Scalper1 News

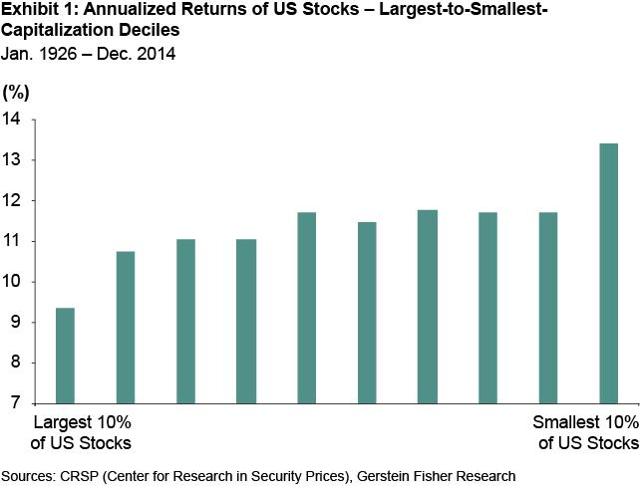

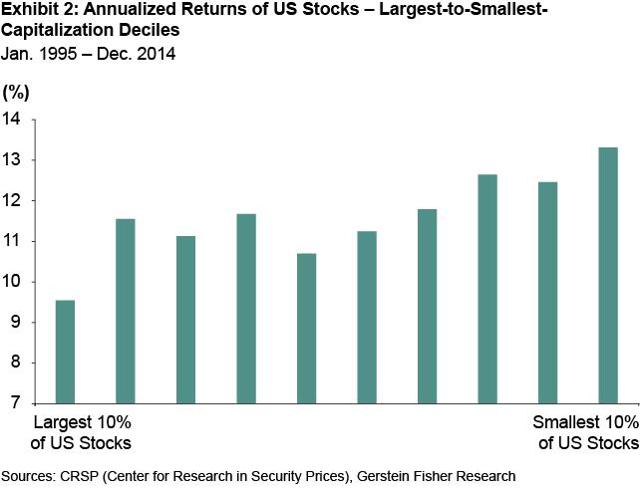

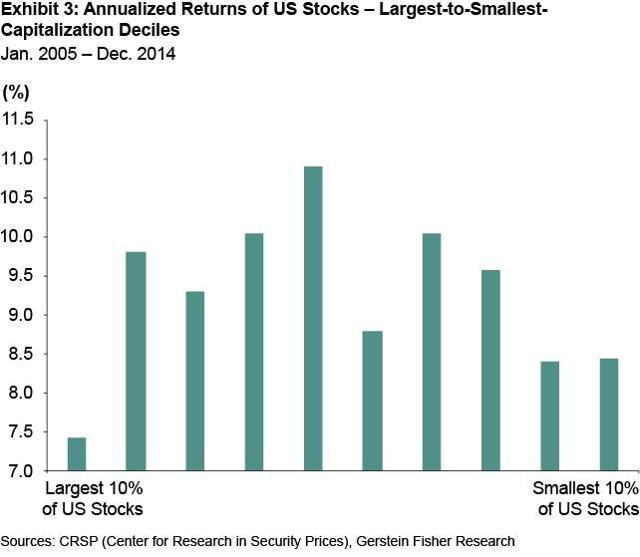

Summary The small cap size premium has shrunk from a 5% annualized return to 1% since Rolf Banz published a landmark paper demonstrating small stocks’ return premium in 1981. The shrinking of the small-cap premium can be explained by several reasons and is not unique in the investment world. A multi-factor investment strategy suggests keeping small-cap stocks, as several factor premiums, including momentum, asset growth and profitability, tend to be stronger among small-cap stocks. Small cap stocks are in a bit of a slump. For example, from January 1, 2014 to July 31, 2015, the Russell 2000 Index of small-company stocks returned just 8.6%, less than half of the 17.4% return of the Russell 1000 Index of large companies. Some market commentators ask whether the small cap premium (the historical phenomenon of small caps tending to outperform large caps) has disappeared; a number of academics even question whether the small cap premium ever existed. For a review of the continuing academic debate on this subject, I invite you to read our recently posted paper, ” Sizing Up the Size Premium .” In this article, I will discuss how we as investment practitioners who construct multi-asset class portfolios think about the small cap premium. The Small Cap Premium First, here’s some history. In 1981, Rolf Banz published a paper on the “small stock effect,” which demonstrated a return premium for small stocks over their larger counterparts.* For instance, from 1961-1980, the size premium earned an annualized return of 5%, which is very attractive. Exhibit 1 below, which divides the market into deciles, illustrates the historical returns from 1926 to 2014 of each market decile. Note the highly significant relationship between firm size and return, where smaller-cap stocks have earned higher returns. (click to enlarge) But since Banz published his paper, a funny thing has happened: the small-cap size premium has shrunk dramatically, from 5% to 1%. In Exhibit 2, which depicts a recent 20-year time period, the smallest decile of stocks is still the best performer, but this chart is much “noisier” than Exhibit 1, which is statistically what one might expect when examining a shorter time period in which data can be more idiosyncratic. Now look at Exhibit 3. Here we see that, during a recent 10-year period, the smallest-cap stocks significantly outperformed only the very largest stocks during the decade. (click to enlarge) (click to enlarge) How do we, as investment managers, explain and address the apparent shrinking of the size premium? I find it fascinating that a nearly identical phenomenon has occurred with value stocks-since Fama and French published their landmark paper on the value premium in 1992, that premium has also shrunk from 5% during the 1972-1991 period of study to just 1%, since 1991. In other words, it seems quite possible that once research on factor premiums (such as size and value) is out there in public, the investment world catches on and whittles away the premium. Since we have tilted portfolios to value and small caps for more than 20 years, I suppose we should plead guilty to aiding and abetting the shrinking premiums! The Case for Small Caps Despite the apparently declining size premium, we do not abandon small cap stocks for a number of reasons. For one thing, we think there is a strong underlying economic argument for why small companies should generate higher returns (though with higher volatility). Small firms do not have the same access to capital as large companies and typically have a higher cost of capital, thus requiring a higher rate of return. When we evaluate investment strategies, we consider economic