Scalper1 News

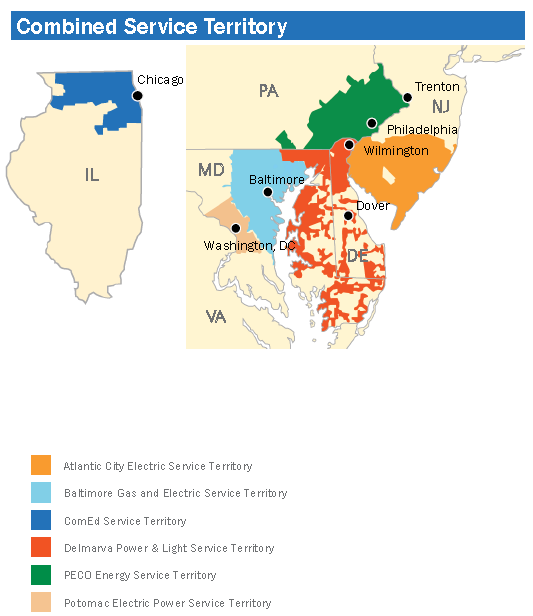

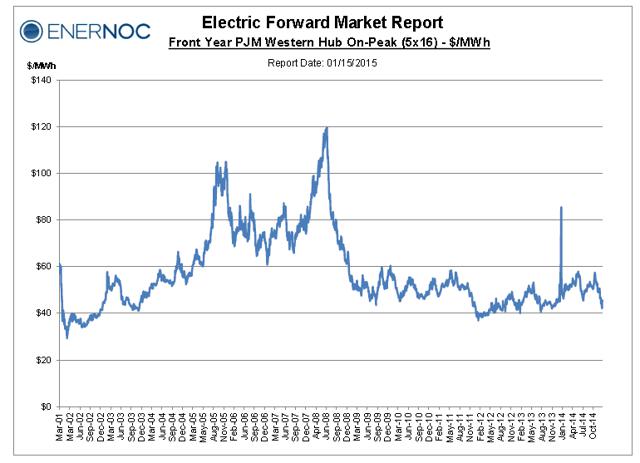

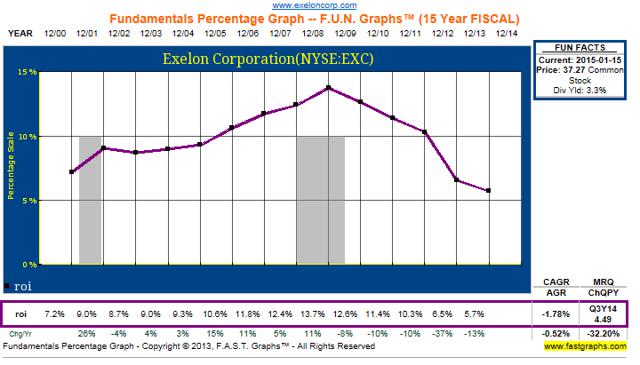

While returning 41.9% total return over the previous 12 months, EXC has a bit more juice in its gas tank. Fundamental business changes have reduced earnings volatility. Gains in profitability are dependent on improving power markets. PJM is so afraid of a lack of generating capacity it has proposed a premium for reliability. While Exelon (NYSE: EXC ) had generated total returns of 41.9% over the previous 12 months, vs 21.2% for the Morningstar Diversified Utilities Index and 11.6% for the S&P 500, there may still be a bit of juice left in its gas tank. However, just do not look at 1-year and 3-year returns as it may make you sick at a puny 1.6% and an even worse -1.2%, vs. 12.6% and 10.5%, respectively, for Diversified Utilities and 18.4% and 14.2%, respectively, for the S&P. Driving EXC higher will be fundamental business strategy changes that is expected to increase earnings from $2.40 in 2014 to $2.51 in 2015 and $2.66 in 2016. The changes include the transformation from 20% regulated revenue (Exelon Utilities segment) and 80% unregulated revenue from merchant power (Exelon Generation segment) in 2008 to around 61% regulated and 39% merchant power by the end of 2017. Profitability in its regulated utility segment should improve over the next few years. Illinois enacted an annual rate evaluation in 2011 that is being phased in and should improve the profit uncertainty of Exelon subsidiary ComEd. 2014 ROE for ComEd is estimated at 8% to 9% vs a target of 9.0% (30-yr Treasury + 5.8%). PECO’s 2014 ROE is expected to be 11% to 12% vs a target of 10% and BGE’s 2014 ROE is expected to be 7% to 8% vs a target also of 10%. ComEd has annual rate reviews using the above formula. PECO is looking for a rate increase to be filed either this year or next and BGE anticipates requesting a rate increase this year and will be its first since 1999. In addition to the above ROE, EXC’s regulated rate base is expected to expand over the next few years. For example, ComEd is expected to grow its rate base from $9.6 billion in 2014 to $12.6 billion in 2017. PECO will increase its rate base from $5.6 billion to $6.3 billion and BGE is expected to expand its rate base from $4.9 billion to $5.8 billion over the same time frame. Combined, EXC is expecting to increase its regulated asset base from $20.1 billion to $24.7 billion over the next three years and would represent 7.8% annual growth. Management believes these regulated utilities can generate 8% to 10% annual EPS growth over the next three years. EXC is in the process of acquiring the regulatory approval to complete its merger with PEPCO (NYSE: POM ). This expansion will not only fill in the geography of its service territory but offers future profit potential as well. Below is a map from EXC’s latest investor presentation outlining the combined service territory after the merger. PEPCO includes Potomac Electric with 800,000 customers, Atlantic City Electric with 545,000 customers and Delmarva Power and Light with 632,000 customers. Source: Exelon investor presentation. An interesting aspect of the acquisition will be EXC management’s ability to improve profitability at PEPCO. Each operating unit has underperformed its allowed ROE, and some by a substantial amount. Below are the 2013 results for earned ROE and allowed ROE, by business: PEPCO MD earned ROE of 7.5% out of an allowed 9.4% PEPCO DC earned ROE of 6.7% out of an allowed 9.5% Delmarva DE Electric earned ROE of 8.8% out of an allowed 9.8% Delmarva DE Gas earned ROE of 8.6% out of an allowed 9.8% Delmarva MD earned ROE of 8.0% out of an allowed 9.8% Atlantic City Electric earned ROE of 4.9% out an allowed 9.8% Management believes regulated utilities can earn $1.25 to $1.55 per share in 2017, sufficient to cover its annual dividend. The balance of EXC’s business is providing merchant power. Of its 32 GW capacity, 60% is power by nuclear, 25% by natural gas, 7% each from hydro and oil, and the remaining 3% from wind and solar. The majority of their generating capacity is located in the PJM controlled Mid-Atlantic and eastern Midwest, but has a growing generating base in Texas. As a merchant power producer, EXC has historically offered substantially higher exposure and risk to the volatility of commodity power markets. As the nation’s largest nuclear power generator, EXC is one of the lowest-cost providers of reliable, base load electricity. Industry peer Southern Company (NYSE: SO ), a major electricity provider in the Southeast, provides its merchant power customers based