Scalper1 News

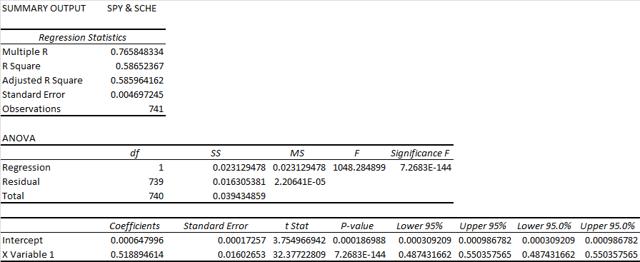

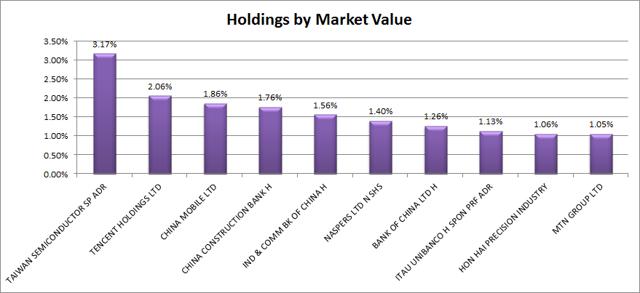

Summary I’m taking a look at SCHE as a candidate for inclusion in my ETF portfolio. The risk level is very high SCHE is the only ETF in the portfolio. I’m finding exposure over 5% to be too dangerous. The ETF has a solid dividend yield and extremely diversified holdings, but still needs to be combined with other ETFs. I’m not assessing any tax impacts. Investors should check their own situation for tax exposure. Investors should be seeking to improve their risk adjusted returns. I’m a big fan of using ETFs to achieve the risk adjusted returns relative to the portfolios that a normal investor can generate for themselves after trading costs. I’m working on building a new portfolio and I’m going to be analyzing several of the ETFs that I am considering for my personal portfolio. One of the funds that I’m considering is the Schwab Emerging Markets ETF (NYSEARCA: SCHE ). I’ll be performing a substantial portion of my analysis along the lines of modern portfolio theory, so my goal is to find ways to minimize costs while achieving diversification to reduce my risk level. What does SCHE do? SCHE attempts to track the total return of FTSE Emerging Index. The ETF falls under the category of “Diversified Emerging Markets”. Funds within this category usually invest at least 50% of their assets in developing nations. For SCHE specifically, the fund aims to invest at least 90% of the assets in stocks within the Emerging Index. The ETF is interested in large and middle cap companies. It is designed to avoid excessive exposure to individual industries. Does SCHE provide diversification benefits to a portfolio? Each investor may hold a different portfolio, but I use (NYSEARCA: SPY ) as the basis for my analysis. I believe SPY, or another large cap U.S. fund with similar properties, represents the reasonable first step for many investors designing an ETF portfolio. Therefore, I start my diversification analysis by seeing how it works with SPY. I start with an ANOVA table: (click to enlarge) The correlation is about 58.6%, which is extremely low for an equity investment. This low correlation bodes very well for the ETF when we start looking at risk adjusted returns. Standard deviation of daily returns (dividend adjusted, measured since January 2012) The standard deviation is bad. There’s no need to sugar coat it. The period I’m using has had relatively low volatility which causes most investments to show lower values for standard deviation. For the period I’ve chosen, the standard deviation of daily returns was 1.0774%. For SPY, it was 0.7300% over the same period. This makes SCHE one of the most volatile ETFs I have examined. Mixing it with SPY I also run comparison on the standard deviation of daily returns for the portfolio assuming that the portfolio is combined with the S&P 500. For research, I assume daily rebalancing because it dramatically simplifies the math. With a 50/50 weighting in a portfolio holding only SPY and SCHE, the standard deviation of daily returns across the entire portfolio is 0.8512%. However, in my opinion, putting 50% of a portfolio in emerging markets is speculative and resembles gambling more than investing. If the position in SPY is raised to 80% while SCHE