You have to hand it to Deere & Company ‘s(NYSE: DE) management. Not much has gone right from an end-market perspective in the last few years, with US farm cash receipts declining since 2014 as prices of key agricultural crops (ex. corn, wheat, and soybean) continue to fall. The end result is that farmers are declining to buy new equipment — particularly the kind of high-margin large agricultural machinery that Deere thrives on — and the company’s sales have slumped.

However, Deere’s stock is up nearly 40% on the year as management continues to defy the doubters. Let’s analyze the key takeaways from the recent earnings report in order to see what’s been going on and why the company looks set for better days.

Image source: © Deere & Company

The warning signs

It’s easy to look at price charts of Deere and agricultural peers AGCO Corporation (NYSE: AGCO) and CNH Industrial NV (NYSE: CNHI) alongside construction machinery rival Caterpillar Inc. (NYSE: CAT) and conclude that it’s simply a matter of Deere’s stock being buoyed by the sector.

However, that conclusion wouldn’t give proper credit to how well management has executed in the current cycle. Going into 2016, the company had many doubters (including the author) predicting the following:

- Rising inventory/sales levels (an issue it shared with AGCO and CNH) would cause a slump in profits as pressure built on Deere’s dealers to aggressively sell off equipment

- Having increased the amount of equipment it has on operating leases, a glut of used equipment would hit the market when those leases expired

- The company would increasingly rely on its financial services segment for profits at a time when credit quality is declining from exceptionally high levels, interest rates appear to be rising, and farmers’ income is declining

The warning signs were, and still are, there. However, that shouldn’t detract from management’s excellent execution and the more positive outlook given in the first-quarter earnings report.

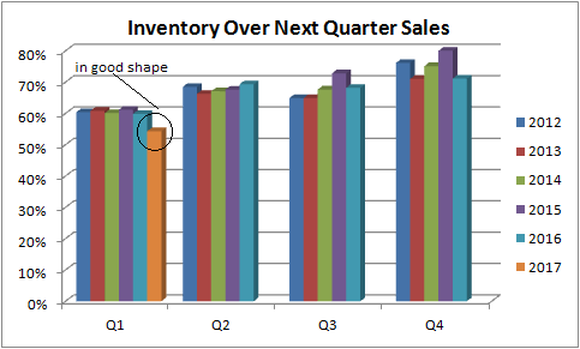

Inventory issues

The following chart shows the ratio of Deere’s inventory divided by its next quarter’s sales. As you can see, Deere’s managed its inventory levels well and ended the first-quarter of 2017 with inventory of $ 3,959 million, when analysts are forecasting $ 7,290 million in sales in the second-quarter. This gives a ratio of 54.3% — well below ratios in previous years’ first quarters.

Data source: Deere & Company presentations. Yahoo Finance. Author’s analysis

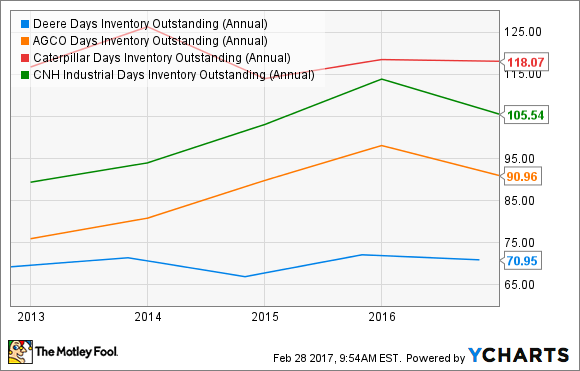

Moreover, in looking at inventory days outstanding (the number of days worth of sales held in inventory), you can see how Deere and Caterpillar have better managed the recent cycle than AGCO ad CNH Industrial have.

DE Days Inventory Outstanding (Annual) data by YCharts

The cherry on the cake is that, despite sales falling 9% in 2016, Deere actually increased pricing, and the latest guidance is for 1% price realization in 2017 as well.

Operating leases

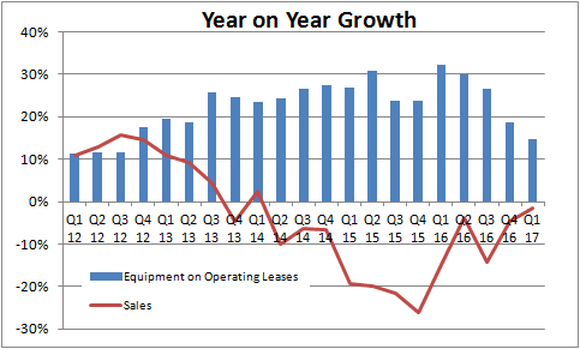

The amount of equipment Deere has on operating leases is still a concern, but less so than before. First, the following chart shows growth in equipment on operating leases compared to equipment sales. As you can see, operating leases started increasing strongly as sales slumped, but now the sales decreases are falling, and Deere’s outlook for equipment sales is for a 4% increase in 2017. Growth in leasing, meanwhile, is slowing.

Data Source: Deere & Company presentations. Chart and analysis by author

Second, on the earnings call Deere’s Director of Investor Relations Tony Huegel noted that the company was dealing well with the more-problematic short-term leases. He noted that beyond the second quarter, “we largely get beyond that headwind that we’ve been experiencing with those 12 month leases. And we’d have significantly fewer as we go through the second half of 2017, which again, assuming the performance on those longer than 12 month leases maintain or improve, would actually bode pretty well” for the rest of the year.

Third, Huegel talk of a stabilizing used equipment market — an indication that fears of a glut of used equipment on the market are overblown.

As for credit quality, Deere’s forecast for credit loss provisions to total 0.29% of its average owned portfolio in 2017 is an increase from previously historic lows, but it’s still lower than the 15 year average.

Image source: © Deere & Company

Looking forward

Deere’s upgraded 2017 outlook for net sales to rise 4% and net income of around $ 1.5 billion is an increase on the 1% and $ 1.4 billion forecast previously. Moreover, as you see above, inventory, used equipment, and leases all appear to be moving in the right direction.

Frankly, there is still cause for concern. After all, North American agriculture machinery sales are forecast to fall 5% to 10% in 2017, and Deere is in the middle of a key quarter with regard to short-term operating leases expiring. However, based on the arguments above, investors can sleep safe knowing they are in the hands of an excellent management team.

10 stocks we like better than Deere & Company

When investing geniuses David and Tom Gardner have a stock tip, it can pay to listen. After all, the newsletter they have run for over a decade, Motley Fool Stock Advisor , has tripled the market.*

David and Tom just revealed what they believe are the 10 best stocks for investors to buy right now… and Deere & Company wasn’t one of them! That’s right — they think these 10 stocks are even better buys.

Click here to learn about these picks!

*Stock Advisor returns as of February 6, 2017

Lee Samaha has no position in any stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy .

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Plantations International