and financial logic as well as study past patterns of returns. Note, also, that not all small caps are created equal. For instance, over time small-cap value stocks have dramatically outperformed small-cap growth ones (14.86% annualized vs. 8.81% from July 1, 1926 to June 30, 2015, according to Center for Research in Security Prices data), which appears to endorse a tilt to value. In addition, the small-cap growth “style box” has historically been a weak performer, but our research demonstrates that, by stripping out the “growthiest” stocks in this category, an investor will be much happier with returns (see ” Returns on Small Cap Growth Stocks, or Lack Thereof: What Risk Factor Exposures Can Tell Us “). Insights such as these are ones that we employ in building portfolios and, indeed, in constructing our own factor-based investment strategies. To this point, I should add that small cap’s dry spell (recall the 10-year cycle of Exhibit 3) is a good example of why we embrace multi-factor investing rather than single-factor investing (for a quick tutorial on our investing style, see ” What is a Multi-Factor Investment Approach? “). Different factors move in different cycles of different duration, which provides diversification. And importantly, several factor premiums (including momentum, asset growth and profitability) tend to be stronger among small-cap stocks, which is yet another reason why we continue to like investing in smaller companies despite the eroding premium. Conclusion The size premium, while weaker than in the past, is generally still positive. Even with a modest small cap premium, we still believe there is a benefit in holding small cap stocks as a distinct tilt in an equity strategy and as an important component of a multi-factor investment strategy. * Banz, Rolf W. “The Relationship Between Market Value and Return of Common Stocks,” Journal of Financial Economics, November 1981. Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Summary The small cap size premium has shrunk from a 5% annualized return to 1% since Rolf Banz published a landmark paper demonstrating small stocks’ return premium in 1981. The shrinking of the small-cap premium can be explained by several reasons and is not unique in the investment world. A multi-factor investment strategy suggests keeping small-cap stocks, as several factor premiums, including momentum, asset growth and profitability, tend to be stronger among small-cap stocks. Small cap stocks are in a bit of a slump. For example, from January 1, 2014 to July 31, 2015, the Russell 2000 Index of small-company stocks returned just 8.6%, less than half of the 17.4% return of the Russell 1000 Index of large companies. Some market commentators ask whether the small cap premium (the historical phenomenon of small caps tending to outperform large caps) has disappeared; a number of academics even question whether the small cap premium ever existed. For a review of the continuing academic debate on this subject, I invite you to read our recently posted paper, ” Sizing Up the Size Premium .” In this article, I will discuss how we as investment practitioners who construct multi-asset class portfolios think about the small cap premium. The Small Cap Premium First, here’s some history. In 1981, Rolf Banz published a paper on the “small stock effect,” which demonstrated a return premium for small stocks over their larger counterparts.