Scalper1 News

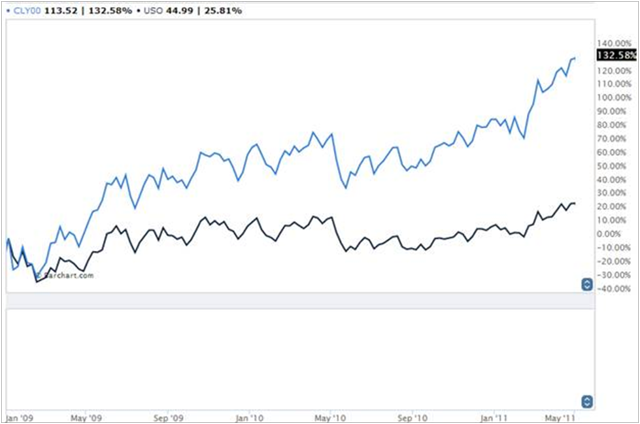

It’s the first (real) week back from holiday break, but the story is the same as it was before Christmas, and before Thanksgiving for that matter…. Crude Oil continues to fall like a lead oil filled balloon, falling below the $50 mark on Monday for the first time since 2009. It’s even gotten to the point of family and friends asking where we think Crude Oil will bottom at parties and dinners, getting our contrarian antennas perked up. The million, or actually Trillion, dollar question is where will Crude finally find a bottom and bounce back? Fortune let us know recently that the $55 drop in Brent Oil prices represents about a Trillion dollars in annual savings. Now, while some are no doubt betting on continued downside with the recent belles of the ball – the inverse oil ETFs and ETNs (the PowerShares DB Crude Oil Double Short ETN (NYSEARCA: DTO ), ProShares UltraShort Bloomberg Crude Oil ETF (NYSEARCA: SCO ) and VelocityShares 3x Inverse Crude Oil ETN (NYSEARCA: DWTI ) ), the last of which is up a smooth 527% since July past performance is not necessarily indicative of future results. Others are no doubt positioning for the inevitable rebound in energy prices, thinking it is just a matter of when, not if. Crude Oil is back around $70 to $100 a barrel. And what a trade that would be. Consider a move back to just $75 a barrel, the very low end of where Crude spent the last 5 years, would be a 50% return from the current $50 level. It seems like that could happen nearly overnight without anyone really thinking much about it. So how do you play a bounce in Oil? Well, the most popular play, by size and volume ( $1.2 Billion in Assets , $387 million changing hands daily), is no doubt the The United States Oil ETF, LP (NYSEARCA: USO ) . But is that really the best way to ‘play’ a bounce? Consider that USO Is designed to track the “daily” movement of oil. What’s the matter with that? One would hope that the ETF closely matches the daily move of Oil, right? Well, yes and no. Yes if you are going to buy the ETF for one day, or even a couple of days; no if your investment thesis is oil prices will climb higher over an extended period of time. Because, and here’s where it gets tricky – USO’s long term price appreciation won’t match the sum of its daily price appreciations. What? How is that possible? You see, the ETF works by buying futures contracts on Oil, and there are 12 different contracts in Crude Oil futures each year, you guessed it – one for every month. And while the so called ‘front month contract’ is trading near the number you see on the news every night ($50 yesterday), the further out contracts, such as 10 to 12 months from now, may already reflect the idea that Oil prices will be higher. Indeed, the price for the December 2015 contract is $57, versus $50 for the front month. So there’s $7, or a 14% gain, already “built in” to the futures price. What’s that mean for the ETF investor? Well, if you are correct that Oil will rebound, and it does so, to the tune of rising 14%, or $7 per barrel, over the next 11 months; the ETF likely won’t appreciate 14% as well. It likely won’t move at all, because it will have to sell out of its expiring futures positions and buy new futures positions each month. This means it will essentially have to “pay” that $7 in what’s called “roll costs.” This is why USO has drastically underperformed the “spot price” of Oil over the past five years, with USO having lost -39 % while the spot price of Oil went UP 48 %. It is like an option or insurance premium – a declining asset with all else held equal. Just look at what happened during the last big rally for energy prices between January 2009 and May 2011. That’s a 110% difference between what you thought was going to happen and what the ETF rewarded you with. (click to enlarge) (Disclaimer: Past performance is not necessarily indicative of future results) Chart Courtesy: Barchart So if you think Oil will be higher 3 months from now, or 12 months from now, instead of tomorrow, USO is at best going to give you some discounted version of your expected gain, and at worse a possible loss when Oil gains. (P.S., the ProShares Ultra Bloomberg Crude Oil ETF (NYSEARCA: UCO ) will do all this, times two… yeah) You don’t even have to take our word for it. Take the description of the USO over at ETF.com . USO is a great vehicle for riding short-term moves in expected crude prices, but longer-term holders take on heavy roll risk. Roll costs can be steep when the curve is up-sloping. Ok – so don’t offer a problem without a solution… What other options are out there? Well, in our realm of futures based investments, you could: Trade futures in Crude Oil, Heating Oil, RBOB Gasoline that match your time frame for a rise in prices; rolling them once annually if needed, as we’ve recommended instead of commodity ETFs for some time now. For example, if you think Crude Oil will be higher 12 to 18 months from now, buy the June 2016 Crude Oil futures (currently It will still underperform the pure spot price, but will only pay that roll cost once per year instead of multiple times). Invest with an energy focused professional commodity trading advisor, we have some names. Invest with a trend following manager – who should benefit from a long term trend up (just as they are benefiting from the trend down right now past performance is not necessarily indicative of future results, albeit the energy portion would only be a small portion (Scalper1 News

