Scalper1 News

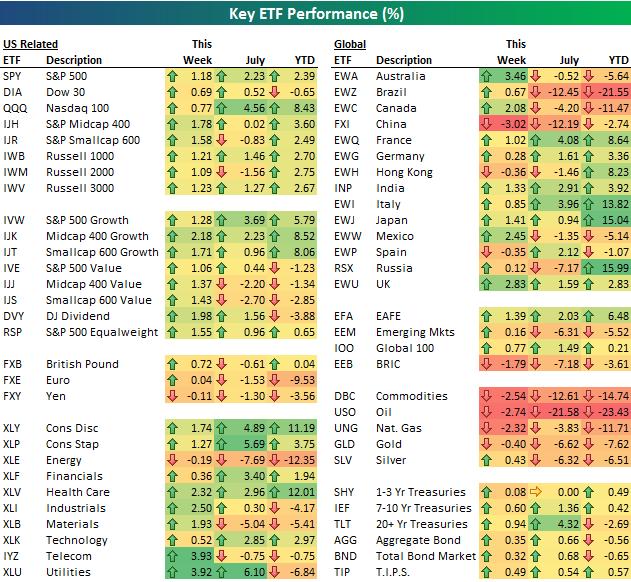

July is now complete, and the S&P 500 SPY ETF finished the month up 2.23%. Below is a look at the performance of all asset classes during the month of July using key ETFs traded on US exchanges. While the SPY ETF was up 2.23% in July, the Nasdaq 100 (NASDAQ: QQQ ) doubled that with a gain of 4.56%. The Dow 30 (NYSEARCA: DIA ), however, was up just 0.52% during the month. And small-caps actually fell. The Russell 2,000 (NYSEARCA: IWM ) fell 1.56%, while the S&P 600 (NYSEARCA: IJR ) fell 0.83%. Mid-caps (NYSEARCA: IJH ) ended the month flat. Looking at sectors, we saw a wide range of performance, with Consumer Discretionary (NYSEARCA: XLY ), Consumer Staples (NYSEARCA: XLP ) and Utilities (NYSEARCA: XLU ) gaining 5%+, and Energy (NYSEARCA: XLE ) and Materials (NYSEARCA: XLB ) falling 5%+. Outside of the U.S., Brazil (NYSEARCA: EWZ ) and China (NYSEARCA: FXI ) both got slaughtered in July with declines of 12%. But the rest of the world did relatively well, with France (NYSEARCA: EWQ ), Germany (NYSEARCA: EWG ), India (NYSEARCA: INP ) and Italy (NYSEARCA: EWI ) all posting decent gains. Along with Brazilian and Chinese equities, commodity ETFs also got smoked. The DBC commodities ETF fell 12.6%, while oil (NYSEARCA: USO ) fell more than 20%. Both gold (NYSEARCA: GLD ) and silver (NYSEARCA: SLV ) fell 6%. Brutal action for the commodities asset class. Finally, Treasuries rallied back in July, with the 20+ Year Treasury ETF (NYSEARCA: TLT ) posting a 4% gain. For the year, though, TLT remains down 2%. Share this article with a colleague Scalper1 News

July is now complete, and the S&P 500 SPY ETF finished the month up 2.23%. Below is a look at the performance of all asset classes during the month of July using key ETFs traded on US exchanges. While the SPY ETF was up 2.23% in July, the Nasdaq 100 (NASDAQ: QQQ ) doubled that with a gain of 4.56%. The Dow 30 (NYSEARCA: DIA ), however, was up just 0.52% during the month. And small-caps actually fell. The Russell 2,000 (NYSEARCA: IWM ) fell 1.56%, while the S&P 600 (NYSEARCA: IJR ) fell 0.83%. Mid-caps (NYSEARCA: IJH ) ended the month flat. Looking at sectors, we saw a wide range of performance, with Consumer Discretionary (NYSEARCA: XLY ), Consumer Staples (NYSEARCA: XLP ) and Utilities (NYSEARCA: XLU ) gaining 5%+, and Energy (NYSEARCA: XLE ) and Materials (NYSEARCA: XLB ) falling 5%+. Outside of the U.S., Brazil (NYSEARCA: EWZ ) and China (NYSEARCA: FXI ) both got slaughtered in July with declines of 12%. But the rest of the world did relatively well, with France (NYSEARCA: EWQ ), Germany (NYSEARCA: EWG ), India (NYSEARCA: INP ) and Italy (NYSEARCA: EWI ) all posting decent gains. Along with Brazilian and Chinese equities, commodity ETFs also got smoked. The DBC commodities ETF fell 12.6%, while oil (NYSEARCA: USO ) fell more than 20%. Both gold (NYSEARCA: GLD ) and silver (NYSEARCA: SLV ) fell 6%. Brutal action for the commodities asset class. Finally, Treasuries rallied back in July, with the 20+ Year Treasury ETF (NYSEARCA: TLT ) posting a 4% gain. For the year, though, TLT remains down 2%. Share this article with a colleague Scalper1 News

Scalper1 News