Scalper1 News

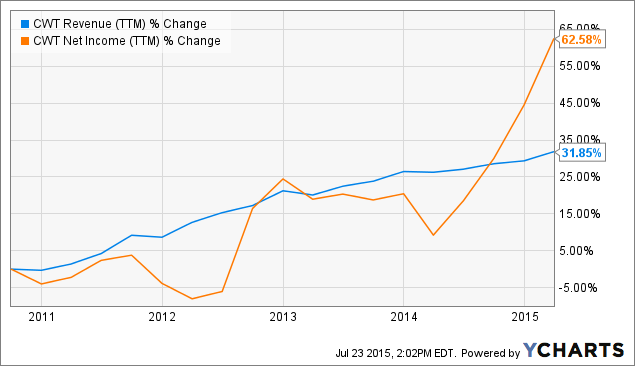

Summary California Water Service Group is a water utility serving California, Washington, New Mexico and Hawaii. California Water Service Group generated free cash flow in only two of the past 19 years. California Water Service Group possesses a high amount of long-term debt. It’s important for long-term investors to develop a guide for doing their investment research. Over the years, I have developed questions to guide me in my thinking when researching the publicly traded universe. Today, let’s talk about California Water Service Group (NYSE: CWT ). 1.) What does the company do? When you buy shares in a company you effectively become part owner of that company. Therefore, it’s important for an investor to understand what a company sells. California Water Service Group sells water. The company operates mainly on the west coast in states such as California, Washington, New Mexico and Hawaii. It operates regulated and non-regulated businesses. 2.) What do the fundamentals look like? Investors should also look for companies that grow revenue and free cash flow over the long term, retaining some of that cash for reinvestment back into the business and for economic hard times. Excellent revenue and free cash flow growth serve as catalysts for superior long-term gains. California Water Service Group expanded its revenue and net income 32% and 63%, respectively, over the past five years (see chart below). CWT Revenue (TTM) data by YCharts California Water Service Group operates in a highly regulated business which constrains operations. Also, drought conditions make operating a water utility difficult. Moreover, the company has only been free cash flow positive in two of the past 10 years, according to Morningstar. Large amounts of capital expenditures exceed operating cash flow due to the capital intensive nature of the business. Capital maintenance of this nature leaves little room for expansion and tangible capital returns to shareholders in the form of dividends, which can contribute heavily to any stock market return. I like to see companies expand their free cash flow over the long term. This gives an indication that a company can stand on its own two feet. California Water Service Group sports a lousy balance sheet by my standards. In the most recent quarter, the company possessed $33.3 million in cash and equivalents, which equates to a mere 5.4% of stockholders’ equity. I always like to see companies with cash amounting to 20% or more of stockholders’ equity to get them through tough times. California Water Service Group’s long-term debt amounts to 68% of stockholders’ equity. I like to see companies keep long-term debt at 50% of stockholders’ equity or less. Operating income only exceeded interest expense by three times in FY 2014. The rule of thumb for safety lies at five times or more. Like most utilities, California Water Service Group does pay a dividend. However, its dividend sustainability doesn’t hold water. I like to see companies pay out less than 50% of their full-year free cash flow in dividends, retaining the remainder for other things. Last year, California Water Service Group ran a free cash flow deficit, meaning that the dividend came from sources other than free cash flow. Currently, the company pays its shareholders $0.67 per share per year and yields 2.9% annually. California Water Service Group’s sub-par fundamentals only translated into 48% total return for the company’s shareholders vs. 114% for the S&P 500 as a whole (chart below). CWT Total Return Price data by YCharts 3.) How much management-employee ownership is there? Investors should always look for businesses where the managers and/or employees own a lot of stock in the company. Managers with a great deal of stock in the company will take better care to maximize company profits, which will enhance share price and their personal wealth along with the wealth of shareholders. According to California Water Service Group, company executives each own less than 1% of the company’s stock. This isn’t too big of a deal, this just mean that management lacks the extra incentive provided by huge ownership of the company. 4.) How does its “Report of Independent Registered Public Accounting Firm” stack up? Every year a company employs external auditors to audit financial statements and evaluate whether the company maintains adequate financial controls. At the conclusion of the audit, you want to see a letter from auditors with the language “unqualified” or “fairly presents”, which generally means that the financial statements and internal systems in constructing them were clean or adequate. If you see “qualified” or “adverse” in the auditing letter’s language, then deeper issues in a company’s financial statements may exist. According to California Water Service Group’s latest auditing statement, the financial statements were presented fairly and the company maintained adequate internal controls. 5.) What types of risk does it have? It’s always important for investors to weigh the various risks such as exposure to political risk in parts of the world where war is the norm, competitive positioning, and market price risk. California Water Service Group operates exclusively in the United States, which means political risk resides in the minimum range. California Water Service Group represents an infrastructure stock, meaning there is little or no competition in its service area. The barriers to entry reside in the high range due to regulatory and capital hurdles to entering the business. However, drought conditions could increase regulatory scrutiny and the introduction of more exotic accounting. California Water Service Group’s market price risk actually resides in the low range. The company’s P/E ratio clocks in at 18 vs. 19 for the S&P 500 as a whole, according to Morningstar. 6.) What does its forward analysis look like? Just because California Water Service Group is a needed water utility doesn’t mean that it’s risk free. I prefer to see companies generate free cash flow on their own and possess a margin of safety in terms of interest cost coverage. Regulatory conditions combined with high capital maintenance will make it difficult for the company to generate free cash flow, which represents the life blood of things like superior capital gains and dividend increases. I am keeping my investment dollars away from this company. Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Summary California Water Service Group is a water utility serving California, Washington, New Mexico and Hawaii. California Water Service Group generated free cash flow in only two of the past 19 years. California Water Service Group possesses a high amount of long-term debt. It’s important for long-term investors to develop a guide for doing their investment research. Over the years, I have developed questions to guide me in my thinking when researching the publicly traded universe. Today, let’s talk about California Water Service Group (NYSE: CWT ). 1.) What does the company do? When you buy shares in a company you effectively become part owner of that company. Therefore, it’s important for an investor to understand what a company sells. California Water Service Group sells water. The company operates mainly on the west coast in states such as California, Washington, New Mexico and Hawaii. It operates regulated and non-regulated businesses. 2.) What do the fundamentals look like? Investors should also look for companies that grow revenue and free cash flow over the long term, retaining some of that cash for reinvestment back into the business and for economic hard times. Excellent revenue and free cash flow growth serve as catalysts for superior long-term gains. California Water Service Group expanded its revenue and net income 32% and 63%, respectively, over the past five years (see chart below). CWT Revenue (TTM) data by YCharts California Water Service Group operates in a highly regulated business which constrains operations. Also, drought conditions make operating a water utility difficult. Moreover, the company has only been free cash flow positive in two of the past 10 years, according to Morningstar. Large amounts of capital expenditures exceed operating cash flow due to the capital intensive nature of the business. Capital maintenance of this nature leaves little room for expansion and tangible capital returns to shareholders in the form of dividends, which can contribute heavily to any stock market return. I like to see companies expand their free cash flow over the long term. This gives an indication that a company can stand on its own two feet. California Water Service Group sports a lousy balance sheet by my standards. In the most recent quarter, the company possessed $33.3 million in cash and equivalents, which equates to a mere 5.4% of stockholders’ equity. I always like to see companies with cash amounting to 20% or more of stockholders’ equity to get them through tough times. California Water Service Group’s long-term debt amounts to 68% of stockholders’ equity. I like to see companies keep long-term debt at 50% of stockholders’ equity or less. Operating income only exceeded interest expense by three times in FY 2014. The rule of thumb for safety lies at five times or more. Like most utilities, California Water Service Group does pay a dividend. However, its dividend sustainability doesn’t hold water. I like to see companies pay out less than 50% of their full-year free cash flow in dividends, retaining the remainder for other things. Last year, California Water Service Group ran a free cash flow deficit, meaning that the dividend came from sources other than free cash flow. Currently, the company pays its shareholders $0.67 per share per year and yields 2.9% annually. California Water Service Group’s sub-par fundamentals only translated into 48% total return for the company’s shareholders vs. 114% for the S&P 500 as a whole (chart below). CWT Total Return Price data by YCharts 3.) How much management-employee ownership is there? Investors should always look for businesses where the managers and/or employees own a lot of stock in the company. Managers with a great deal of stock in the company will take better care to maximize company profits, which will enhance share price and their personal wealth along with the wealth of shareholders. According to California Water Service Group, company executives each own less than 1% of the company’s stock. This isn’t too big of a deal, this just mean that management lacks the extra incentive provided by huge ownership of the company. 4.) How does its “Report of Independent Registered Public Accounting Firm” stack up? Every year a company employs external auditors to audit financial statements and evaluate whether the company maintains adequate financial controls. At the conclusion of the audit, you want to see a letter from auditors with the language “unqualified” or “fairly presents”, which generally means that the financial statements and internal systems in constructing them were clean or adequate. If you see “qualified” or “adverse” in the auditing letter’s language, then deeper issues in a company’s financial statements may exist. According to California Water Service Group’s latest auditing statement, the financial statements were presented fairly and the company maintained adequate internal controls. 5.) What types of risk does it have? It’s always important for investors to weigh the various risks such as exposure to political risk in parts of the world where war is the norm, competitive positioning, and market price risk. California Water Service Group operates exclusively in the United States, which means political risk resides in the minimum range. California Water Service Group represents an infrastructure stock, meaning there is little or no competition in its service area. The barriers to entry reside in the high range due to regulatory and capital hurdles to entering the business. However, drought conditions could increase regulatory scrutiny and the introduction of more exotic accounting. California Water Service Group’s market price risk actually resides in the low range. The company’s P/E ratio clocks in at 18 vs. 19 for the S&P 500 as a whole, according to Morningstar. 6.) What does its forward analysis look like? Just because California Water Service Group is a needed water utility doesn’t mean that it’s risk free. I prefer to see companies generate free cash flow on their own and possess a margin of safety in terms of interest cost coverage. Regulatory conditions combined with high capital maintenance will make it difficult for the company to generate free cash flow, which represents the life blood of things like superior capital gains and dividend increases. I am keeping my investment dollars away from this company. Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Scalper1 News