Scalper1 News

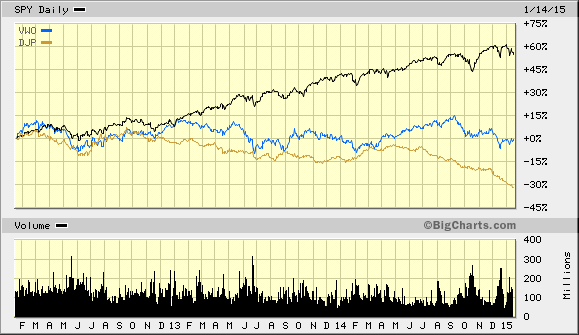

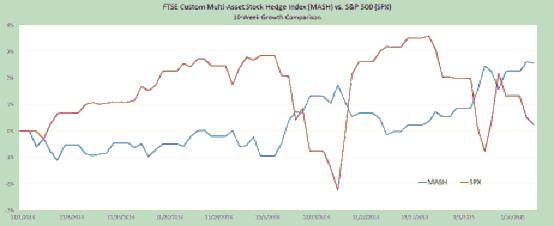

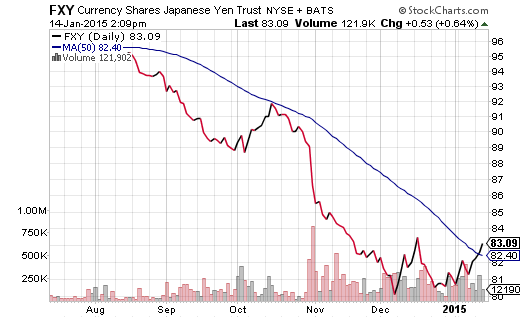

If foreign economic stagnation and commodity price depreciation is an old story, then why are U.S. equities suddenly responding as though the U.S. economy might be in danger? The daily volatility over the last 10 weeks is primarily attributable to the Federal Reserve terminating its third iteration of “QE” back in October. The central banks of the world have been remarkably successful at repressing the risk of equity market participation. The media are telling us that U.S. stocks have been under pressure this January due to global growth fears and an accompanying rout across the entire commodity space. Yet that only tells a small part of the story. After all, the S&P 500 SPDR Trust ETF (NYSEARCA: SPY ) has performed quite admirably over the past three years, blissfully unresponsive to the global growth woes reflected in ETFs like the Vanguard FTSE Emerging Markets ETF (NYSEARCA: VWO ) and the iPath Dow Jones-UBS Commodity Index Total Return ETN (NYSEARCA: DJP ). If foreign economic stagnation and commodity price depreciation is an old story, then why are U.S. equities suddenly responding as though the U.S. economy might be in danger? Where’s the enthusiasm for the enormous stimulus associated with cheap oil and gas? What happened to the euphoria over the best job growth since 1999? In truth, the daily volatility over the last 10 weeks is primarily attributable to the Federal Reserve terminating its third iteration of “QE” back in October – an electronic money creating, bond-buying program that resulted in the Fed acquiring trillions in U.S. debt. Consider the reality that when the Fed removed a large portion of the supply of treasuries, investors who would have bought those treasuries had to buy assets like corporate bonds instead. This reduced the borrowing costs for corporations and allowed many of them to refinance debts as well as buy back shares of their own stock. Up went the stock market. Similarly, the Fed removed a large portion of the supply of mortgage-backed securities, ultimately lowering the mortgage costs for real estate. Up went the housing market. An increase in the net worth of corporations, small businesses as well as wealthier families did create an atmosphere for greater economic confidence. However, with the Federal Reserve hinting that overnight lending rates might go up as soon as April, butterflies flapping their wings in Rio de Janeiro and Beijing have been creating tremors for U.S. equities. In essence, the stock market is not so sure that our “booming” domestic economy is a self-sustaining wonderland in the absence of central bank stimulus. Nowhere is this more obvious than in the relatively tranquil progress of the FTSE Custom Multi-Asset Stock Hedge Index. In the ten weeks since QE ended (through Jan 14), the index has quietly gained 2.5% while the S&P 500 has fluctuated wildly on its way to being flat. (Note: These results do not yet account for Wednesday’s stock