is used at 20% the standard deviation of daily returns drops down to 0.7617%. In my opinion, the proper exposure here needs to be fairly low. Remember that as a portfolio becomes more diversified the variance of returns depends more on covariance among the assets rather than their individual variance. With 95% in SPY and 5% in SCHE the portfolio has a variance of 0.7356%. I think this is the highest exposure I would consider. Why I use standard deviation of daily returns I don’t believe historical returns have predictive power for future returns, but I do believe historical values for standard deviations of returns relative to other ETFs have some predictive power on future risks and correlations. Yield & Taxes The distribution yield is 2.44%. The SEC 30 day yield is 2.64%. Those yields aren’t bad and make this ETF look attractive as part of a dividend portfolio. However, the ETF invests in foreign securities and I’m not a CPA or CFP. Investors concerned about tax consequences should seek advice from someone knowledgeable about their tax situation. Expense Ratio The ETF is posting .14% for an expense ratio. This is low relative to many ETFs, though I prefer to see equity REITs with expense ratios under .10%. Market to NAV The ETF is trading at a .29% premium to NAV currently. That’s high enough to be a slight disincentive to investing, but not huge. This value can change very abruptly so investors should check it before placing an order. By the time this is published, that value will probably different. Largest Holdings The diversification within the ETF is good, as shown by the following chart: (click to enlarge) Only one position is over 2% and by the 6th company exposures are under 1.50%. That’s fairly solid diversification. If an investor is choosing to use ETFs, I would expect their goal to be the diversification benefits and low expense ratios. SCHE passes both of those tests. Investing in the ETF is largely relying on modern portfolio theory. The argument for the investment is the very low correlation of the portfolio to the major U.S. index funds. Making an investment requires a belief that markets are at least somewhat efficient so that the companies within the portfolio will be reasonably priced. Conclusion I’m currently screening a large volume of ETFs for my own portfolio. The portfolio I’m building is through Schwab, so I’m able to trade SCHE with no commissions. I have a strong preference for researching ETFs that are free to trade in my account, so most of my research will be on ETFs that fall under the “ETF OneSource” program. In my opinion, SCHE looks like a possible candidate for inclusion because of the low expense ratios and low correlation but the standard deviation of returns on the individual ETF were so high I am questioning whether I will stick to the 5% exposure I had initially planned or if I will lower it even farther. If I have to lower the exposure to something like 1%, it is hardly worth including because it is one more investment to track. For investors planning on investing more than $100,000 through ETFs the appeal of a 1% position increases. When I start compiling more complex portfolios, I will include SCHE in my tests. It’s a little on the risky side, but as long the position is 5% or less I think it will work. Scalper1 News