on a long-term Purchase Power Agreement PPA that could extend over 20 years. EXC, on the other hand, relies on the regional PJM-managed three-year rolling contracts, making pricing more susceptible to the whims of the commodity power market. It is important for investors to appreciate this fundamental difference as it influences both revenue and profitability. Below is the Front Year Price graph on electricity pricing for the PJM Western Hub dating back to 2001, as offered by sriverconsulting.com (pdf), a segment of EnerNOC (NASDAQ: ENOC ). The graph is the average of the front 12 months NYMEX future contracts for PJM West-Hub Electric trading on that date. Example: The front-year on July 15, 2008, was the average of the July 2008 to June 2009 contracts, which was $104.35/MW. (click to enlarge) Source: South River Consulting. Notice the collapse from $120 in June 2008 to a bottom of $40 in February 2012. Since 2009, pricing has been stuck in the $40 to $60 range. The spike in January 2014 was the result of very low generating reserve capacity during the polar vortex cold spell in the Northeast. Below is a graph of EXC’s 15-year return on invested capital ROIC: (click to enlarge) Source: F.A.S.T.graphs.com. The correlation between PJM pricing and ROIC is obvious in these two graphs. It is not a coincidence profits and stock prices also peaked at the same time — in 2008. The growth of EXC will be reliant on a recovery of electricity pricing in the Mid-Atlantic and Northeast. The sharp price spike in 2014 is indicative of the severe supply dislocation experienced during the cold snap. Not only was natural gas generating plants curtailed due to a lack of pipeline capacity but equipment seized up in the cold. Coal piles were frozen, making it difficult to feed the plant. Combined, an unsustainable 22% of available generating capacity was offline. Considering the possibility of another vortex-like event, PJM stated , a comparable rate of generator outages in the winter of 2015/2016, coupled with extremely cold temperatures and expected coal retirements, would likely prevent PJM from meeting its peak load requirements. In a letter (pdf) to the House Energy Subcommittee concerning the power situation in the Northeast, PJM’s Craig Glazer, VP-Federal Government Policy, wrote: Because less-expensive coal generation is retiring and in part is being replaced by demand-response or other potential high energy cost resources, excess generation will narrow and energy prices could become more volatile due to the increasing reliance on natural gas for electricity generation. “Would likely prevent PJM from meeting its peak load requirements” is a nice way of saying brownouts or blackouts. “Energy prices could become more volatile” is also code for higher prices. The lack of power reserves and the spike in prices spooked the PJM to alter its auction process and to offer a price premium to power generators who would guarantee reliability regardless of the weather. Nuclear power generation is considered the most reliably by the PJM, and EXC’s plants qualify for the premium. The premium could add $0.17 to $0.25 to earnings per share. More information is available from the article “Exelon: Nuke Reliability Worth An Additional $5 A Share,” published last October. There is also concern the Northeast is facing a shortage of generating capacity due to the ongoing closing of coal plants and the December 2014 shuttering of the Vermont Yankee nuclear plant. According to EXC’s presentation, about 20MW of generating capacity is expected to be closed in the Northeast between 2012 and 2016, with half that capacity closing this year. Many blindly claim adding to intermittent load solar- and wind-generating capacity or building new natural gas generating facilities will offset closed base-load coal and nuclear generating capacity. However, the reality is intermittent-load is a poor replacement choice for base-load and due to pipeline constraints there is a potential shortage of natural gas in the Northeast, as demonstrated during the winter of 2014. Even the grid manager in the Northeast acknowledges the conundrum of available power and pipeline constraints. The report “ISO New England 2014 Regional Electricity Outlook” states: The capacity that will replace New England’s retiring generators is likely to be a combination of renewable and gas-fired resources. However, the relationship between renewables and the conventional resources needed to ensure grid reliability presents a puzzle: more wind and solar power creates a need for fast-starting, flexible resources that can take up the slack when the wind stops or the clouds roll in. New