 31, 2015.

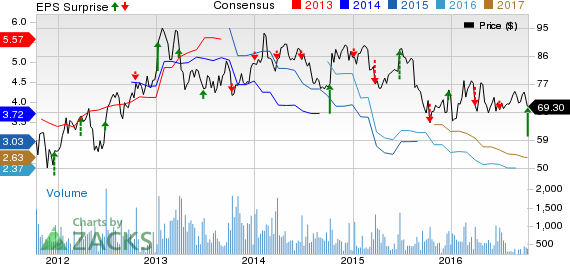

LINDSAY CORP Price, Consensus and EPS Surprise

LINDSAY CORP Price, Consensus and EPS Surprise | LINDSAY CORP Quote

Fiscal 2016 Performance

Lindsay reported earnings per share of $ 1.85 in fiscal 2016, down 17% from $ 2.22 in the prior fiscal and also falling short of the Zacks Consensus Estimate. Revenues were at $ 516 billion, down 8% year over year. Revenues however surpassed the Zacks Consensus Estimate of $ 498 million.

Financial Position

Lindsay had cash and cash equivalents of $ 101 million as of Aug 31, 2016, compared with $ 139 million as of Aug 31, 2015. The company reported cash flow of $ 33 million for fiscal 2016, compared with $ 48.7 million in prior fiscal. Lindsay had long-term debt of $ 117 million at the fiscal 2016 end, flat year over year.

During the fiscal 2016, the company repurchased a total of 688,790 shares for $ 48.3 million. As of Aug 31, 2016, shares worth around $ 63.7 million remained under the company’s buyback program.

Outlook

Even though Lindsay witnessed increase in irrigation revenues in the quarter, the irrigation market remains challenging as lower commodity prices and farm income continue to restrain demand for its irrigation products. On the other hand, activity in the infrastructure market is improving which will benefit its infrastructure business.

Estimated record production for both corn and soybeans from the fall harvest in the U.S. will exert downward pressure on commodity prices. The company thus remains cautious and does not anticipate any meaningful improvement in the overall irrigation market in fiscal 2017. The company meanwhile will continue to manage its cost structure while investing in productivity improvement and selected growth initiatives. Long-term trends remain positive for Lindsay owing to increased agricultural production for the growing population, higher food production, efficient water use and infrastructure upgrades, and expansion.

Lindsay currently carries a Zacks Rank #4 (Sell).

Stocks to Consider

Some better-ranked stocks in the sector include Deere & Company DE , Caterpillar Inc. CAT and AGCO Corporation AGCO . Deere & Company delivered an average positive earnings surprise of 32.16% in the last four quarters. The company carries a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Caterpillar carries Zacks Rank #2 (Buy) and has also delivered an average positive earnings surprise of 5.20% in the past four quarters. AGCO Corporation, another Zacks Rank #2 stock has an average positive earnings surprise of 62.51% in the past four quarters.

Confidential from Zacks

Beyond this Analyst Blog, would you like to see Zacks’ best recommendations that are not available to the public? Our Executive VP, Steve Reitmeister, knows when key trades are about to be triggered and which of our experts has the hottest hand. Click to see them now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

CATERPILLAR INC (CAT): Free Stock Analysis Report

DEERE & CO (DE): Free Stock Analysis Report

AGCO CORP (AGCO): Free Stock Analysis Report

LINDSAY CORP (LNN): Free Stock Analysis Report

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Plantations International