* For instance, from 1961-1980, the size premium earned an annualized return of 5%, which is very attractive. Exhibit 1 below, which divides the market into deciles, illustrates the historical returns from 1926 to 2014 of each market decile. Note the highly significant relationship between firm size and return, where smaller-cap stocks have earned higher returns. (click to enlarge) But since Banz published his paper, a funny thing has happened: the small-cap size premium has shrunk dramatically, from 5% to 1%. In Exhibit 2, which depicts a recent 20-year time period, the smallest decile of stocks is still the best performer, but this chart is much “noisier” than Exhibit 1, which is statistically what one might expect when examining a shorter time period in which data can be more idiosyncratic. Now look at Exhibit 3. Here we see that, during a recent 10-year period, the smallest-cap stocks significantly outperformed only the very largest stocks during the decade. (click to enlarge) (click to enlarge) How do we, as investment managers, explain and address the apparent shrinking of the size premium? I find it fascinating that a nearly identical phenomenon has occurred with value stocks-since Fama and French published their landmark paper on the value premium in 1992, that premium has also shrunk from 5% during the 1972-1991 period of study to just 1%, since 1991. In other words, it seems quite possible that once research on factor premiums (such as size and value) is out there in public, the investment world catches on and whittles away the premium. Since we have tilted portfolios to value and small caps for more than 20 years, I suppose we should plead guilty to aiding and abetting the shrinking premiums! The Case for Small Caps Despite the apparently declining size premium, we do not abandon small cap stocks for a number of reasons. For one thing, we think there is a strong underlying economic argument for why small companies should generate higher returns (though with higher volatility). Small firms do not have the same access to capital as large companies and typically have a higher cost of capital, thus requiring a higher rate of return. When we evaluate investment strategies, we consider economic and financial logic as well as study past patterns of returns. Note, also, that not all small caps are created equal. For instance, over time small-cap value stocks have dramatically outperformed small-cap growth ones (14.86% annualized vs. 8.81% from July 1, 1926 to June 30, 2015, according to Center for Research in Security Prices data), which appears to endorse a tilt to value. In addition, the small-cap growth “style box” has historically been a weak performer, but our research demonstrates that, by stripping out the “growthiest” stocks in this category, an investor will be much happier with returns (see ” Returns on Small Cap Growth Stocks, or Lack Thereof: What Risk Factor Exposures Can Tell Us “). Insights such as these are ones that we employ in building portfolios and, indeed, in constructing our own factor-based investment strategies. To this point, I should add that small cap’s dry spell (recall the 10-year cycle of Exhibit 3) is a good example of why we embrace multi-factor investing rather than single-factor investing (for a quick tutorial on our investing style, see ” What is a Multi-Factor Investment Approach? “). Different factors move in different cycles of different duration, which provides diversification. And importantly, several factor premiums (including momentum, asset growth and profitability) tend to be stronger among small-cap stocks, which is yet another reason why we continue to like investing in smaller companies despite the eroding premium. Conclusion The size premium, while weaker than in the past, is generally still positive. Even with a modest small cap premium, we still believe there is a benefit in holding small cap stocks as a distinct tilt in an equity strategy and as an important component of a multi-factor investment strategy. * Banz, Rolf W. “The Relationship Between Market Value and Return of Common Stocks,” Journal of Financial Economics, November 1981. Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Scalper1 News