It’s the first (real) week back from holiday break, but the story is the same as it was before Christmas, and before Thanksgiving for that matter…. Crude Oil continues to fall like a lead oil filled balloon, falling below the $50 mark on Monday for the first time since 2009. It’s even gotten to the point of family and friends asking where we think Crude Oil will bottom at parties and dinners, getting our contrarian antennas perked up. The million, or actually Trillion, dollar question is where will Crude finally find a bottom and bounce back? Fortune let us know recently that the $55 drop in Brent Oil prices represents about a Trillion dollars in annual savings. Now, while some are no doubt betting on continued downside with the recent belles of the ball – the inverse oil ETFs and ETNs (the PowerShares DB Crude Oil Double Short ETN (NYSEARCA: DTO ), ProShares UltraShort Bloomberg Crude Oil ETF (NYSEARCA: SCO ) and VelocityShares 3x Inverse Crude Oil ETN (NYSEARCA: DWTI ) ), the last of which is up a smooth 527% since July past performance is not necessarily indicative of future results. Others are no doubt positioning for the inevitable rebound in energy prices, thinking it is just a matter of when, not if. Crude Oil is back around $70 to $100 a barrel. And what a trade that would be. Consider a move back to just $75 a barrel, the very low end of where Crude spent the last 5 years, would be a 50% return from the current $50 level. It seems like that could happen nearly overnight without anyone really thinking much about it. So how do you play a bounce in Oil? Well, the most popular play, by size and volume ( $1.2 Billion in Assets , $387 million changing hands daily), is no doubt the The United States Oil ETF, LP (NYSEARCA: USO ) . But is that really the best way to ‘play’ a bounce? Consider that USO Is designed to track the “daily” movement of oil. What’s the matter with that? One would hope that the ETF closely matches the daily move of Oil, right? Well, yes and no. Yes if you are going to buy the ETF for one day, or even a couple of days; no if your investment thesis is oil prices will climb higher over an extended period of time. Because, and here’s where it gets tricky – USO’s long term price appreciation won’t match the sum of its daily price appreciations. What? How is that possible? You see, the ETF works by buying futures contracts on Oil, and there are 12 different contracts in Crude Oil futures each year, you guessed it – one for every month. And while the so called ‘front month contract’ is trading near the number you see on the news every night ($50 yesterday), the further out contracts, such as 10 to 12 months from now, may already reflect the idea that Oil prices will be higher. Indeed, the price for the December 2015 contract is $57, versus $50 for the front month. So there’s $7, or a 14% gain, already “built in” to the futures price. What’s that mean for the ETF investor? Well, if you are correct that Oil will rebound, and it does so, to the tune of rising 14%, or $7 per barrel, over the next 11 months; the ETF likely won’t appreciate 14% as well. It likely won’t move at all, because it will have to sell out of its expiring futures positions and buy new futures positions each month. This means it will essentially have to “pay” that $7 in what’s called “roll costs.” This is why USO has drastically underperformed the “spot price” of Oil over the past five years, with USO having lost -39 % while the spot price of Oil went UP 48 %. It is like an option or insurance premium – a declining asset with all else held equal. Just look at what happened during the last big rally for energy prices between January 2009 and May 2011. That’s a 110% difference between what you thought was going to happen and what the ETF rewarded you with. (click to enlarge) (Disclaimer: Past performance is not necessarily indicative of future results) Chart Courtesy: Barchart So if you think Oil will be higher 3 months from now, or 12 months from now, instead of tomorrow, USO is at best going to give you some discounted version of your expected gain, and at worse a possible loss when Oil gains. (P.S., the ProShares Ultra Bloomberg Crude Oil ETF (NYSEARCA: UCO ) will do all this, times two… yeah) You don’t even have to take our word for it. Take the description of the USO over at ETF.com . USO is a great vehicle for riding short-term moves in expected crude prices, but longer-term holders take on heavy roll risk. Roll costs can be steep when the curve is up-sloping. Ok – so don’t offer a problem without a solution… What other options are out there? Well, in our realm of futures based investments, you could: Trade futures in Crude Oil, Heating Oil, RBOB Gasoline that match your time frame for a rise in prices; rolling them once annually if needed, as we’ve recommended instead of commodity ETFs for some time now. For example, if you think Crude Oil will be higher 12 to 18 months from now, buy the June 2016 Crude Oil futures (currently It will still underperform the pure spot price, but will only pay that roll cost once per year instead of multiple times). Invest with an energy focused professional commodity trading advisor, we have some names. Invest with a trend following manager – who should benefit from a long term trend up (just as they are benefiting from the trend down right now past performance is not necessarily indicative of future results, albeit the energy portion would only be a small portion (Scalper1 News

Scalper1 News