natural gas generators will likely fill this role, with their relative ease of siting and typically lower fuel costs-but this will further strain natural gas pipeline capacity. Most new pipelines to the gas-starved Northeast would traverse the State of New York, which recently banned fracking. For example, the Constitution Pipeline from the Marcellus to the Northeast has received FERC approval but awaits State environmental approvals. The opposition to the pipeline through N.Y. could delay the project. The region currently has five major pipeline systems and seven new projects have been proposed. However, several of them have stalled because of ferocious opposition. From two NY Times articles here and here : A year ago, the governors of the six New England states agreed to pursue a coordinated regional strategy, including more pipelines and at least one major transmission line for hydropower. The plan called for electricity customers in all six states to subsidize the projects, on the theory that they would make up that money in lower utility bills. However, in August, the Massachusetts Legislature rejected the plan, saying in part that cheap energy would flood the market and thwart attempts to advance wind and solar projects. That halted the whole effort. According to National Grid (NYSE: NGG ), the gas and electric utility for a majority of the Northeast, the lack of natural gas generating capacity and the lack of pipeline capacity is a contributing factor in higher electricity rates. Connecticut’s rate of 19.74 cents per kilowatt-hour for September was the highest in the continental United States and twice that of energy-rich states like West Virginia and Louisiana. The lowest rate, 8.95 cents, was in Washington State, where the Columbia River is the nation’s largest producer of hydropower. For the coming winter, National Grid, the largest utility in Massachusetts, expects prices to rise to 24.24 cents, a record high. The average customer will pay $121.20 a month, a 37 percent increase from $88.25 last winter. The lack of electric generating capacity is and will continue driving up the price for electricity, which will positively affect EXC. Based on beta and yield, EXC is current valued in line with other large-cap electric utilities. EXC has a beta of 0.50 vs. an average of 0.54 and offers a yield of 3.3% vs. an average of 3.3%. However, EXC is trading at a P/E of 15 vs. an average of 19, or a 20% discount based on its P/E ratio. In addition, while the average electric utility is expected to grow earnings by 4% to 6% annually, EXC could far exceed this rate based on higher pricing of its merchant power. Returning to ROIC, EXC has historically far surpassed its peers in generating returns based on their total capital structure. This is a direct result of their exposure to commodity power pricing. As the company has turned to a more regulated profile, their historic double digit ROIC has understandably declined. With higher profitability in their merchant power segment, investors should expect to see ROIC increase to the high single digit range of 8% to 9%. This level of ROIC will still be on the higher end of their peers. Morningstar offers their unique analysis on EXC: Bulls Say: Low-cost nuclear power plants run year-round and generate large profits even with currently depressed power prices. Exelon benefits more than any other utility from rising coal and natural gas prices, higher electricity demand, and environmental regulations on fossil fuel power plants. If gas and power prices remain low for many years, the Constellation acquisition in 2012 could prove prescient. Bears Say: Exelon’s performance depends on volatile power prices that fluctuate based on natural gas prices, coal prices, and regional electricity demand. Acquiring Constellation’s no-moat retail business and narrow-moat distribution utility in 2012 diluted Exelon’s wide moat. Many of Exelon’s growth projects come with regulated or contracted returns, reducing shareholders’ leverage to a rebound in power markets. It should be noted last week Morningstar downgraded EXC from “4 stars” to “3 stars,”, which is considered as neutral. The most likely reasons in the recent run-up in share prices. While not as cheap as a year ago when I penned the article “Exelon: Selling At 10-Year Lows” (or the four subsequent articles) suggesting investors buy in the $28 range, EXC still offers an 11% to 18% potential capital gain based on a 2-year target price between $42 and $45. Adding a 3.3% yield would generate annual returns of 7% to 10%. While not a barn-burner, this total return should be adequate for utility investors. Author’s Note: Please review full disclosure on author’s profile page. Scalper1 News

