Scalper1 News

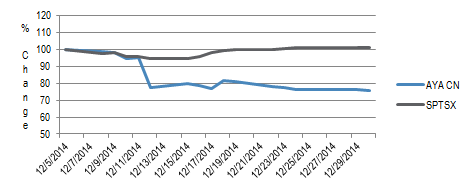

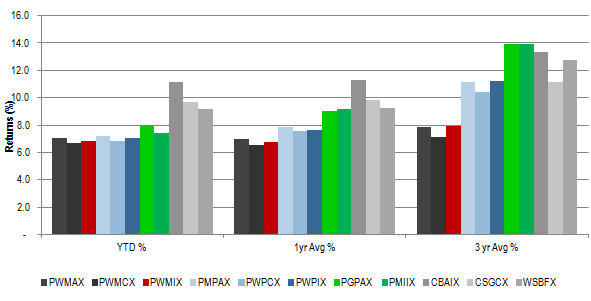

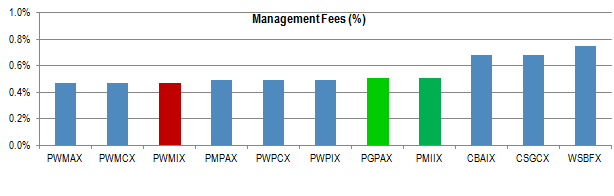

Summary Recap on Part 1: top short idea (AYA CN) has paid off. Part 2 introduces more ways to play the responsible investing theme. See below for blended strategy and a more conservative fixed-income strategy in a world of record-setting equity markets. Recap on Part 1 Socially responsible investing is becoming a mainstream phenomenon. Just this week, CNBC caught wind of it and featured the slumping of sin stocks, As a recap of Investing is Not Gambling, Part 1 , AYA CN was featured as the most overvalued gambling stock in the note. Since Part 1 was published, AYA stock has underperformed the SPTSX index: AYA slumped 20+% while the index finished the year essentially flat. Source: Bloomberg In this article, Part 2, I will introduce more ways to play the social responsibility theme. More ways to play this strategy I. Equity-Fixed Income Blended Strategy A Bloomberg screen returns over 130 mutual funds that either exclude or restrict gambling related investments. Strategies of these funds range from equities to bonds, and from balanced to international. To be clear, the exclusion/restriction is not a simple black-and-white rule. If you read the prospectuses (which you should), sophisticated fund managers conduct in-depth analysis . If the overall social impact and financial returns outweigh the profit contribution from gambling products, the security may be retained in the portfolio. For example, if an innovative machine manufacturer derives 5% of its profit from slot machines and the rest from carbon control devices, its securities may well be included. If you are leery about excessive exposure to equities (at near-record level one has sufficient reasons to think so), you should look for blended strategy among the 130 or so funds. When selecting funds, investors should pay attention to their different benchmarks. The highest returning fund may not be the best investment just because it has the most aggressive strategy (i.e. higher allocation to equities). With that in mind, I have laid out funds with blended strategy and grouped them by benchmarks. They are then ranked by equity exposure. As shown in the chart below, PWMAX , PWMCX , and PWMIX all are compared against a benchmark with only 24% equity exposure and, not surprisingly, have the lowest returns. The equity weight then goes up to 42% for PMPAX, PWPCX, and PWPIX; it rises to 55% for PGPAX and PMMIIX; and it finally reaches 60% for CBAIX, CSGCX, and WSBFX. Next, comparing fund returns against their respective benchmark, one will get a real picture of each fund’s alpha. It turns out, PWMIX has the highest alpha and the third lowest management fees. For investors with a higher risk appetite, PGPAX and PMIIX offer a good compromise between aggressiveness and alpha. Chart: fund returns Source: Bloomberg II. Fixed Income Focus Strategy Again, if you are bearish on the equity market in 2015, excluding funds with equity exposure, you can still choose from 50-odd funds. Following a similar selection process as above, investors will see that Praxis Genesis Conservative Strategy Fund (MUTF: MCONX ) offers outstanding risk-adjusted returns with a management fee of only 0.05%. Last but not the least, for the purists out there, MCONX strictly excludes any security related to the gambling industry. One thing I did not explore so far is project-based investments, such as the Social Impact Bonds pilot program in the UK. Institutional investors such as high-net worth individuals and foundations are invited to either guarantee first loss or lend capital into the program. Such projects are usually off limit to retail investors. However, I am all ears if you know of projects accessible to all. Scalper1 News

Summary Recap on Part 1: top short idea (AYA CN) has paid off. Part 2 introduces more ways to play the responsible investing theme. See below for blended strategy and a more conservative fixed-income strategy in a world of record-setting equity markets. Recap on Part 1 Socially responsible investing is becoming a mainstream phenomenon. Just this week, CNBC caught wind of it and featured the slumping of sin stocks, As a recap of Investing is Not Gambling, Part 1 , AYA CN was featured as the most overvalued gambling stock in the note. Since Part 1 was published, AYA stock has underperformed the SPTSX index: AYA slumped 20+% while the index finished the year essentially flat. Source: Bloomberg In this article, Part 2, I will introduce more ways to play the social responsibility theme. More ways to play this strategy I. Equity-Fixed Income Blended Strategy A Bloomberg screen returns over 130 mutual funds that either exclude or restrict gambling related investments. Strategies of these funds range from equities to bonds, and from balanced to international. To be clear, the exclusion/restriction is not a simple black-and-white rule. If you read the prospectuses (which you should), sophisticated fund managers conduct in-depth analysis . If the overall social impact and financial returns outweigh the profit contribution from gambling products, the security may be retained in the portfolio. For example, if an innovative machine manufacturer derives 5% of its profit from slot machines and the rest from carbon control devices, its securities may well be included. If you are leery about excessive exposure to equities (at near-record level one has sufficient reasons to think so), you should look for blended strategy among the 130 or so funds. When selecting funds, investors should pay attention to their different benchmarks. The highest returning fund may not be the best investment just because it has the most aggressive strategy (i.e. higher allocation to equities). With that in mind, I have laid out funds with blended strategy and grouped them by benchmarks. They are then ranked by equity exposure. As shown in the chart below, PWMAX , PWMCX , and PWMIX all are compared against a benchmark with only 24% equity exposure and, not surprisingly, have the lowest returns. The equity weight then goes up to 42% for PMPAX, PWPCX, and PWPIX; it rises to 55% for PGPAX and PMMIIX; and it finally reaches 60% for CBAIX, CSGCX, and WSBFX. Next, comparing fund returns against their respective benchmark, one will get a real picture of each fund’s alpha. It turns out, PWMIX has the highest alpha and the third lowest management fees. For investors with a higher risk appetite, PGPAX and PMIIX offer a good compromise between aggressiveness and alpha. Chart: fund returns Source: Bloomberg II. Fixed Income Focus Strategy Again, if you are bearish on the equity market in 2015, excluding funds with equity exposure, you can still choose from 50-odd funds. Following a similar selection process as above, investors will see that Praxis Genesis Conservative Strategy Fund (MUTF: MCONX ) offers outstanding risk-adjusted returns with a management fee of only 0.05%. Last but not the least, for the purists out there, MCONX strictly excludes any security related to the gambling industry. One thing I did not explore so far is project-based investments, such as the Social Impact Bonds pilot program in the UK. Institutional investors such as high-net worth individuals and foundations are invited to either guarantee first loss or lend capital into the program. Such projects are usually off limit to retail investors. However, I am all ears if you know of projects accessible to all. Scalper1 News

Scalper1 News