Scalper1 News

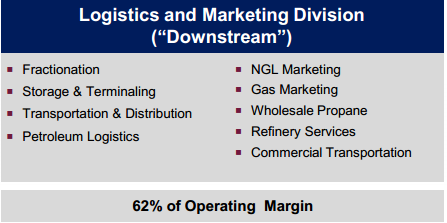

Summary In the current low energy price environment, strong companies are looking for assets or companies they can take over on the cheap. Targa Resources Corp. is the general partner of a quality MLP that has suffered with lower energy commodity prices. TRGP is down 35% even as dividend increased 6% every quarter. Several large cap energy midstream companies could start a bidding war for TRGP. A 30% premium on the current share price is not out of the question. The steep declines in the energy commodity prices have led to speculation about mergers or acquisitions in the sector. I primarily follow the MLP and related companies, and so far in 2015, acquisition activity has been light. Vanguard Natural Resources LLC (NASDAQ: VNR ) has agreed to acquire a couple of smaller upstream MLPs and Enterprise Product Partners LP (NYSE: EPD ) just announced a $2.1 billion private deal acquisition of gathering and processing assets. Outside of these I can’t think of any meaningful purchases. I think that Targa Resources Corp. (NYSE: TRGP ) could be ripe for a take over offer from an energy midstream company looking to add quality assets and a historically successful midstream operation. Targa Overview Targa Resources Corp. owns the general partner interest and 9.1% of the LP units of Targa Resources Partners LP (NYSE: NGLS ) a $7.9 billion market cap midstream MLP. NGLS generates about 40% of its operating margin from gathering services in Texas and Oklahoma and the balance comes from logistics and marketing, which includes the following services: Targa Resources Corp. has used the GP incentives growth model to produce a high level of dividend growth compared to the NGLS distribution growth rate. If you are not familiar with the GP growth potential, I covered how the partnership system works in this article . Over the last three years the TRGP dividend has increased 27% up to 35% year over year every quarter. This growth in the TRGP dividend was fueled by high single digit distribution growth at the MLP level. Targa Resource Partners has aggressively developed and acquired midstream assets. The company has invested over $2 billion in organic capex since 2012, bringing $1 billion worth of projects online in each of the last two years. In addition, over $8 billion in acquisitions have closed over the last three years. In February Targa Resources closed its acquisition of Atlas Pipeline Partners, LP and Atlas Energy, LP. Commodity Price Declines Slow DCF Growth In the current slower drilling and lower energy price environment, Targa Resources Partners most recent guidance is for 4% to 7% distribution growth in 2015 with 1.0 times distributable cash flow coverage. In 2014 the NGLS distribution grew by 8% on 1.5 times DCF coverage. The Targa Resources Corp dividend guidance for 2015 is 25% growth, compared to 27% growth in 2014. The market has noticed the significant drop in DCF coverage at the MLP level, pushing down the NGLS and TRGP share prices by 30% and 35% respectively since last September. In 2015, the TRGP share price has cycled a couple of times between about $90 and $107. In the last 6 weeks the price has dropped from the $107 cycle peak to currently trade around $90. Reasons for the decline seem to be around falling energy commodity prices and the failure of TRGP to announce some sort of MLP roll up plan similar to the recent Kinder Morgan Inc. (NYSE: KMI ) and Williams Companies (NYSE: WMB ) moves. See: Income Power Couple: Stacking Kinder Morgan Against Williams Companies The steep share price decline has pushed the TRGP yield up to 3.6%, well above the low 2% yield the company carried last year and the 2% to 2.5% rate the market current puts on 25% high visibility dividend growth. It seems that the market does not believe that this year’s growth guidance will be met and prospects have slowed for Targa Resource Partners in the longer term. Potential Acquirers In spite of the current downturn in values, the Targa Resources companies have a high quality book of assets and operations. The company’s gathering assets are in the heart of the Permian basin and the processing, storage and export assets are in prime locations on the Gulf Coast. To acquire these assets would be a boost to one of several large cap midstream companies. If a company buys up TRGP as the general partner, the MLP is then controlled, to be merged with other assets or left as a stand alone partnership. Here are a couple of large cap MLPs that would benefit from the acquisition of Targa Resources Corp and have the resources to make a $6 billion or higher bid for the company. Enterprise Product Partners : With its $60 billion market cap, EPD needs to make meaningful acquisitions to move the needle. The Targa assets would dovetail in nicely with the Enterprise holdings. EPD made a similar acquisition last year by first buying the privately held Oiltanking GP interests and then later making an offer for the publicly traded Oiltanking LP units. Williams Companies likes to view itself as one of the major natural gas infrastructure players. Acquiring Targa would be similar to last year’s absorption of Access Midstream Partners. Williams first picked up all of the Access GP ownership and then merged the MLP into Williams Partners. Energy Transfer Equity LP (NYSE: ETE ) : The Energy Transfer group has been a more of build by acquisition set of businesses. Last year they made a run at Targa, but nothing came of it. I would not surprise me if Energy Transfer made another offer for the company. If one of the listed companies made an offer for TRGP, it would not be a surprise to see a bidding war break out. An offer of $120 per share might be enough to obtain the company. Disclosure: The author is long TRGP, KMI, WMB. