Scalper1 News

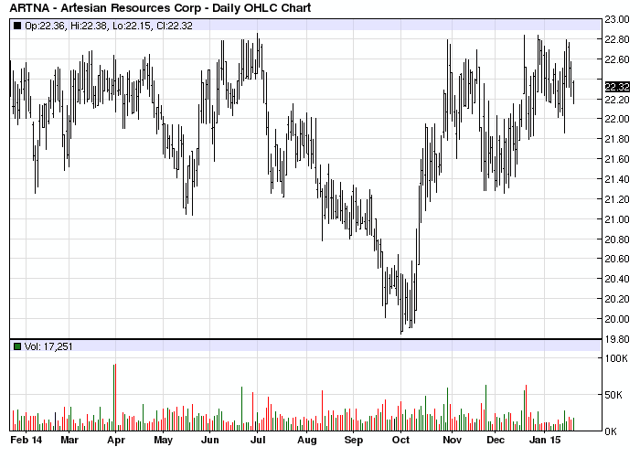

Water shortages in North America are becoming more acute. Infrastructure costs are becoming increasing large for municipal governments. Artesian Resources is positioned to garner increasing revenues from local governments. We had briefly touched on Artesian Resources Corp (NASDAQ: ARTNA ) on our website recently and wanted to revisit it with a bit more ‘meat on the bone.’ When you think about regulated utility companies in North America you likely think of the local electric company or natural gas company–the ones we write checks to year around, but as investors we need to cast the net a bit further. Throughout the United States and Canada our water and sewer service comes from municipal systems in over 70% of households. Another 15% of us have our own well (like all 10 houses in our subdivision have their own well), while 11% are served by investor utilities. About the same percentages hold true for sewage systems. All of us North Americans understand that water is becoming an increasingly valuable resource and this is truer and truer everyday. Whether it be irrigating crops or fracking oil wells the need for water simply continues to grow. Similarly, the need to treat sewage in a way that allows the liquid and solid waste to be disposed of in a way that doesn’t harm the environment is taxing our infrastructure which is old and inefficient. Local municipalities are stressed financially trying to maintain their water and sewage plant and equipment, yet both state and federal regulations simply continue to pile on in a way that demands a huge amount of capital to address water safety and environmental concerns. Thinking about this one has to believe there is a huge potential long term opportunity in investor owned companies that can help address the water and sewer issues of the nation. Certainly many investors have followed these companies for a very long time and maybe owned shares, but given the modest level of dividends paid by most of the water utility companies they had not really hit our radar screen. Only by attempting to discern where we would find the safety we desired coupled with the dividends and long term potential for capital gains did we start to dig deeper around the water arena. Artesian Resources Corp is primarily operating in Delaware, but with operations in Pennsylvania and Maryland. They have been providing water services (and now sewer) to the area for over 100 years–so they certainly have the experience necessary to be successful. Recently they have acquired a couple additional local water systems and are shopping for more–there goal is to be aggressive. We think they have the background that will allow them to move strongly forward. Artesian Resources Corp is a rather small company (we prefer companies that are smaller for some reason) with revenue that is likely to hit $72 or $73 million in the year that just ended (December 31). From this the company will garner around $10 million in net income–around $1.10-$1.15 per share. Additionally, if we look at free cash flow we can add back another $9 million in depreciation–giving relatively huge cash flow of around $2/share. From this they will pay out around 85 cents/share in dividends (a current yield of 3.82%). This is a reasonable payout ratio of about 40-45% leaving a good deal of cash for re-investment–and believe me there will be no shortage of projects vying for the capital. Now as we look at some of the most recent financial history of the company we are impressed by a near 30% year over year income gain last quarter and a 10% gain for the 9 month period. These were attained with revenue growth of just 8% and 4% respectively. Looking at dividends the company has raised them twice a year for the last 5 years. We definitely like these rising payouts even if they are just around 3-4% a year. One must remember that this is mainly a regulated utility – not a high tech supercharged company. As a utility they have plenty of debt (have you ever known a utility to have little debt?), but they are borrowing at reasonable interest rates and their ability to refi this debt when it comes due should be no issue. The share price has remained relatively stable over the last year–in fact essentially flat. As a conservative income investor we would like to a stable fair dividend and the opportunity for future capital gains (not a guarantee of that gain–just the opportunity). Here is how the shares have performed in the last year. (click to enlarge) Now for a few negatives. First off the company has 2 classes of common stock–and the class that you and I own is Non-Voting . Insiders own all of the voting stock, thus you have to have good faith in the management as you have no say in the operations and management of the company. In principle we dislike this with a passion, but on the other hand we buy preferred stocks all the time and we have no problem with having no vote in the company so I guess we can live with it with Artesian. secondly the company recently lost a lawsuit in which they disputed some contract terms and will need to anty up $3 million to settle the claims. Fortunately, the company accrued the bills as they received them so the payment should not affect their income statement although it will cause a ding on the balance sheet. With the above in mind we have personally purchased a small personal position in these shares (as well as in our most recent Model portfolio) Our belief is that this should be bought with a 5 year invest commitment. The company website is here . For those wanting the ‘unvarnished’ financials here is the latest SEC filed 10Q. Scalper1 News

