Shares of The Kroger Co. KR touched a 52-week low of $ 29.25 yesterday, before closing trade a notch higher at $ 29.28. The stock has lost nearly 29% year to date. Let’s delve deeper to find out what’s leading to this bearish run.

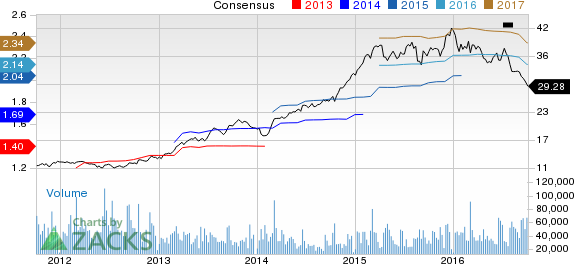

KROGER CO Price and Consensus

KROGER CO Price and Consensus | KROGER CO Quote

What’s Hurting Kroger?

A deflationary environment and cautious consumer spending are making things tough for Kroger. Also, higher debt-to-capitalization ratio remains a cause of concern.

Kroger ended second-quarter fiscal 2016 with a total debt of $ 12,420 million, reflecting a high debt-to-capitalization ratio of approximately 65%. This could adversely affect the company’s credit worthiness and make it more susceptible to the macro-economic factors as well as competitive pressure.

Recently, the company posted second-quarter fiscal 2016 results, wherein its adjusted earnings surpassed the Zacks Consensus Estimate, but total sales missed the same for the sixth straight quarter, despite registering a year-over-year increase of 4%.

All these factors compelled management to trim its fiscal 2016 earnings projection. Kroger now expects adjusted earnings in the band of $ 2.10−$ 2.20 per share, down from a range of $ 2.19−$ 2.28 anticipated earlier.

Consequently, the Zacks Consensus Estimate witnessed a downtrend. Over the past 30 days, the consensus Estimate of $ 2.14 and $ 2.34 for fiscal 2016 and fiscal 2017, has declined 7 cents and 8 cents, respectively.

Additionally, Kroger, which holds a Zacks Rank #4 (Sell), faces intense competition from big players like Safeway and Supervalu, other conventional retailers and specialty gourmet retailers. The competition relates to price, aggressive store expansion and promotional activities to drive traffic, which may dent the company’s sales and margins.

Though we think the company is well positioned to deliver higher earnings, primarily through strong identical supermarket sales growth, based on the aforementioned factors, it is evident that Kroger is no longer a favored pick, at least for the short term. Hence, investors may shift their focus to some better-ranked stocks.

Stocks to Consider

Some stocks that warrant a look include Fresh Del Monte Produce Inc. FDP , Omega Protein Corporation OME and US Foods Holding Corp. USFD .

Fresh Del Monte is currently hovering close to its 52-week high of $ 60.85 and sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here .

US Foods, a Zacks Rank #1 stock, has a long-term earnings growth rate of 18.6%.

Omega Protein, which carries a Zacks Rank #2 (Buy), has a long-term earnings growth rate of 8%.

Confidential from Zacks

Beyond this Analyst Blog, would you like to see Zacks’ best recommendations that are not available to the public? Our Executive VP, Steve Reitmeister, knows when key trades are about to be triggered and which of our experts has the hottest hand. Click to see them now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

FRESH DEL MONTE (FDP): Free Stock Analysis Report

OMEGA PROTEIN (OME): Free Stock Analysis Report

KROGER CO (KR): Free Stock Analysis Report

US FOODS HLDG (USFD): Free Stock Analysis Report

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Plantations International