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Summary In the current low energy price environment, strong companies are looking for assets or companies they can take over on the cheap. Targa Resources Corp. is the general partner of a quality MLP that has suffered with lower energy commodity prices. TRGP is down 35% even as dividend increased 6% every quarter. Several large cap energy midstream companies could start a bidding war for TRGP. A 30% premium on the current share price is not out of the question. The steep declines in the energy commodity prices have led to speculation about mergers or acquisitions in the sector. I primarily follow the MLP and related companies, and so far in 2015, acquisition activity has been light. Vanguard Natural Resources LLC (NASDAQ: VNR ) has agreed to acquire a couple of smaller upstream MLPs and Enterprise Product Partners LP (NYSE: EPD ) just announced a $2.1 billion private deal acquisition of gathering and processing assets. Outside of these I can’t think of any meaningful purchases. I think that Targa Resources Corp. (NYSE: TRGP ) could be ripe for a take over offer from an energy midstream company looking to add quality assets and a historically successful midstream operation. Targa Overview Targa Resources Corp. owns the general partner interest and 9.1% of the LP units of Targa Resources Partners LP (NYSE: NGLS ) a $7.9 billion market cap midstream MLP. NGLS generates about 40% of its operating margin from gathering services in Texas and Oklahoma and the balance comes from logistics and marketing, which includes the following services: Targa Resources Corp. has used the GP incentives growth model to produce a high level of dividend growth compared to the NGLS distribution growth rate. If you are not familiar with the GP growth potential, I covered how the partnership system works in this article . Over the last three years the TRGP dividend has increased 27% up to 35% year over year every quarter. This growth in the TRGP dividend was fueled by high single digit distribution growth at the MLP level. Targa Resource Partners has aggressively developed and acquired midstream assets. The company has invested over $2 billion in organic capex since 2012, bringing $1 billion worth of projects online in each of the last two years. In addition, over $8 billion in acquisitions have closed over the last three years. In February Targa Resources closed its acquisition of Atlas Pipeline Partners, LP and Atlas Energy, LP. Commodity Price Declines Slow DCF Growth In the current slower drilling and lower energy price environment, Targa Resources Partners most recent guidance is for 4% to 7% distribution growth in 2015 with 1.0 times distributable cash flow coverage. In 2014 the NGLS distribution grew by 8% on 1.5 times DCF coverage. The Targa Resources Corp dividend guidance for 2015 is 25% growth, compared to 27% growth in 2014. The market has noticed the significant drop in DCF coverage at the MLP level, pushing down the NGLS and TRGP share prices by 30% and 35% respectively since last September. In 2015, the TRGP share price has cycled a couple of times between about $90 and $107. In the last 6 weeks the price has dropped from the $107 cycle peak to currently trade around $90. Reasons for the decline seem to be around falling energy commodity prices and the failure of TRGP to announce some sort of MLP roll up plan similar to the recent Kinder Morgan Inc. (NYSE: KMI ) and Williams Companies (NYSE: WMB ) moves. See: Income Power Couple: Stacking Kinder Morgan Against Williams Companies The steep share price decline has pushed the TRGP yield up to 3.6%, well above the low 2% yield the company carried last year and the 2% to 2.5% rate the market current puts on 25% high visibility dividend growth. It seems that the market does not believe that this year’s growth guidance will be met and prospects have slowed for Targa Resource Partners in the longer term. Potential Acquirers In spite of the current downturn in values, the Targa Resources companies have a high quality book of assets and operations. The company’s gathering assets are in the heart of the Permian basin and the processing, storage and export assets are in prime locations on the Gulf Coast. To acquire these assets would be a boost to one of several large cap midstream companies. If a company buys up TRGP as the general partner, the MLP is then controlled, to be merged with other assets or left as a stand alone partnership. Here are a couple of large cap MLPs that would benefit from the acquisition of Targa Resources Corp and have the resources to make a $6 billion or higher bid for the company. Enterprise Product Partners : With its $60 billion market cap, EPD needs to make meaningful acquisitions to move the needle. The Targa assets would dovetail in nicely with the Enterprise holdings. EPD made a similar acquisition last year by first buying the privately held Oiltanking GP interests and then later making an offer for the publicly traded Oiltanking LP units. Williams Companies likes to view itself as one of the major natural gas infrastructure players. Acquiring Targa would be similar to last year’s absorption of Access Midstream Partners. Williams first picked up all of the Access GP ownership and then merged the MLP into Williams Partners. Energy Transfer Equity LP (NYSE: ETE ) : The Energy Transfer group has been a more of build by acquisition set of businesses. Last year they made a run at Targa, but nothing came of it. I would not surprise me if Energy Transfer made another offer for the company. If one of the listed companies made an offer for TRGP, it would not be a surprise to see a bidding war break out. An offer of $120 per share might be enough to obtain the company. Disclosure: The author is long TRGP, KMI, WMB. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Scalper1 News