< div i.d. =" articleText" legibility=" 117.69588196433" >

< img class= "articleImgLg "alt=" Potashcorp Rocanville Storage space Internet" src =" https://www.scalper1.com/wp-content/uploads/2016/06/potashcorp-rocanville-storage-web_large.jpg”/ > Graphic source: PotashCorp. This might be actually the most effective headlines entrepreneurs in Potash Organization (NYSE: CONTAINER) and also The Mosaic Provider( NYSE: MONTHS )have actually heard in a very long time. In a primary growth that can mark a turn-around for these business, Belarus exposed that this levels to a partnership along with Russia-based potash provider Uralkali, 3 years after the Belaruskali-Uralkali cartel split. Belarus head of state Alexander Lukashenko really did not mince phrases in the course of an activity where he created the observing surprising revelation:

< blockquote legibility= "7" > New Uralkali investors are actually relating to me each month stating: “Take our company.” We are actually not against that. Let’s unite, on our situations. Let’s return to job as well as agree how much our team are going to make.

Those terms could possibly hold the trick to PotashCorp’s and Variety’s futures, and also alter their tragedies.

The split that rocked the potash sector

Before I look into the importance of Lukashenko’s phrases, that is crucial to recognize why the potash industry has endured in latest years.

The worldwide potash business was mostly controlled by two producer teams: the Belarusian Potash Company, consisted of Uralkali as well as Belaruskali, and Canpotex, consisted of PotashCorp, Variety, as well as Agrium. The 2 groups regulated nearly 70% from the international potash supply, which assisted reinforce potash prices. In 2009, potash area costs soared to videotape highs from virtually $ 900 per tonne.

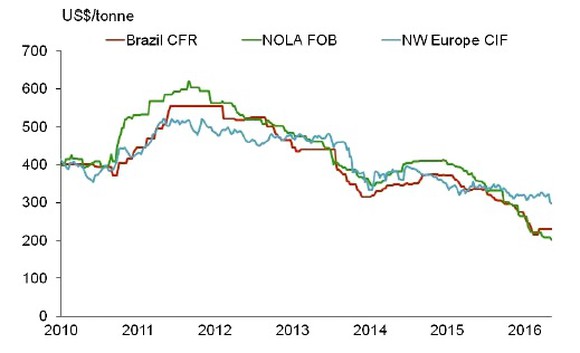

While the financial crisis reached potash rates right after, the industry aspects modified considerably after 2013, when Uralkali suddenly ended its arrangement with Belaruskali to pursue a volume-over-price approach in a desperate offer to gain a greater part from the cake. The split disrupted the potash marketplace, delivering rates from the nutrient toppling to multiyear lows. Today, potash is actually choosing merely around $ 260 per tonne in the spot market.

< img class=" articleImgLg" alt =" Flowerpot Cost" src=" https://www.scalper1.com/wp-content/uploads/2016/06/pot-price_large.jpg"/ > Globe potash prices. Image source: PotashCorp’s

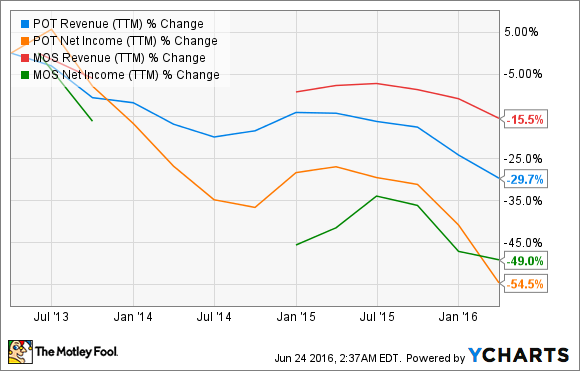

Market Summary Record, May 2016. Every effort by PotashCorp and Variety to halt the slide in potash rates has actually wasted, merely because the shakeout placed the sphere in the customers’ court of law also as manufacturers like Belaruskali clambered to beat others in the race to get market reveal by signing export contracts with essential eating nations China as well as India at shockingly small cost. Uralkali as well as Canpotex possessed no choice but to jump on the bandwagon. The result: Potash consumers were giggling their technique to the bank along with low-cost contracts while potash producers were entrusted moving leading and also profits. Both PotashCorp and Mosaic have found their profits cut in half due to the fact that 2013.

< a href=" http://ycharts.com/companies/POT/chart/" rel =" nofollow "> < a href=" http://ycharts.com/companies/POT/revenues_ttm" rel= “nofollow” > POT Revenue (TTM) records by

YCharts. What PotashCorp and Mosaic need straight now Given the backdrop, it isn’t really very difficult to recognize why a patch-up in between the Belarusian as well as Russian potash developers might improve PotashCorp’s as well as Variety’s lucks, specifically since Uralkali is the planet’s largest potash developer through manufacturing and also possesses a tough control over business supply. Determining through Lukashenko’s words, Belarus is keen to sign up with hands along with Uralkali the moment again to regulate development editions and enhance the demand-supply circumstance in the industry. That could supply a much-needed floor to potash rates. While Uralkali hasn’t already pointed out everything to that effect but, its enthusiasm in a homecoming definitely would not be actually surprising, either, provided that its earnings likewise had an attacked as potash prices nose-dived. Moreover, PotashCorp’s aggressive current transfer to gain market share, like its own unsuccessful $ 8.8 billion proposal to acquire German rival K+S, pose a major hazard to Uralkali’s leadership position. Incorporated, these factors may urge Uralkali to reassess its tactic. For PotashCorp and Variety, the partnership might merely indicate one point: the bottoming from potash costs, and an end to the join their sales as well as profits. That is actually specifically just what clients in the beleaguered companies need to have to see at the moment. A secret billion-dollar equity possibility =” http://www.fool.com/mms/mark/ecap-foolcom-apple-wearable?aid=6965&source=irbeditxt0000017&ftm_cam=rb-wearable-d&ftm_pit=2692&ftm_veh=article_pitch&utm_campaign=article&utm_medium=feed&utm_source=nasdaq” rel=” nofollow” > simply go here. Neha Chamaria possesses no stance in any type of stocks pointed out. The has no position in any one of the inventories mentioned. Attempt any of our Absurd e-newsletter solutions< a href=" http://www.fool.com/shop/newsletters/index.aspx?source=isiedilnk018048" rel =" nofollow "> free for 30 days. We Fools might not all secure the very same point of views, but our team all believe that looking at a varied assortment from insights makes us better entrepreneurs. The Motley Blockhead has a < a href=" http://www.fool.com/Legal/fool-disclosure-policy.aspx" rel=" nofollow "

The planet’s biggest tech provider neglected to present you one thing, yet a couple of Commercial analysts and the Blockhead really did not miss a beat: There is actually a little firm that is actually powering their new gizmos as well as the coming change in innovation. As well as we assume its own inventory cost has virtually unlimited space to compete early, in-the-know capitalists! To be some of them, < a href

> disclosure policy. The beliefs and opinions shared here are the point of views and also viewpoints from the writer and perform certainly not essentially reveal those from Nasdaq, Inc.

Most recent Articles Plantations International