While returning 41.9% total return over the previous 12 months, EXC has a bit more juice in its gas tank. Fundamental business changes have reduced earnings volatility. Gains in profitability are dependent on improving power markets. PJM is so afraid of a lack of generating capacity it has proposed a premium for reliability. While Exelon (NYSE: EXC ) had generated total returns of 41.9% over the previous 12 months, vs 21.2% for the Morningstar Diversified Utilities Index and 11.6% for the S&P 500, there may still be a bit of juice left in its gas tank. However, just do not look at 1-year and 3-year returns as it may make you sick at a puny 1.6% and an even worse -1.2%, vs. 12.6% and 10.5%, respectively, for Diversified Utilities and 18.4% and 14.2%, respectively, for the S&P. Driving EXC higher will be fundamental business strategy changes that is expected to increase earnings from $2.40 in 2014 to $2.51 in 2015 and $2.66 in 2016. The changes include the transformation from 20% regulated revenue (Exelon Utilities segment) and 80% unregulated revenue from merchant power (Exelon Generation segment) in 2008 to around 61% regulated and 39% merchant power by the end of 2017. Profitability in its regulated utility segment should improve over the next few years. Illinois enacted an annual rate evaluation in 2011 that is being phased in and should improve the profit uncertainty of Exelon subsidiary ComEd. 2014 ROE for ComEd is estimated at 8% to 9% vs a target of 9.0% (30-yr Treasury + 5.8%). PECO’s 2014 ROE is expected to be 11% to 12% vs a target of 10% and BGE’s 2014 ROE is expected to be 7% to 8% vs a target also of 10%. ComEd has annual rate reviews using the above formula. PECO is looking for a rate increase to be filed either this year or next and BGE anticipates requesting a rate increase this year and will be its first since 1999. In addition to the above ROE, EXC’s regulated rate base is expected to expand over the next few years. For example, ComEd is expected to grow its rate base from $9.6 billion in 2014 to $12.6 billion in 2017. PECO will increase its rate base from $5.6 billion to $6.3 billion and BGE is expected to expand its rate base from $4.9 billion to $5.8 billion over the same time frame. Combined, EXC is expecting to increase its regulated asset base from $20.1 billion to $24.7 billion over the next three years and would represent 7.8% annual growth. Management believes these regulated utilities can generate 8% to 10% annual EPS growth over the next three years. EXC is in the process of acquiring the regulatory approval to complete its merger with PEPCO (NYSE: POM ). This expansion will not only fill in the geography of its service territory but offers future profit potential as well. Below is a map from EXC’s latest investor presentation outlining the combined service territory after the merger. PEPCO includes Potomac Electric with 800,000 customers, Atlantic City Electric with 545,000 customers and Delmarva Power and Light with 632,000 customers. Source: Exelon investor presentation. An interesting aspect of the acquisition will be EXC management’s ability to improve profitability at PEPCO. Each operating unit has underperformed its allowed ROE, and some by a substantial amount. Below are the 2013 results for earned ROE and allowed ROE, by business: PEPCO MD earned ROE of 7.5% out of an allowed 9.4% PEPCO DC earned ROE of 6.7% out of an allowed 9.5% Delmarva DE Electric earned ROE of 8.8% out of an allowed 9.8% Delmarva DE Gas earned ROE of 8.6% out of an allowed 9.8% Delmarva MD earned ROE of 8.0% out of an allowed 9.8% Atlantic City Electric earned ROE of 4.9% out an allowed 9.8% Management believes regulated utilities can earn $1.25 to $1.55 per share in 2017, sufficient to cover its annual dividend. The balance of EXC’s business is providing merchant power. Of its 32 GW capacity, 60% is power by nuclear, 25% by natural gas, 7% each from hydro and oil, and the remaining 3% from wind and solar. The majority of their generating capacity is located in the PJM controlled Mid-Atlantic and eastern Midwest, but has a growing generating base in Texas. As a merchant power producer, EXC has historically offered substantially higher exposure and risk to the volatility of commodity power markets. As the nation’s largest nuclear power generator, EXC is one of the lowest-cost providers of reliable, base load electricity. Industry peer Southern Company (NYSE: SO ), a major electricity provider in the Southeast, provides its merchant power customers based on a long-term Purchase Power Agreement PPA that could extend over 20 