Scalper1 News

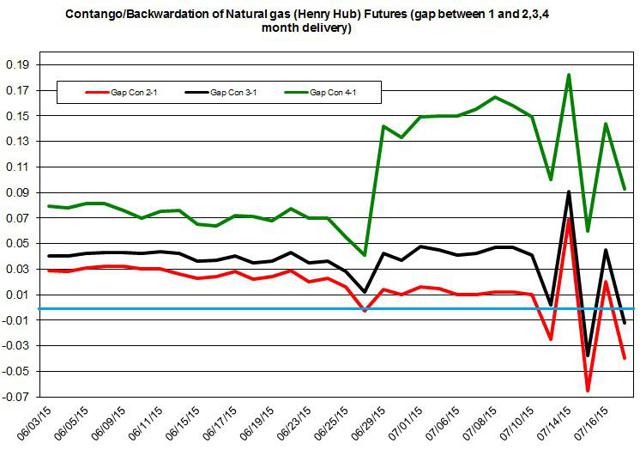

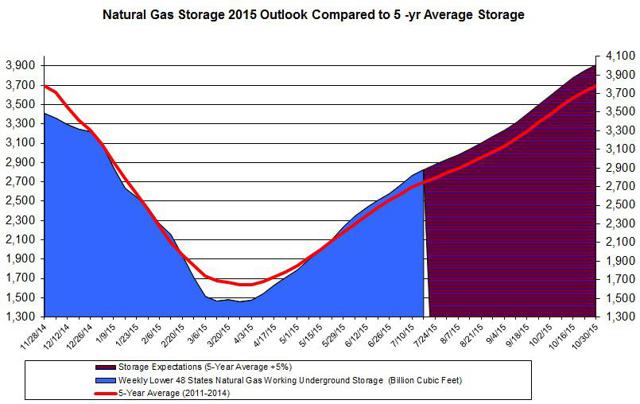

The natural gas market remains soft despite the rise in demand for the commodity in the power sector. The Backwardation continues to keep UNG below the price of natural gas. The storage is expected to further rise at a faster than normal pace, which could keep down UNG. Despite the ongoing weakness in the energy market, the United States Natural Gas (NYSEARCA: UNG ) remained relatively flat in the past month at around the $13 mark. The price of the Henry Hub is still in the $2.7-$2.8 range and has yet to show any signs of recovery. Even the hotter than normal temperatures that is driving up the demand for natural gas in the electric power sector hasn’t pulled up the price of UNG. When it comes to the latest developments in the futures markets, the Contango for the four-month delivery has started to pick up, as you can see in the chart below. (click to enlarge) Source of data taken from EIA Nonetheless, the near-term futures are still, for the most part, in Backwardation. This finding suggests the Backwardation in the futures markets, for now, will keep UNG underperforming the price of the Henry Hub: During the past couple of months, UNG rose by only 3.7%; the Henry Hub rose by 5%. It could take a while before we see UNG rising again to pass the $15 mark. One factor that could move the price of UNG is the levels of storage. As of last week, the storage rose by only 61 Bcf – this was 9 Bcf lower than market expectations . The demand for natural gas grew in the power sector, which reduced the injections to storage. And the supply slipped by 0.9% mostly due to lower production – a drop of 1%, week over week. The production is still up for the year by 4%, but this growth rate is lower than in previous months. Perhaps the low rig count has started to impede the progress in the production of natural gas. Based on the latest Baker Hughes report, the number of rigs fell to 216. Despite the lower growth rate in production and falling number of rigs, the Energy Information Administration still projects the natural gas output will rise by 5.7% this year and 2% in 2016. Furthermore, according to the recent Energy Information Administration monthly update, the storage is expected to rise at a faster than normal pace and bring the storage to 3,919 Bcf by the end of October – the expected end of the injection season. This storage level will be 3.2% higher than the 5-year average. Based on this outlook, the EIA estimates the injections to storage will remain, on average, 5% higher than the 5-year average. (click to enlarge) Source of data taken from EIA and Author’s calculations For the next few weeks, the injections to storage are expected to be only slightly higher than normal, in part, due to the rise in demand in the power sector. The weather is expected to be much warmer than normal throughout the South and West Coast, but colder than normal in the Northeast and Midwest. The potential rise in demand in the electric sector is also supported by the projected higher than normal cooling degree days : They are estimated to be 23 degrees higher than normal this week. The rise in demand in the power sector hasn’t been enough to pull up the price of UNG so far this year. The production has started to slow down, which could help tighten the natural gas market. But if the weather keeps heating up, production eases down, and injections to storage remain stable, these factors could start to slowly push back up the price of UNG. Nonetheless, UNG is still likely to remain at its low level in the near term. For more see: Natural Gas is Still Floating… Barely . Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Scalper1 News

The natural gas market remains soft despite the rise in demand for the commodity in the power sector. The Backwardation continues to keep UNG below the price of natural gas. The storage is expected to further rise at a faster than normal pace, which could keep down UNG. Despite the ongoing weakness in the energy market, the United States Natural Gas (NYSEARCA: UNG ) remained relatively flat in the past month at around the $13 mark. The price of the Henry Hub is still in the $2.7-$2.8 range and has yet to show any signs of recovery. Even the hotter than normal temperatures that is driving up the demand for natural gas in the electric power sector hasn’t pulled up the price of UNG. When it comes to the latest developments in the futures markets, the Contango for the four-month delivery has started to pick up, as you can see in the chart below. (click to enlarge) Source of data taken from EIA Nonetheless, the near-term futures are still, for the most part, in Backwardation. This finding suggests the Backwardation in the futures markets, for now, will keep UNG underperforming the price of the Henry Hub: During the past couple of months, UNG rose by only 3.7%; the Henry Hub rose by 5%. It could take a while before we see UNG rising again to pass the $15 mark. One factor that could move the price of UNG is the levels of storage. As of last week, the storage rose by only 61 Bcf – this was 9 Bcf lower than market expectations . The demand for natural gas grew in the power sector, which reduced the injections to storage. And the supply slipped by 0.9% mostly due to lower production – a drop of 1%, week over week. The production is still up for the year by 4%, but this growth rate is lower than in previous months. Perhaps the low rig count has started to impede the progress in the production of natural gas. Based on the latest Baker Hughes report, the number of rigs fell to 216. Despite the lower growth rate in production and falling number of rigs, the Energy Information Administration still projects the natural gas output will rise by 5.7% this year and 2% in 2016. Furthermore, according to the recent Energy Information Administration monthly update, the storage is expected to rise at a faster than normal pace and bring the storage to 3,919 Bcf by the end of October – the expected end of the injection season. This storage level will be 3.2% higher than the 5-year average. Based on this outlook, the EIA estimates the injections to storage will remain, on average, 5% higher than the 5-year average. (click to enlarge) Source of data taken from EIA and Author’s calculations For the next few weeks, the injections to storage are expected to be only slightly higher than normal, in part, due to the rise in demand in the power sector. The weather is expected to be much warmer than normal throughout the South and West Coast, but colder than normal in the Northeast and Midwest. The potential rise in demand in the electric sector is also supported by the projected higher than normal cooling degree days : They are estimated to be 23 degrees higher than normal this week. The rise in demand in the power sector hasn’t been enough to pull up the price of UNG so far this year. The production has started to slow down, which could help tighten the natural gas market. But if the weather keeps heating up, production eases down, and injections to storage remain stable, these factors could start to slowly push back up the price of UNG. Nonetheless, UNG is still likely to remain at its low level in the near term. For more see: Natural Gas is Still Floating… Barely . Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Scalper1 News