Scalper1 News

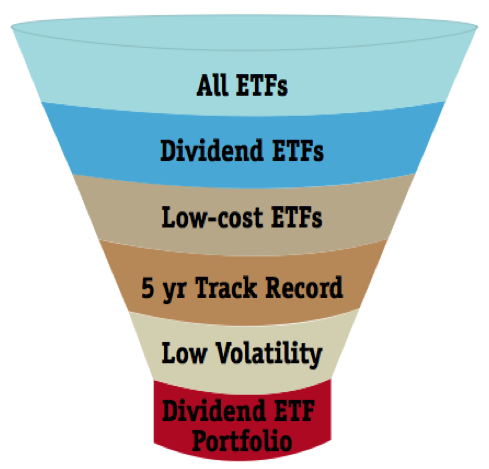

Originally published on February 3, 2014. Updated on January 23, 2015. How to create the highest dividend ETF portfolio The best investors become specialists in an area of investment interest such as stocks that pay dividends. They absorb as much information as they can in that one area. Gaining more knowledge increases the chance of making more money, even if you already have an advisor. These specialists realize that every investment area has multiple layers of complexity that can take time to understand. This article is a high level overview of how to create a dividend ETF portfolio. It shares the process of finding and selecting the best dividend ETFs for a high dividend ETF portfolio. Here is the best process for creating the highest dividend ETF portfolio within the confines of low volatility: The First Step in Building the Highest Dividend ETF Portfolio: Screening for the Best High Dividend ETFs Here are some of the broad details of the screening process you should consider: Start with all available ETFs. Screen for dividend ETFs: Find all ETFs that specialize in dividend paying companies and/or pay at least a 3% dividend. Rank all of these dividend ETFs by internal cost from lowest to highest and throw out the bottom 50% of the most expensive. Numerous studies show that cost is one of the most important factors of future performance. Then eliminate all dividend ETF funds that do not have a five year track record. You need to be able to see how they have been replicating the index, and buying a new fund that closes down is not good investing. Next, eliminate all dividend ETFs that have more volatility than the Russell 3000 Index. Dividend ETF portfolios are for income, and a stable price helps reduce the chance of losing more money on price than you are making on the dividend. Important Concepts in the Screening Process for Creating the Highest Dividend ETF Portfolio Do not search for highest dividend ETF until you have completed this screening process. Once this process is done then you have a great group of low cost, low volatility dividend ETFs with at least a five year track record. Searching for the best high dividend ETF fund based solely on dividend will lead you in the wrong direction. You will mostly find a dividend ETF that loses more on the price than it makes on the dividend. Ignore how much money the ETF has made in the past. We only want to know that the ETF has been in existence for at least five years so that we can examine the liquidity and portfolio drift issues. Past performance does not equal future results. Timing when to buy an ETF and when to sell does not work. No one knows where any one investment is going. The vast majority of investors believe market timing works, which is great for the brokerage firms. We think if the majority of high cost mutual funds with all their highly educated portfolio managers, unbelievable research, and superior technology cannot beat their comparable indexes then we will leave trying to time the market to someone else. Next Steps to Create Your Highest Dividend ETF Portfolio Place all of the dividend ETFs that survived the above screen into efficient frontier software. Use the Capital Asset Pricing Model (CAPM) to replace the historical rates of return in your efficient frontier analysis. Using historical returns produces over-concentrated portfolios that worked great in the past. Unless you have a time machine, you want portfolios that work great in the future. Using CAPM to replace historical returns is the first step to make a well balanced portfolio. Do not ignore rising dividend ETF funds just because they pay a low dividend. Often these funds are great to combine with a higher dividend payer such as a utility ETF. The combination provides greater price stability with a good dividend payout. Look for some international dividend ETFs to round out your portfolio. The world is a big place, and we never know where money will go next. Having the proper amount of international exposure actually lowers the overall price volatility of your portfolio. Share this article with a colleague Scalper1 News

Originally published on February 3, 2014. Updated on January 23, 2015. How to create the highest dividend ETF portfolio The best investors become specialists in an area of investment interest such as stocks that pay dividends. They absorb as much information as they can in that one area. Gaining more knowledge increases the chance of making more money, even if you already have an advisor. These specialists realize that every investment area has multiple layers of complexity that can take time to understand. This article is a high level overview of how to create a dividend ETF portfolio. It shares the process of finding and selecting the best dividend ETFs for a high dividend ETF portfolio. Here is the best process for creating the highest dividend ETF portfolio within the confines of low volatility: The First Step in Building the Highest Dividend ETF Portfolio: Screening for the Best High Dividend ETFs Here are some of the broad details of the screening process you should consider: Start with all available ETFs. Screen for dividend ETFs: Find all ETFs that specialize in dividend paying companies and/or pay at least a 3% dividend. Rank all of these dividend ETFs by internal cost from lowest to highest and throw out the bottom 50% of the most expensive. Numerous studies show that cost is one of the most important factors of future performance. Then eliminate all dividend ETF funds that do not have a five year track record. You need to be able to see how they have been replicating the index, and buying a new fund that closes down is not good investing. Next, eliminate all dividend ETFs that have more volatility than the Russell 3000 Index. Dividend ETF portfolios are for income, and a stable price helps reduce the chance of losing more money on price than you are making on the dividend. Important Concepts in the Screening Process for Creating the Highest Dividend ETF Portfolio Do not search for highest dividend ETF until you have completed this screening process. Once this process is done then you have a great group of low cost, low volatility dividend ETFs with at least a five year track record. Searching for the best high dividend ETF fund based solely on dividend will lead you in the wrong direction. You will mostly find a dividend ETF that loses more on the price than it makes on the dividend. Ignore how much money the ETF has made in the past. We only want to know that the ETF has been in existence for at least five years so that we can examine the liquidity and portfolio drift issues. Past performance does not equal future results. Timing when to buy an ETF and when to sell does not work. No one knows where any one investment is going. The vast majority of investors believe market timing works, which is great for the brokerage firms. We think if the majority of high cost mutual funds with all their highly educated portfolio managers, unbelievable research, and superior technology cannot beat their comparable indexes then we will leave trying to time the market to someone else. Next Steps to Create Your Highest Dividend ETF Portfolio Place all of the dividend ETFs that survived the above screen into efficient frontier software. Use the Capital Asset Pricing Model (CAPM) to replace the historical rates of return in your efficient frontier analysis. Using historical returns produces over-concentrated portfolios that worked great in the past. Unless you have a time machine, you want portfolios that work great in the future. Using CAPM to replace historical returns is the first step to make a well balanced portfolio. Do not ignore rising dividend ETF funds just because they pay a low dividend. Often these funds are great to combine with a higher dividend payer such as a utility ETF. The combination provides greater price stability with a good dividend payout. Look for some international dividend ETFs to round out your portfolio. The world is a big place, and we never know where money will go next. Having the proper amount of international exposure actually lowers the overall price volatility of your portfolio. Share this article with a colleague Scalper1 News

Scalper1 News