years. EXC, on the other hand, relies on the regional PJM-managed three-year rolling contracts, making pricing more susceptible to the whims of the commodity power market. It is important for investors to appreciate this fundamental difference as it influences both revenue and profitability. Below is the Front Year Price graph on electricity pricing for the PJM Western Hub dating back to 2001, as offered by sriverconsulting.com (pdf), a segment of EnerNOC (NASDAQ: ENOC ). The graph is the average of the front 12 months NYMEX future contracts for PJM West-Hub Electric trading on that date. Example: The front-year on July 15, 2008, was the average of the July 2008 to June 2009 contracts, which was $104.35/MW. (click to enlarge) Source: South River Consulting. Notice the collapse from $120 in June 2008 to a bottom of $40 in February 2012. Since 2009, pricing has been stuck in the $40 to $60 range. The spike in January 2014 was the result of very low generating reserve capacity during the polar vortex cold spell in the Northeast. Below is a graph of EXC’s 15-year return on invested capital ROIC: (click to enlarge) Source: F.A.S.T.graphs.com. The correlation between PJM pricing and ROIC is obvious in these two graphs. It is not a coincidence profits and stock prices also peaked at the same time — in 2008. The growth of EXC will be reliant on a recovery of electricity pricing in the Mid-Atlantic and Northeast. The sharp price spike in 2014 is indicative of the severe supply dislocation experienced during the cold snap. Not only was natural gas generating plants curtailed due to a lack of pipeline capacity but equipment seized up in the cold. Coal piles were frozen, making it difficult to feed the plant. Combined, an unsustainable 22% of available generating capacity was offline. Considering the possibility of another vortex-like event, PJM stated , a comparable rate of generator outages in the winter of 2015/2016, coupled with extremely cold temperatures and expected coal retirements, would likely prevent PJM from meeting its peak load requirements. In a letter (pdf) to the House Energy Subcommittee concerning the power situation in the Northeast, PJM’s Craig Glazer, VP-Federal Government Policy, wrote: Because less-expensive coal generation is retiring and in part is being replaced by demand-response or other potential high energy cost resources, excess generation will narrow and energy prices could become more volatile due to the increasing reliance on natural gas for electricity generation. “Would likely prevent PJM from meeting its peak load requirements” is a nice way of saying brownouts or blackouts. “Energy prices could become more volatile” is also code for higher prices. The lack of power reserves and the spike in prices spooked the PJM to alter its auction process and to offer a price premium to power generators who would guarantee reliability regardless of the weather. Nuclear power generation is considered the most reliably by the PJM, and EXC’s plants qualify for the premium. The premium could add $0.17 to $0.25 to earnings per share. More information is available from the article “Exelon: Nuke Reliability Worth An Additional $5 A Share,” published last October. There is also concern the Northeast is facing a shortage of generating capacity due to the ongoing closing of coal plants and the December 2014 shuttering of the Vermont Yankee nuclear plant. According to EXC’s presentation, about 20MW of generating capacity is expected to be closed in the Northeast between 2012 and 2016, with half that capacity closing this year. Many blindly claim adding to intermittent load solar- and wind-generating capacity or building new natural gas generating facilities will offset closed base-load coal and nuclear generating capacity. However, the reality is intermittent-load is a poor replacement choice for base-load and due to pipeline constraints there is a potential shortage of natural gas in the Northeast, as demonstrated during the winter of 2014. Even the grid manager in the Northeast acknowledges the conundrum of available power and pipeline constraints. The report “ISO New England 2014 Regional Electricity Outlook” states: The capacity that will replace New England’s retiring generators is likely to be a combination of renewable and gas-fired resources. However, the relationship between renewables and the conventional resources needed to ensure grid reliability presents a puzzle: more wind and solar power creates a need for fast-starting, flexible resources that can take up the slack when the wind stops or the clouds roll in. New natural gas generators will likely fill this role, with their relative ease of