Water shortages in North America are becoming more acute. Infrastructure costs are becoming increasing large for municipal governments. Artesian Resources is positioned to garner increasing revenues from local governments. We had briefly touched on Artesian Resources Corp (NASDAQ: ARTNA ) on our website recently and wanted to revisit it with a bit more ‘meat on the bone.’ When you think about regulated utility companies in North America you likely think of the local electric company or natural gas company–the ones we write checks to year around, but as investors we need to cast the net a bit further. Throughout the United States and Canada our water and sewer service comes from municipal systems in over 70% of households. Another 15% of us have our own well (like all 10 houses in our subdivision have their own well), while 11% are served by investor utilities. About the same percentages hold true for sewage systems. All of us North Americans understand that water is becoming an increasingly valuable resource and this is truer and truer everyday. Whether it be irrigating crops or fracking oil wells the need for water simply continues to grow. Similarly, the need to treat sewage in a way that allows the liquid and solid waste to be disposed of in a way that doesn’t harm the environment is taxing our infrastructure which is old and inefficient. Local municipalities are stressed financially trying to maintain their water and sewage plant and equipment, yet both state and federal regulations simply continue to pile on in a way that demands a huge amount of capital to address water safety and environmental concerns. Thinking about this one has to believe there is a huge potential long term opportunity in investor owned companies that can help address the water and sewer issues of the nation. Certainly many investors have followed these companies for a very long time and maybe owned shares, but given the modest level of dividends paid by most of the water utility companies they had not really hit our radar screen. Only by attempting to discern where we would find the safety we desired coupled with the dividends and long term potential for capital gains did we start to dig deeper around the water arena. Artesian Resources Corp is primarily operating in Delaware, but with operations in Pennsylvania and Maryland. They have been providing water services (and now sewer) to the area for over 100 years–so they certainly have the experience necessary to be successful. Recently they have acquired a couple additional local water systems and are shopping for more–there goal is to be aggressive. We think they have the background that will allow them to move strongly forward. Artesian Resources Corp is a rather small company (we prefer companies that are smaller for some reason) with revenue that is likely to hit $72 or $73 million in the year that just ended (December 31). From this the company will garner around $10 million in net income–around $1.10-$1.15 per share. Additionally, if we look at free cash flow we can add back another $9 million in depreciation–giving relatively huge cash flow of around $2/share. From this they will pay out around 85 cents/share in dividends (a current yield of 3.82%). This is a reasonable payout ratio of about 40-45% leaving a good deal of cash for re-investment–and believe me there will be no shortage of projects vying for the capital. Now as we look at some of the most recent financial history of the company we are impressed by a near 30% year over year income gain last quarter and a 10% gain for the 9 month period. These were attained with revenue growth of just 8% and 4% respectively. Looking at dividends the company has raised them twice a year for the last 5 years. We definitely like these rising payouts even if they are just around 3-4% a year. One must remember that this is mainly a regulated utility – not a high tech supercharged company. As a utility they have plenty of debt (have you ever known a utility to have little debt?), but they are borrowing at reasonable interest rates and their ability to refi this debt when it comes due should be no issue. The share price has remained relatively stable over the last year–in fact essentially flat. As a conservative income investor we would like to a stable fair dividend and the opportunity for future capital gains (not a guarantee of that gain–just the opportunity). Here is how the shares have performed in the last year. (click to enlarge) Now for a few negatives. First off the company has 2 classes of common stock–and the class that you and I own is Non-Voting . Insiders own all of the voting stock, thus you have to have good faith in the management as you have no say in the operations and management of the company. In principle we dislike this with a passion, but on the other hand we buy preferred stocks all the time and we have no problem with having no vote in the company so I guess we can live with it with Artesian. secondly the company recently lost a lawsuit in which they disputed some contract terms and will need to anty up $3 million to settle the claims. Fortunately, the company accrued the bills as they received them so the payment should not affect their income statement although it will cause a ding on the balance sheet. With the above in mind we have personally purchased a small personal position in these shares (as well as in our most recent Model portfolio) Our belief is that this should be bought with a 5 year invest commitment. The company website is here . For those wanting the ‘unvarnished’ financials here is the latest SEC filed 10Q. Scalper1 News

Scalper1 News