declines.) While the bullish media typically ignore the bulk of what happens with non-equity asset classes, there are specific currencies, commodities and country debt that have historically performed well in moderate-to-severe stock downturns. Asset types like longer-term treasuries, zero-coupon bonds, munis, German bunds, gold, the franc, the yen, the dollar and others fit the bill. The index, often referred to by others as the “MASH Index,” does not short or use leverage like a bear fund; safer haven holdings (ex stocks) often perform better than cash in stock uptrends as well. You can learn more about the FTSE Custom Multi-Asset Stock Hedge Index at StockHedgeIndex.com . Those investors who remain in the bullish camp theorize that the U.S. economy is strong enough to handle modest rate increases. They also anticipate the inevitability of quantitative easing or similar asset-back purchasing measures in the euro-zone as well as China acting to bolster its economic output through a variety of techniques; stock bulls view the troubles overseas as noise and vow to continue buying dips on weakness. In contrast, bears counter with the fact that U.S. stocks are not only at the high end of historical valuations, they may be at the highest levels in recorded history. For instance, Jim Paulsen at Wells Capital explained that U.S. stocks have never been this expensive ever, at least not when one employs the median price-to-earnings ratio. (And Paulsen has been a fixture in the bull camp!) My view? I am neither bullish nor bearish in practice. That said, I am a proponent of applying insurance principles to the investing process. Stop-limit loss orders , trendlines, put options, multi-asset stock hedging – they all minimize the risk of catastrophic loss. Indeed, the reason I partnered with the world’s largest index provider (FTSE-Russell) in developing the FTSE Custom Multi-Asset Stock Hedge Index was to offer a new way to reduce the risks associated with stock market euphoria. The central banks of the world have been remarkably successful at repressing the risk of equity market participation. Throughout the six years of the 2009-2015 bull, whenever there has been a belch (or even a hiccup), the Federal Reserve has come to the rescue with more bond-buying stimulus. On the flip side, if they stick to their guns on raising rates this time, you can expect the uncertainty to fuel even more desire for perceived safe havens. You might look at the iShares 10-20 Year Treasury Bond ETF (NYSEARCA: TLH ) as well as carry trade reversal beneficiaries like the CurrencyShares Japanese Yen Trust ETF (NYSEARCA: FXY ). If the conversation shifts towards “no rate increases until 2016″ or even “a bit more QE is a possibility,” then the unbridled excitement for stock ownership would pump new life into the aging bull. Disclosure: Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc, and/or its clients may hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert web site. ETF Expert content is created independently of any advertising relationships. Scalper1 News

