Scalper1 News

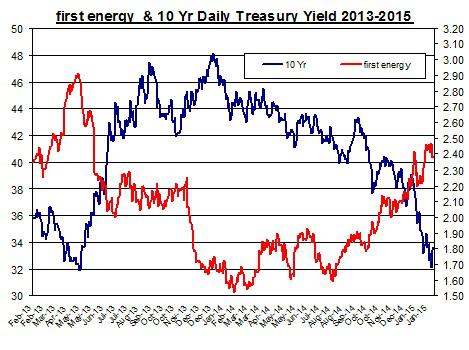

Summary FirstEnergy’s stock added nearly 30% in the past six months. Have low U.S. treasury yields increased the demand for FirstEnergy? What are the other factors that could also drive up shares of FirstEnergy? Shares of FirstEnergy (NYSE: FE ) have added nearly 30% to their value in the past six months. The common notion is that falling U.S. treasury yields tend to increase the demand for utility companies such as FirstEnergy. But is this the case? Also, what are some of the other factors that could drive up the price of FirstEnergy? Do U.S. treasury yields matter? To answer this question, let’s examine the relation of the 10 year treasury yield and the movement in FirstEnergy’s stock over the last couple of years. Source of data taken from Google Finance and U.S. Treasury At first glance we can see in times when treasury yields have gone down, as was the case in recent months, the stock of FirstEnergy rallied and vice versa. But after reviewing the linear correlation between the two sets of data – the correlation for the period was only -0.05 – it’s harder to make the case for a strong relation between U.S. treasury yields and FirstEnergy. But still the relation could be more a matter of people slowly moving their funds to utility companies such as FirstEnergy rather than having a direct clear cut reaction to these changes in the market. In other words, the relation could be more in the trend line than in the day to day shifts. This could all change if the FOMC were to start to raise its cash rate in the second half of the year, which should increase treasury yields. One of the main reasons people like to invest in utility companies such as FirstEnergy is for its stability and relatively high yields. The current annual dividend yield is 3.6%. In comparison, Exelon (NYSE: EXC ) and Duke Energy (NYSE: DUK ) also offer similar dividend yields of 3.4% and 3.7%, respectively. But these factors aren’t the only reasons for the higher demand for FirstEnergy. Here are a few of more reasons to consider: The company is also aiming to expand its operations: FirstEnergy is in the midst of a potential of $7 billion investment in transmission across 24,000 mile transmission system in its Regulated Transmission segment – which transmits electricity through transmission facilities. Back in 2014 the company allocated $4.2 billion for this investment, which is expected to conclude in 2017 and result in the upgrade and expansion of the transmission system. For 2014, the company estimated capex for this project to reach $1.35 billion. These investments will be funded via debt, issuing stocks, employment benefits and cash. Electricity generation is expected to rise in 2015 Based on the latest report by the Energy Information Administration , consumption of electricity in the residential sector is expected to slightly decline by 0.3% in 2015, year over year. This is mainly due to 12% drop in heating degree days this year compared to 2014. Despite the lower demand for electricity in the residential sector, electricity generation is still projected to rise by 1.1% in 2015. Moreover, the EIA also estimates retail residential prices to rise by 1.1% in 2015. This could suggest higher revenue for utility companies such as FirstEnergy. The company will release its fourth quarter report at the end of February, in which the company may provide an update on its guidance for 2015. Lower coal and natural gas prices Another thing that plays in favor for FirstEnergy is the currently low coal and natural gas prices. The company’s fuel mix includes 57% coal and 8% natural gas. The current price of coal (Central Appalachian) is around $46 per short ton – back in early 2014 the price was close to $60 per short ton. Moreover, natural gas is roughly $2.6. In comparison, back in February 2014 the price of natural gas was over $5. The low energy prices are likely to improve FirstEnergy’s profit margin in the first quarter of 2015 and subsequent quarters, assuming coal and natural gas prices remain at their current low levels. Takeaway FirstEnergy is benefiting from low energy prices, falling U.S. treasury yields and potential rise in retail prices in the coming months. These factors are likely to keep the company an interesting investment opportunity. Disclosure: The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Summary FirstEnergy’s stock added nearly 30% in the past six months. Have low U.S. treasury yields increased the demand for FirstEnergy? What are the other factors that could also drive up shares of FirstEnergy? Shares of FirstEnergy (NYSE: FE ) have added nearly 30% to their value in the past six months. The common notion is that falling U.S. treasury yields tend to increase the demand for utility companies such as FirstEnergy. But is this the case? Also, what are some of the other factors that could drive up the price of FirstEnergy? Do U.S. treasury yields matter? To answer this question, let’s examine the relation of the 10 year treasury yield and the movement in FirstEnergy’s stock over the last couple of years. Source of data taken from Google Finance and U.S. Treasury At first glance we can see in times when treasury yields have gone down, as was the case in recent months, the stock of FirstEnergy rallied and vice versa. But after reviewing the linear correlation between the two sets of data – the correlation for the period was only -0.05 – it’s harder to make the case for a strong relation between U.S. treasury yields and FirstEnergy. But still the relation could be more a matter of people slowly moving their funds to utility companies such as FirstEnergy rather than having a direct clear cut reaction to these changes in the market. In other words, the relation could be more in the trend line than in the day to day shifts. This could all change if the FOMC were to start to raise its cash rate in the second half of the year, which should increase treasury yields. One of the main reasons people like to invest in utility companies such as FirstEnergy is for its stability and relatively high yields. The current annual dividend yield is 3.6%. In comparison, Exelon (NYSE: EXC ) and Duke Energy (NYSE: DUK ) also offer similar dividend yields of 3.4% and 3.7%, respectively. But these factors aren’t the only reasons for the higher demand for FirstEnergy. Here are a few of more reasons to consider: The company is also aiming to expand its operations: FirstEnergy is in the midst of a potential of $7 billion investment in transmission across 24,000 mile transmission system in its Regulated Transmission segment – which transmits electricity through transmission facilities. Back in 2014 the company allocated $4.2 billion for this investment, which is expected to conclude in 2017 and result in the upgrade and expansion of the transmission system. For 2014, the company estimated capex for this project to reach $1.35 billion. These investments will be funded via debt, issuing stocks, employment benefits and cash. Electricity generation is expected to rise in 2015 Based on the latest report by the Energy Information Administration , consumption of electricity in the residential sector is expected to slightly decline by 0.3% in 2015, year over year. This is mainly due to 12% drop in heating degree days this year compared to 2014. Despite the lower demand for electricity in the residential sector, electricity generation is still projected to rise by 1.1% in 2015. Moreover, the EIA also estimates retail residential prices to rise by 1.1% in 2015. This could suggest higher revenue for utility companies such as FirstEnergy. The company will release its fourth quarter report at the end of February, in which the company may provide an update on its guidance for 2015. Lower coal and natural gas prices Another thing that plays in favor for FirstEnergy is the currently low coal and natural gas prices. The company’s fuel mix includes 57% coal and 8% natural gas. The current price of coal (Central Appalachian) is around $46 per short ton – back in early 2014 the price was close to $60 per short ton. Moreover, natural gas is roughly $2.6. In comparison, back in February 2014 the price of natural gas was over $5. The low energy prices are likely to improve FirstEnergy’s profit margin in the first quarter of 2015 and subsequent quarters, assuming coal and natural gas prices remain at their current low levels. Takeaway FirstEnergy is benefiting from low energy prices, falling U.S. treasury yields and potential rise in retail prices in the coming months. These factors are likely to keep the company an interesting investment opportunity. Disclosure: The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Scalper1 News