siting and typically lower fuel costs-but this will further strain natural gas pipeline capacity. Most new pipelines to the gas-starved Northeast would traverse the State of New York, which recently banned fracking. For example, the Constitution Pipeline from the Marcellus to the Northeast has received FERC approval but awaits State environmental approvals. The opposition to the pipeline through N.Y. could delay the project. The region currently has five major pipeline systems and seven new projects have been proposed. However, several of them have stalled because of ferocious opposition. From two NY Times articles here and here : A year ago, the governors of the six New England states agreed to pursue a coordinated regional strategy, including more pipelines and at least one major transmission line for hydropower. The plan called for electricity customers in all six states to subsidize the projects, on the theory that they would make up that money in lower utility bills. However, in August, the Massachusetts Legislature rejected the plan, saying in part that cheap energy would flood the market and thwart attempts to advance wind and solar projects. That halted the whole effort. According to National Grid (NYSE: NGG ), the gas and electric utility for a majority of the Northeast, the lack of natural gas generating capacity and the lack of pipeline capacity is a contributing factor in higher electricity rates. Connecticut’s rate of 19.74 cents per kilowatt-hour for September was the highest in the continental United States and twice that of energy-rich states like West Virginia and Louisiana. The lowest rate, 8.95 cents, was in Washington State, where the Columbia River is the nation’s largest producer of hydropower. For the coming winter, National Grid, the largest utility in Massachusetts, expects prices to rise to 24.24 cents, a record high. The average customer will pay $121.20 a month, a 37 percent increase from $88.25 last winter. The lack of electric generating capacity is and will continue driving up the price for electricity, which will positively affect EXC. Based on beta and yield, EXC is current valued in line with other large-cap electric utilities. EXC has a beta of 0.50 vs. an average of 0.54 and offers a yield of 3.3% vs. an average of 3.3%. However, EXC is trading at a P/E of 15 vs. an average of 19, or a 20% discount based on its P/E ratio. In addition, while the average electric utility is expected to grow earnings by 4% to 6% annually, EXC could far exceed this rate based on higher pricing of its merchant power. Returning to ROIC, EXC has historically far surpassed its peers in generating returns based on their total capital structure. This is a direct result of their exposure to commodity power pricing. As the company has turned to a more regulated profile, their historic double digit ROIC has understandably declined. With higher profitability in their merchant power segment, investors should expect to see ROIC increase to the high single digit range of 8% to 9%. This level of ROIC will still be on the higher end of their peers. Morningstar offers their unique analysis on EXC: Bulls Say: Low-cost nuclear power plants run year-round and generate large profits even with currently depressed power prices. Exelon benefits more than any other utility from rising coal and natural gas prices, higher electricity demand, and environmental regulations on fossil fuel power plants. If gas and power prices remain low for many years, the Constellation acquisition in 2012 could prove prescient. Bears Say: Exelon’s performance depends on volatile power prices that fluctuate based on natural gas prices, coal prices, and regional electricity demand. Acquiring Constellation’s no-moat retail business and narrow-moat distribution utility in 2012 diluted Exelon’s wide moat. Many of Exelon’s growth projects come with regulated or contracted returns, reducing shareholders’ leverage to a rebound in power markets. It should be noted last week Morningstar downgraded EXC from “4 stars” to “3 stars,”, which is considered as neutral. The most likely reasons in the recent run-up in share prices. While not as cheap as a year ago when I penned the article “Exelon: Selling At 10-Year Lows” (or the four subsequent articles) suggesting investors buy in the $28 range, EXC still offers an 11% to 18% potential capital gain based on a 2-year target price between $42 and $45. Adding a 3.3% yield would generate annual returns of 7% to 10%. While not a barn-burner, this total return should be adequate for utility investors. Author’s Note: Please review full disclosure on author’s profile page. Scalper1 News

Scalper1 News