If foreign economic stagnation and commodity price depreciation is an old story, then why are U.S. equities suddenly responding as though the U.S. economy might be in danger? The daily volatility over the last 10 weeks is primarily attributable to the Federal Reserve terminating its third iteration of “QE” back in October. The central banks of the world have been remarkably successful at repressing the risk of equity market participation. The media are telling us that U.S. stocks have been under pressure this January due to global growth fears and an accompanying rout across the entire commodity space. Yet that only tells a small part of the story. After all, the S&P 500 SPDR Trust ETF (NYSEARCA: SPY ) has performed quite admirably over the past three years, blissfully unresponsive to the global growth woes reflected in ETFs like the Vanguard FTSE Emerging Markets ETF (NYSEARCA: VWO ) and the iPath Dow Jones-UBS Commodity Index Total Return ETN (NYSEARCA: DJP ). If foreign economic stagnation and commodity price depreciation is an old story, then why are U.S. equities suddenly responding as though the U.S. economy might be in danger? Where’s the enthusiasm for the enormous stimulus associated with cheap oil and gas? What happened to the euphoria over the best job growth since 1999? In truth, the daily volatility over the last 10 weeks is primarily attributable to the Federal Reserve terminating its third iteration of “QE” back in October – an electronic money creating, bond-buying program that resulted in the Fed acquiring trillions in U.S. debt. Consider the reality that when the Fed removed a large portion of the supply of treasuries, investors who would have bought those treasuries had to buy assets like corporate bonds instead. This reduced the borrowing costs for corporations and allowed many of them to refinance debts as well as buy back shares of their own stock. Up went the stock market. Similarly, the Fed removed a large portion of the supply of mortgage-backed securities, ultimately lowering the mortgage costs for real estate. Up went the housing market. An increase in the net worth of corporations, small businesses as well as wealthier families did create an atmosphere for greater economic confidence. However, with the Federal Reserve hinting that overnight lending rates might go up as soon as April, butterflies flapping their wings in Rio de Janeiro and Beijing have been creating tremors for U.S. equities. In essence, the stock market is not so sure that our “booming” domestic economy is a self-sustaining wonderland in the absence of central bank stimulus. Nowhere is this more obvious than in the relatively tranquil progress of the FTSE Custom Multi-Asset Stock Hedge Index. In the ten weeks since QE ended (through Jan 14), the index has quietly gained 2.5% while the S&P 500 has fluctuated wildly on its way to being flat. (Note: These results do not yet account for Wednesday’s stock declines.) While the bullish media typically ignore the bulk of what happens with non-equity asset classes, there are specific currencies, commodities and country debt that have historically performed well in moderate-to-severe stock downturns. Asset types like longer-term treasuries, zero-coupon bonds, munis, German bunds, gold, the franc, the yen, the dollar and others fit the bill. The index, often referred to by others as the “MASH Index,” does not short or use leverage like a bear fund; safer haven holdings (ex stocks) often perform better than cash in stock uptrends as well. You can learn more about the FTSE Custom Multi-Asset Stock Hedge Index at StockHedgeIndex.com . Those investors who remain in the bullish camp theorize that the U.S. economy is strong enough to handle modest rate increases. They also anticipate the inevitability of quantitative easing or similar asset-back purchasing measures in the euro-zone as well as China acting to bolster its economic output through a variety of techniques; stock bulls view the troubles overseas as noise and vow to continue buying dips on weakness. In contrast, bears counter with the fact that U.S. stocks are not only at the high end of historical valuations, they may be at the highest levels in recorded history. For instance, Jim Paulsen at Wells Capital explained that U.S. stocks have never been this expensive ever, at least not when one employs the median price-to-earnings ratio. (And Paulsen has been a fixture in the bull camp!) My view? I am neither bullish nor bearish in practice. That said, I am a proponent of applying insurance principles to the investing process. Stop-limit loss orders , trendlines, put options, multi-asset stock hedging – they all minimize the risk of catastrophic loss. Indeed, the reason I partnered with the world’s largest index provider (FTSE-Russell) in developing the FTSE Custom Multi-Asset Stock Hedge Index was to offer a new way to reduce the risks associated with stock market euphoria. The central banks of the world have been remarkably successful at repressing the risk of equity market participation. Throughout the six years of the 2009-2015 bull, whenever there has been a belch (or even a hiccup), the Federal Reserve has come to the rescue with more bond-buying stimulus. On the flip side, if they stick to their guns on raising rates this time, you can expect the uncertainty to fuel even more desire for perceived safe havens. You might look at the iShares 10-20 Year Treasury Bond ETF (NYSEARCA: TLH ) as well as carry trade reversal beneficiaries like the CurrencyShares Japanese Yen Trust ETF (NYSEARCA: FXY ). If the conversation shifts towards “no rate increases until 2016″ or even “a bit more QE is a possibility,” then the unbridled excitement for stock ownership would pump new life into the aging bull. Disclosure: Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc, and/or its clients may hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert web site. ETF Expert content is created independently of any advertising relationships. Scalper1 News

Scalper1 News