Scalper1 News

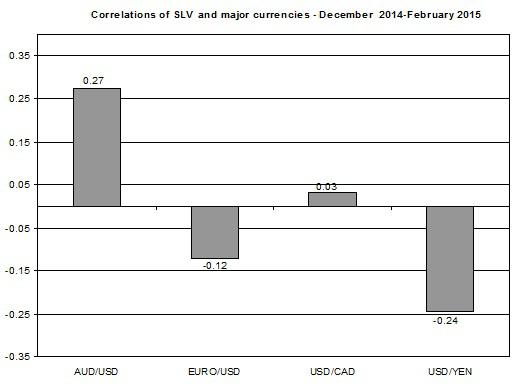

The price of SLV declined by 9% since its high a few weeks back. The recent Non-farm payroll passed expectations and coincided with the decline of SLV. The markets have revised up their expectations for a rate hike in mid-2015. The latest non-farm payroll report showed a better-than-expected result of 257,000 jobs gain in January – the market expectations were at 236,000. This news contributed to the latest fall in iShares Silver Trust ETF (NYSEARCA: SLV ), which lost 3.3% on Friday and nearly 9% from its high back in January 22nd. Here are the latest developments in the U.S. economy and its relation to the progress of SLV. The table below shows the relation between the changes in the non-farm payroll and the price of SLV in the past few reports. This time, the non-farm payroll came well above market expectations, which has led to a fall in the price of SLV. Another positive result was the revisions for December and November, which, combined, reached 147,000 more jobs than previously estimated. (click to enlarge) Source of data taken from Bureau of Labor Statistics The latest U.S. labor report also showed a higher-than-previously seen gain in wages – a 2.2% rise in hourly wages, which is the biggest gain since November 2008. This could be one of the main indicators that the FOMC has been looking for in determining its next move. If the recent rise in wages will put them on a higher path for growth, this could suggest the policy the FOMC has been implementing in recent years could come to an end within a few months. These recent positive results on both the number of jobs and gain in wages could bring the FOMC one step closer towards raising rates, which could, at the very least, curb down the rally of SLV. U.S. treasury yields have started to pick up again, which tends to move in the opposite direction to SLV; i.e. when yields rise, the price of SLV tends to decline. This was the case in recent weeks. Moreover, based on the latest update by the CME , the probability of a rate hike in the June meeting has increased to 27% – a month ago this probability was around 17.4%. For the July meeting, the probabilities are even higher at 50% compared to 37% a month back. So not for nothing, the market has also revised up its expectations for mid-year rate hike. But the ongoing economic slowdown and economic uncertainty in Europe could bring back down U.S. treasury yields. If yields were to resume their descent, as they did earlier this year, this trend could start pressuring back up SLV. In the meantime, the developments in Europe including the QE program and the tensions between the Greeks and the Germans over policy is likely to bring further down the Euro against leading currencies including the US dollar. Moreover, the recent decisions of Bank of Canada and Reserve Bank of Australia to reduce their cash rates are only bringing up the U.S. dollar. The ongoing recovery of the U.S. dollar against major currencies could start to adversely impact the price of SLV, albeit in recent weeks the correlations among major currency pairs and SLV were relatively weak, as indicated in the chart below. Source of data taken from Bloomberg The silver lining for silver bugs is that the strengthening of the U.S. dollar could also, down the line, start to weigh on the progress of the U.S. economy and taper down its growth. After all, a stronger dollar may reduce the competitive edge of U.S. exports, increase trade deficit and cut imported inflation. Therefore, if this trend persists, it may eventually start to have an adverse impact on the U.S. economic recovery, which could benefit SLV investors. The silver market isn’t an investment for the faint of heart, which is characterized with high volatility. The ongoing recovery in the U.S. economy is likely to keep pushing down the price of SLV. But from the other side, the global economic mess we face, especially in Europe, could bring down U.S. treasury yields and thus also increase the demand for precious metals. These two opposing forces are likely to keep SLV zigzagging in the near term. For more see: Is SLV about to change course? Disclosure: The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article. Scalper1 News

The price of SLV declined by 9% since its high a few weeks back. The recent Non-farm payroll passed expectations and coincided with the decline of SLV. The markets have revised up their expectations for a rate hike in mid-2015. The latest non-farm payroll report showed a better-than-expected result of 257,000 jobs gain in January – the market expectations were at 236,000. This news contributed to the latest fall in iShares Silver Trust ETF (NYSEARCA: SLV ), which lost 3.3% on Friday and nearly 9% from its high back in January 22nd. Here are the latest developments in the U.S. economy and its relation to the progress of SLV. The table below shows the relation between the changes in the non-farm payroll and the price of SLV in the past few reports. This time, the non-farm payroll came well above market expectations, which has led to a fall in the price of SLV. Another positive result was the revisions for December and November, which, combined, reached 147,000 more jobs than previously estimated. (click to enlarge) Source of data taken from Bureau of Labor Statistics The latest U.S. labor report also showed a higher-than-previously seen gain in wages – a 2.2% rise in hourly wages, which is the biggest gain since November 2008. This could be one of the main indicators that the FOMC has been looking for in determining its next move. If the recent rise in wages will put them on a higher path for growth, this could suggest the policy the FOMC has been implementing in recent years could come to an end within a few months. These recent positive results on both the number of jobs and gain in wages could bring the FOMC one step closer towards raising rates, which could, at the very least, curb down the rally of SLV. U.S. treasury yields have started to pick up again, which tends to move in the opposite direction to SLV; i.e. when yields rise, the price of SLV tends to decline. This was the case in recent weeks. Moreover, based on the latest update by the CME , the probability of a rate hike in the June meeting has increased to 27% – a month ago this probability was around 17.4%. For the July meeting, the probabilities are even higher at 50% compared to 37% a month back. So not for nothing, the market has also revised up its expectations for mid-year rate hike. But the ongoing economic slowdown and economic uncertainty in Europe could bring back down U.S. treasury yields. If yields were to resume their descent, as they did earlier this year, this trend could start pressuring back up SLV. In the meantime, the developments in Europe including the QE program and the tensions between the Greeks and the Germans over policy is likely to bring further down the Euro against leading currencies including the US dollar. Moreover, the recent decisions of Bank of Canada and Reserve Bank of Australia to reduce their cash rates are only bringing up the U.S. dollar. The ongoing recovery of the U.S. dollar against major currencies could start to adversely impact the price of SLV, albeit in recent weeks the correlations among major currency pairs and SLV were relatively weak, as indicated in the chart below. Source of data taken from Bloomberg The silver lining for silver bugs is that the strengthening of the U.S. dollar could also, down the line, start to weigh on the progress of the U.S. economy and taper down its growth. After all, a stronger dollar may reduce the competitive edge of U.S. exports, increase trade deficit and cut imported inflation. Therefore, if this trend persists, it may eventually start to have an adverse impact on the U.S. economic recovery, which could benefit SLV investors. The silver market isn’t an investment for the faint of heart, which is characterized with high volatility. The ongoing recovery in the U.S. economy is likely to keep pushing down the price of SLV. But from the other side, the global economic mess we face, especially in Europe, could bring down U.S. treasury yields and thus also increase the demand for precious metals. These two opposing forces are likely to keep SLV zigzagging in the near term. For more see: Is SLV about to change course? Disclosure: The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Scalper1 News