Summary I’m taking a look at SCHE as a candidate for inclusion in my ETF portfolio. The risk level is very high SCHE is the only ETF in the portfolio. I’m finding exposure over 5% to be too dangerous. The ETF has a solid dividend yield and extremely diversified holdings, but still needs to be combined with other ETFs. I’m not assessing any tax impacts. Investors should check their own situation for tax exposure. Investors should be seeking to improve their risk adjusted returns. I’m a big fan of using ETFs to achieve the risk adjusted returns relative to the portfolios that a normal investor can generate for themselves after trading costs. I’m working on building a new portfolio and I’m going to be analyzing several of the ETFs that I am considering for my personal portfolio. One of the funds that I’m considering is the Schwab Emerging Markets ETF (NYSEARCA: SCHE ). I’ll be performing a substantial portion of my analysis along the lines of modern portfolio theory, so my goal is to find ways to minimize costs while achieving diversification to reduce my risk level. What does SCHE do? SCHE attempts to track the total return of FTSE Emerging Index. The ETF falls under the category of “Diversified Emerging Markets”. Funds within this category usually invest at least 50% of their assets in developing nations. For SCHE specifically, the fund aims to invest at least 90% of the assets in stocks within the Emerging Index. The ETF is interested in large and middle cap companies. It is designed to avoid excessive exposure to individual industries. Does SCHE provide diversification benefits to a portfolio? Each investor may hold a different portfolio, but I use (NYSEARCA: SPY ) as the basis for my analysis. I believe SPY, or another large cap U.S. fund with similar properties, represents the reasonable first step for many investors designing an ETF portfolio. Therefore, I start my diversification analysis by seeing how it works with SPY. I start with an ANOVA table: (click to enlarge) The correlation is about 58.6%, which is extremely low for an equity investment. This low correlation bodes very well for the ETF when we start looking at risk adjusted returns. Standard deviation of daily returns (dividend adjusted, measured since January 2012) The standard deviation is bad. There’s no need to sugar coat it. The period I’m using has had relatively low volatility which causes most investments to show lower values for standard deviation. For the period I’ve chosen, the standard deviation of daily returns was 1.0774%. For SPY, it was 0.7300% over the same period. This makes SCHE one of the most volatile ETFs I have examined. Mixing it with SPY I also run comparison on the standard deviation of daily returns for the portfolio assuming that the portfolio is combined with the S&P 500. For research, I assume daily rebalancing because it dramatically simplifies the math. With a 50/50 weighting in a portfolio holding only SPY and SCHE, the standard deviation of daily returns across the entire portfolio is 0.8512%. However, in my opinion, putting 50% of a portfolio in emerging markets is speculative and resembles gambling more than investing. If the position in SPY is raised to 80% while SCHE is used at 20% the standard deviation of daily returns drops down to 0.7617%. In my opinion, the proper exposure here needs to be fairly low. Remember that as a portfolio becomes more diversified the variance of returns depends more on covariance among the assets rather than their individual variance. With 95% in SPY and 5% in SCHE the portfolio has a variance of 0.7356%. I think this is the highest exposure I would consider. Why I use standard deviation of daily returns I don’t believe historical returns have predictive power for future returns, but I do believe historical values for standard deviations of returns relative to other ETFs have some predictive power on future risks and correlations. Yield & Taxes The distribution yield is 2.44%. The SEC 30 day yield is 2.64%. Those yields aren’t bad and make this ETF look attractive as part of a dividend portfolio. However, the ETF invests in foreign securities and I’m not a CPA or CFP. Investors concerned about tax consequences should seek advice from someone knowledgeable about their tax situation. Expense Ratio The ETF is posting .14% for an expense ratio. This is low relative to many ETFs, though I prefer to see equity REITs with expense ratios under .10%. Market to NAV The ETF is trading at a .29% premium to NAV currently. That’s high enough to be a slight disincentive to investing, but not huge. This value can change very abruptly so investors should check it before placing an order. By the time this is published, that value will probably different. Largest Holdings The diversification within the ETF is good, as shown by the following chart: (click to enlarge) Only one position is over 2% and by the 6th company exposures are under 1.50%. That’s fairly solid diversification. If an investor is choosing to use ETFs, I would expect their goal to be the diversification benefits and low expense ratios. SCHE passes both of those tests. Investing in the ETF is largely relying on modern portfolio theory. The argument for the investment is the very low correlation of the portfolio to the major U.S. index funds. Making an investment requires a belief that markets are at least somewhat efficient so that the companies within the portfolio will be reasonably priced. Conclusion I’m currently screening a large volume of ETFs for my own portfolio. The portfolio I’m building is through Schwab, so I’m able to trade SCHE with no commissions. I have a strong preference for researching ETFs that are free to trade in my account, so most of my research will be on ETFs that fall under the “ETF OneSource” program. In my opinion, SCHE looks like a possible candidate for inclusion because of the low expense ratios and low correlation but the standard deviation of returns on the individual ETF were so high I am questioning whether I will stick to the 5% exposure I had initially planned or if I will lower it even farther. If I have to lower the exposure to something like 1%, it is hardly worth including because it is one more investment to track. For investors planning on investing more than $100,000 through ETFs the appeal of a 1% position increases. When I start compiling more complex portfolios, I will include SCHE in my tests. It’s a little on the risky side, but as long the position is 5% or less I think it will work. Scalper1 News

Scalper1 News