Scalper1 News

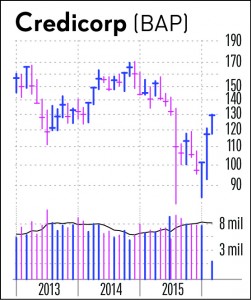

Are there any signs that emerging market economies are less sick now? One clue may be found in the positive stock market action seen in certain overseas banks. IBD ranks 197 industry groups every day in terms of six-month relative price performance (see the entire table in Monday’s paper on Page B15). Today, few finance-related groups rank in the top 40, but the foreign banks group has cracked the top 30, coming in at No. 29 vs. 47th three weeks ago and vs. 90th six weeks ago. Helping drive this progress are six stocks with an IBD Composite Rating of 85 or higher; five of these six are at 95 or better. Four are based in South America: Peru’s Credicorp ( BAP ) and three Argentine lenders, BBVA Banco Frances ( BFR ), Banco Macro ( BMA ) and Galicia ( GGAL ), which has gotten frequent coverage in IBD’s Global Leaders column lately. Rounding out the six are India’s HDFC Bank ( HDB ) and Brazil’s Banco Santander ( BSBR ). Meanwhile, major U.S. lenders are struggling in the stock market. JPMorgan Chase ( JPM ) is down nearly 10% since Jan. 1, and Wells Fargo ( WFC ) is down 8%. A bet on banks is by most accounts a wager on the overall health of an economy. That seems to be the case in Peru. In January, the country’s Finance Minister Alonso Segura told Bloomberg News in Davos that he expects economic growth to rev up to 4% this year after likely expanding 2.9% to 3% in 2015. Amid these positive numbers, the country’s central bank on Feb. 11 decided to raise interest rates. It hiked the reference rate by 25 basis points to 4.25%, marking the fourth raise in six months. Yet Angela Bouzanis, senior economist at FocusEconomics, noted that Peru’s central bank sees “GDP growth performing close to its potential in 2016.” Reflecting that view, the economic analysis firm’s “LatinFocus Consensus Forecast” sees the reference rate at 4.36% by the end of the year. A steady rise in interest rates is generally good news for large commercial banks, allowing them to boost net interest margins without killing off growth in loans. Credicorp conducts commercial and consumer lending through offices spread across not only Peru, but also Bolivia and Panama. Insurance, pension fund administration and investment banking also make up a portion of the $4.8 billion in revenue recorded in 2015. Since 2007, the bank’s earnings per share have risen every year except in 2013 and have also nearly tripled over that span (from $4.40 in 2007 to $12.03 in 2015). Wall Street sees 2016 profit up 2%. The stock sports a 95 Composite Rating, buttressed by strong revenue growth in five of the past six years, a 20% return on equity last year, and net interest margin of 5.7% in 2014. Shares crossed back above their 200-day moving average, a sign of renewed demand. Now just 19% below its 52-week peak of 157.89, the stock has the potential to form a base and break out. BBVA Banco Frances and Bancro Macro are both up for the year amid optimism that new Argentine President Mauricio Macri will carry out meaningful pro-business reforms. However, the former is expected to see falling EPS in 2016 (-24%) and 2017 (-12%). The latter should see a 17% drop in 2016 EPS to $6.94, followed by a 19% rebound in 2017 to $8.24. Scalper1 News

Are there any signs that emerging market economies are less sick now? One clue may be found in the positive stock market action seen in certain overseas banks. IBD ranks 197 industry groups every day in terms of six-month relative price performance (see the entire table in Monday’s paper on Page B15). Today, few finance-related groups rank in the top 40, but the foreign banks group has cracked the top 30, coming in at No. 29 vs. 47th three weeks ago and vs. 90th six weeks ago. Helping drive this progress are six stocks with an IBD Composite Rating of 85 or higher; five of these six are at 95 or better. Four are based in South America: Peru’s Credicorp ( BAP ) and three Argentine lenders, BBVA Banco Frances ( BFR ), Banco Macro ( BMA ) and Galicia ( GGAL ), which has gotten frequent coverage in IBD’s Global Leaders column lately. Rounding out the six are India’s HDFC Bank ( HDB ) and Brazil’s Banco Santander ( BSBR ). Meanwhile, major U.S. lenders are struggling in the stock market. JPMorgan Chase ( JPM ) is down nearly 10% since Jan. 1, and Wells Fargo ( WFC ) is down 8%. A bet on banks is by most accounts a wager on the overall health of an economy. That seems to be the case in Peru. In January, the country’s Finance Minister Alonso Segura told Bloomberg News in Davos that he expects economic growth to rev up to 4% this year after likely expanding 2.9% to 3% in 2015. Amid these positive numbers, the country’s central bank on Feb. 11 decided to raise interest rates. It hiked the reference rate by 25 basis points to 4.25%, marking the fourth raise in six months. Yet Angela Bouzanis, senior economist at FocusEconomics, noted that Peru’s central bank sees “GDP growth performing close to its potential in 2016.” Reflecting that view, the economic analysis firm’s “LatinFocus Consensus Forecast” sees the reference rate at 4.36% by the end of the year. A steady rise in interest rates is generally good news for large commercial banks, allowing them to boost net interest margins without killing off growth in loans. Credicorp conducts commercial and consumer lending through offices spread across not only Peru, but also Bolivia and Panama. Insurance, pension fund administration and investment banking also make up a portion of the $4.8 billion in revenue recorded in 2015. Since 2007, the bank’s earnings per share have risen every year except in 2013 and have also nearly tripled over that span (from $4.40 in 2007 to $12.03 in 2015). Wall Street sees 2016 profit up 2%. The stock sports a 95 Composite Rating, buttressed by strong revenue growth in five of the past six years, a 20% return on equity last year, and net interest margin of 5.7% in 2014. Shares crossed back above their 200-day moving average, a sign of renewed demand. Now just 19% below its 52-week peak of 157.89, the stock has the potential to form a base and break out. BBVA Banco Frances and Bancro Macro are both up for the year amid optimism that new Argentine President Mauricio Macri will carry out meaningful pro-business reforms. However, the former is expected to see falling EPS in 2016 (-24%) and 2017 (-12%). The latter should see a 17% drop in 2016 EPS to $6.94, followed by a 19% rebound in 2017 to $8.24. Scalper1 News

Scalper1 News