Scalper1 News

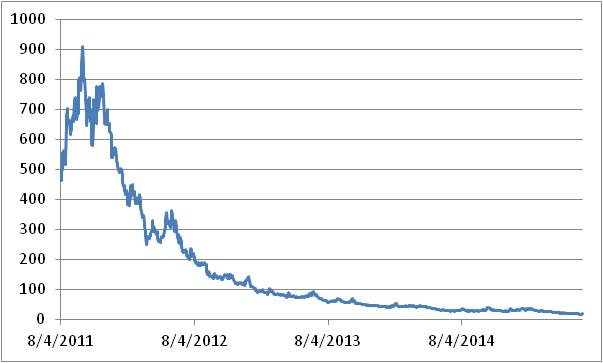

VXX spiked almost 17% on Monday. That is the fourth largest move it has ever had. I believe this represents a unique opportunity to benefit from panicking investors. In the last couple of months of last year and into 2015, I spent a lot of time trading volatility (NYSEARCA: VXX ). I was fortunate enough to have pretty good success but when markets largely calmed down earlier this year, there wasn’t much going on. Well, for anyone that wasn’t under a rock on Monday, volatility returned all at once as the VIX spiked 34% on the day amid worries imported from Greece. I won’t go over the Greece drama because you can read about it many other places so in this article, I’ll focus directly on what I think is a very tradable move in the VIX via the ETF VXX. (click to enlarge) We can see the move in the VXX yesterday was absolutely massive. It gapped up on the open but that was just the start of the action as we can see from the chart. That sets up what I believe is a reasonably high risk, high reward setup in volatility that investors can consider if you believe the Greek crisis will be a ‘sell the news’ kind of event. The VXX moved up nearly 17% on Monday so that got me to thinking; that’s a huge move, how many times has this happened before? I pulled pricing data since VXX’ inception from Yahoo! and looked to see how many daily moves were in excess of Monday’s gain and the answer is just three. Three days in 2011 (two in August, one in November) posted up moves of more than Monday’s 16.8% move. First off, there have been more than 1,600 trading days for VXX so the fact that Monday’s move was larger than all but three days is quite extraordinary in itself. That alone would suggest a bit of value seeking may be in order simply due to the magnitude of the move. However, the three days in 2011 that saw moves this large were in the midst of a global meltdown in stocks. The S&P was getting crushed along with every other major index around the world so shorting the VXX after the first spike in early August would have been a rough trade. Here’s what happened starting with the day of the first 17%+ spike up in VXX back in 2011. VXX almost doubled after the first move up so in today’s terms, we’d be right there at the beginning of this chart if the pattern repeats. Shorting VXX would have produced sizable losses until the end of 2011 when VXX began to normalize. It looks like a blip on this chart but four months of gut-wrenching losses can get the best of anyone. That is why I always reiterate that trading volatility is not for everyone. There are days when you get crushed and you have to take the pain but if that’s not for you, there are plenty of other instruments to trade. The other point I wanted to make with this chart is that even though VXX nearly doubled after a similar spike to what happened on Monday, in time, it returned to its normal, wealth-destroying self. That is what I want to take advantage of and given that Greece is a small sliver of the Eurozone’s economic output, I’m betting that is exactly what is going to happen. I can’t tell you when it will happen but one thing I know with virtual certainty is that VXX will spike and fall as it always does. I don’t know how high it will go before it falls but fall it will and when it does, it will probably fall hard. That has been the pattern and I’m betting it will take place again. I bought some (NASDAQ: XIV ) on Monday as a way to short the VXX in a virtually costless way and to take advantage of when the VXX does roll over and begin to destroy wealth again. If the market is down again on Tuesday I will buy more because there is a very small chance this trade won’t work out in the favor of VXX shorts over the medium term. VXX is a trading vehicle that erodes value over time so holding the inverse creates value over time, on average. You can put the odds more in your favor when you short into intense strength like what we saw on Monday so that is what I have done. Best of luck out there, it should be entertaining. Disclosure: I am/we are long XIV. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Scalper1 News

VXX spiked almost 17% on Monday. That is the fourth largest move it has ever had. I believe this represents a unique opportunity to benefit from panicking investors. In the last couple of months of last year and into 2015, I spent a lot of time trading volatility (NYSEARCA: VXX ). I was fortunate enough to have pretty good success but when markets largely calmed down earlier this year, there wasn’t much going on. Well, for anyone that wasn’t under a rock on Monday, volatility returned all at once as the VIX spiked 34% on the day amid worries imported from Greece. I won’t go over the Greece drama because you can read about it many other places so in this article, I’ll focus directly on what I think is a very tradable move in the VIX via the ETF VXX. (click to enlarge) We can see the move in the VXX yesterday was absolutely massive. It gapped up on the open but that was just the start of the action as we can see from the chart. That sets up what I believe is a reasonably high risk, high reward setup in volatility that investors can consider if you believe the Greek crisis will be a ‘sell the news’ kind of event. The VXX moved up nearly 17% on Monday so that got me to thinking; that’s a huge move, how many times has this happened before? I pulled pricing data since VXX’ inception from Yahoo! and looked to see how many daily moves were in excess of Monday’s gain and the answer is just three. Three days in 2011 (two in August, one in November) posted up moves of more than Monday’s 16.8% move. First off, there have been more than 1,600 trading days for VXX so the fact that Monday’s move was larger than all but three days is quite extraordinary in itself. That alone would suggest a bit of value seeking may be in order simply due to the magnitude of the move. However, the three days in 2011 that saw moves this large were in the midst of a global meltdown in stocks. The S&P was getting crushed along with every other major index around the world so shorting the VXX after the first spike in early August would have been a rough trade. Here’s what happened starting with the day of the first 17%+ spike up in VXX back in 2011. VXX almost doubled after the first move up so in today’s terms, we’d be right there at the beginning of this chart if the pattern repeats. Shorting VXX would have produced sizable losses until the end of 2011 when VXX began to normalize. It looks like a blip on this chart but four months of gut-wrenching losses can get the best of anyone. That is why I always reiterate that trading volatility is not for everyone. There are days when you get crushed and you have to take the pain but if that’s not for you, there are plenty of other instruments to trade. The other point I wanted to make with this chart is that even though VXX nearly doubled after a similar spike to what happened on Monday, in time, it returned to its normal, wealth-destroying self. That is what I want to take advantage of and given that Greece is a small sliver of the Eurozone’s economic output, I’m betting that is exactly what is going to happen. I can’t tell you when it will happen but one thing I know with virtual certainty is that VXX will spike and fall as it always does. I don’t know how high it will go before it falls but fall it will and when it does, it will probably fall hard. That has been the pattern and I’m betting it will take place again. I bought some (NASDAQ: XIV ) on Monday as a way to short the VXX in a virtually costless way and to take advantage of when the VXX does roll over and begin to destroy wealth again. If the market is down again on Tuesday I will buy more because there is a very small chance this trade won’t work out in the favor of VXX shorts over the medium term. VXX is a trading vehicle that erodes value over time so holding the inverse creates value over time, on average. You can put the odds more in your favor when you short into intense strength like what we saw on Monday so that is what I have done. Best of luck out there, it should be entertaining. Disclosure: I am/we are long XIV. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Scalper1 News