< div id =" articleText" legibility=" 145.53419483101" > As the leading N. American potash developer, PotashCorp has a whole lot riding on a recovery in crop nutrient prices. Picture resource: PotashCorp. The descending spiral from potash pricing simply escalated as Belarusian Potash Co. (BPC) declared this had actually signed an agreement along with India where this will offer 700,000 tonnes of the vegetation nutrient at only $ 227 per tonne, a rate a 3rd lesser compared to exactly what was actually realized final year, as well as its lowest rate in a decade.

While China, as the world’s largest individual from the plant food element, possesses yet to sign a buy delivery in 2016 (as well as now perhaps won’t), there doesn’t seem a let-up visible for the dropping rates. Unless, that is, the cartels from Belaruskali and Uralkali join forces again, which only may take place.

Burning your home down

The fertilizer market has actually been in shambles since 2013, when BPC, which, at the moment, comprised from Belaruskali and its own Russian counterpart, split considering that Uralkali desired to offer all from the potash this made on the free market in an offer to acquire market reveal. Recently, the cartel, which all together had actually managed some 43% from the worldwide potash market, kept several of its own manufacturing if you want to maintain rates elevated. The split up as well as subsequential flooding from the market along with brand new potash supply resulted in costs to head to in to a tailspin.

Where producers had been getting $ 400 every tonne before the failure, prices immediately fell to $ 305 each tonne, as well as along with the market place still experiencing a supply glut, professionals anticipate they only may dropped to $ 200 per tonne– or perhaps lower.

N. American potash manufacturers, besides, have actually all been actually disclosing drastically lesser costs in comparison to exactly what they were actually earlier obtaining. PotashCorp (NYSE: CONTAINER) stated in April that its understood cost was merely $ 178 per tonne on a worldwide manner, 37% listed below the cost this had actually discovered in the year-ago period, while Variety (NYSE: MOS) claimed it averaged selling prices from $ 207 per tonne. Agrium (NYSE: AGU) reported that acquired $ 199 each tonne.

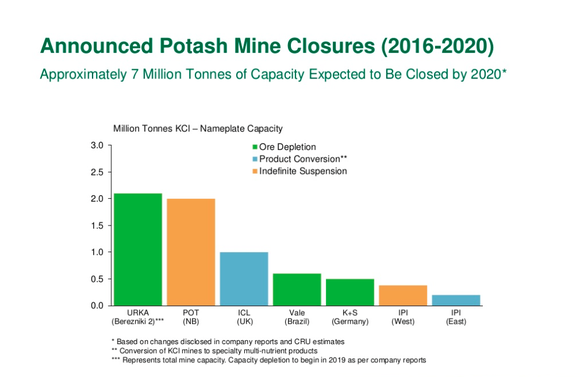

< img class=" articleImgLg "alt=" Display Shot" src=" https://www.scalper1.com/wp-content/uploads/2016/07/screen-shot-2016-07-01-at-12009-pm_large.png "/ > The potash source surplus is compeling miners to take capability from the market. Photo resource: PotashCorp expert presentation.

While India’s deal relatively establishes one thing from a flooring for potash in a lot of markets, China is still the straw that stirs the drink. Given that its supplies are high and also it’s still obtaining supply on a month-to-month manner off Russia, this’s under no stress to sign a contract, and this surely will not carry out therefore at such a high limit. If costs dropped to $ 200 or even reduced, as well as remain there for a sustained time frame, PotashCorp’s reward < a href=http:// “

http://www.fool.com/investing/2016/06/11/why-now-is-not-the-time-to-buy-potashcorp-agrium-o.aspx?&utm_campaign=article&utm_medium=feed&utm_source=nasdaq” rel =” nofollow “> can be endangered. This is why the possibility for the corporate trust’s reawakening resulted in potash manufacturer stocks to hop when the probability turned into social.

Prolonging an olive division

Belorussian President Alexander Lukashenko appeared a conciliatory tone along with Uralkali just recently, stating its own rivalrous investors had been actually relating to him to claim they preferred a homecoming of the business. He claimed he had not been resisted to the suggestion, though he carried out mention any type of revival would certainly must be on his phrases.

That is actually why potash investors could certainly not wish to get their hopes up expensive. The very same concerns that resulted in the breakup nearly 3 years earlier are certainly not probably to be actually settled in purchase for both ahead back together.

For example, Reuters disclosed the previous base from BPC remained in Minsk, the Belorussian financing, a location that bothered Uralkali, but the Belarusian Telegraph Agency quoted Lukashenko as claiming, “We will certainly not relocate Belarusian Potash Business.”

In BPC’s latest deal negotiations with India, Uralkali had not been satisfied along with the cost its own rival agreed on. Russian information firm Interfax mentioned a Uralkali speaker as calling the $ 227 per tonne rate too low, and also stating his firm had not been prepared to sign a contract along with India. No question Uralkali hasn’t forgotten that its CEO was actually restrained briefly in Belarus complying with the cartel’s breaking up.

Although real estate investors might really hope the corporate trust would certainly get back all together to assist maintain costs, the various other side from that piece is that higher fertilizer expenses will definitely also bring about greater crop prices, raising meals expenses for everyone. Because of this, this does not look like the remedy that will certainly aid PotashCorp, Agrium, or even Mosaic– neither will definitely it carry out everything for consumers over the long condition, either.

A secret billion-dollar stock option

The country’s largest technology company overlooked to reveal you one thing, but a handful of Wall Road analysts and also the Blockhead really did not skip a beat: There is actually a tiny business that’s powering their brand-new gadgets and also the coming transformation in innovation. As well as our company presume its own supply cost has virtually endless room to operate for early, in-the-know entrepreneurs! To become among them, < a href

do not always exhibit those of Nasdaq, Inc. < a rel =" nofollow" href =" http://articlefeeds.nasdaq.com/~r/nasdaq/symbols/~3/5qHE5g237qY/is-this-what-finally-saves-potashcorp-agrium-and-mosaic-cm644356" > Most current Contents Plantations International